What a brutal six months it’s been for Enovis. The stock has dropped 22.5% and now trades at $31.96, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Enovis, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we don't have much confidence in Enovis. Here are three reasons why we avoid ENOV and a stock we'd rather own.

Why Do We Think Enovis Will Underperform?

With a focus on helping patients regain or maintain their natural motion, Enovis (NYSE: ENOV) develops and manufactures medical devices for orthopedic care, from injury prevention and pain management to joint replacement and rehabilitation.

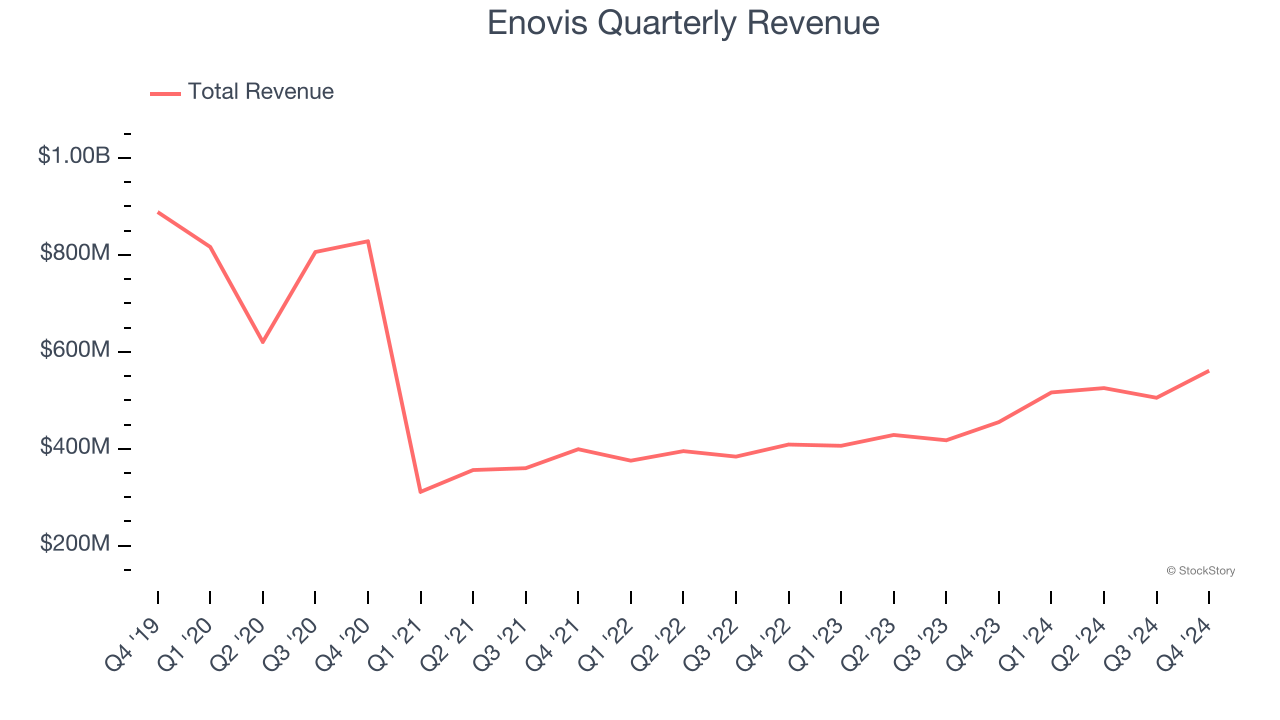

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Enovis’s demand was weak and its revenue declined by 8.7% per year. This was below our standards and is a sign of poor business quality.

2. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Enovis’s five-year average ROIC was negative 4.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Enovis doesn’t pass our quality test. Following the recent decline, the stock trades at 10.2× forward price-to-earnings (or $31.96 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than Enovis

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.