Edgewell Personal Care has gotten torched over the last six months - since December 2024, its stock price has dropped 27.4% to $26.96 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Edgewell Personal Care, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Edgewell Personal Care Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in Edgewell Personal Care. Here are three reasons why there are better opportunities than EPC and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

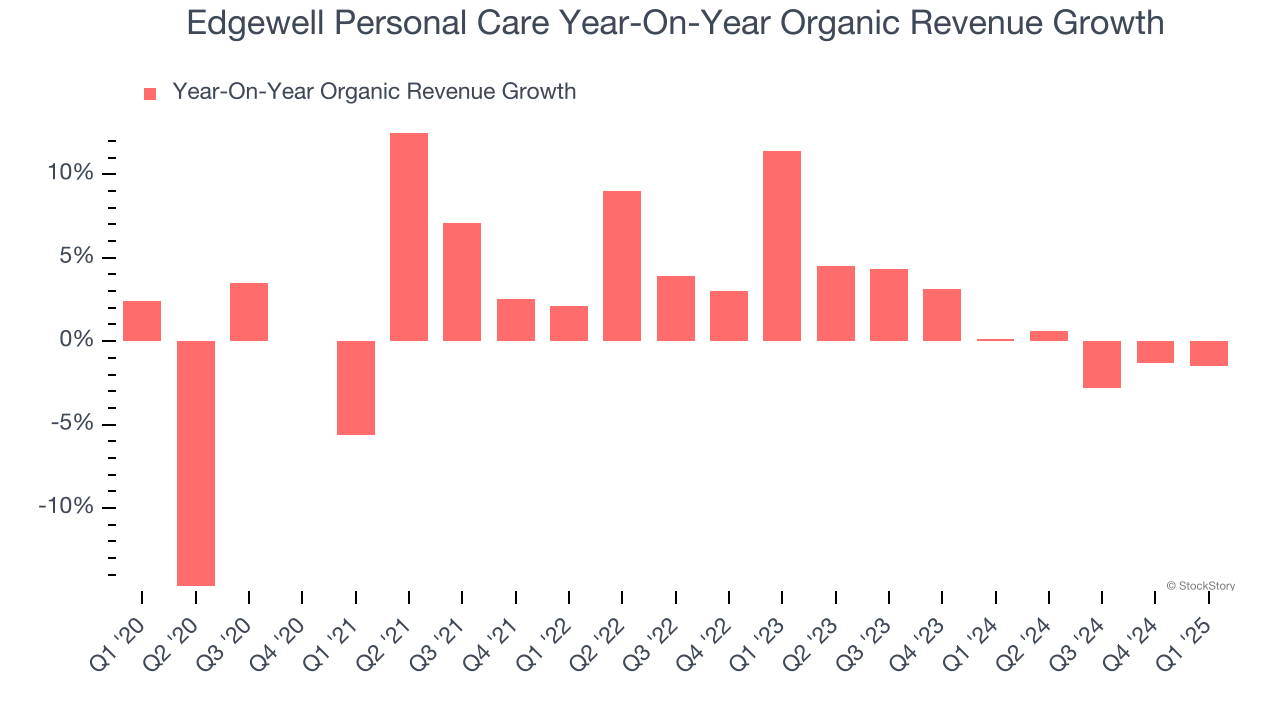

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Edgewell Personal Care’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

2. Free Cash Flow Margin Dropping

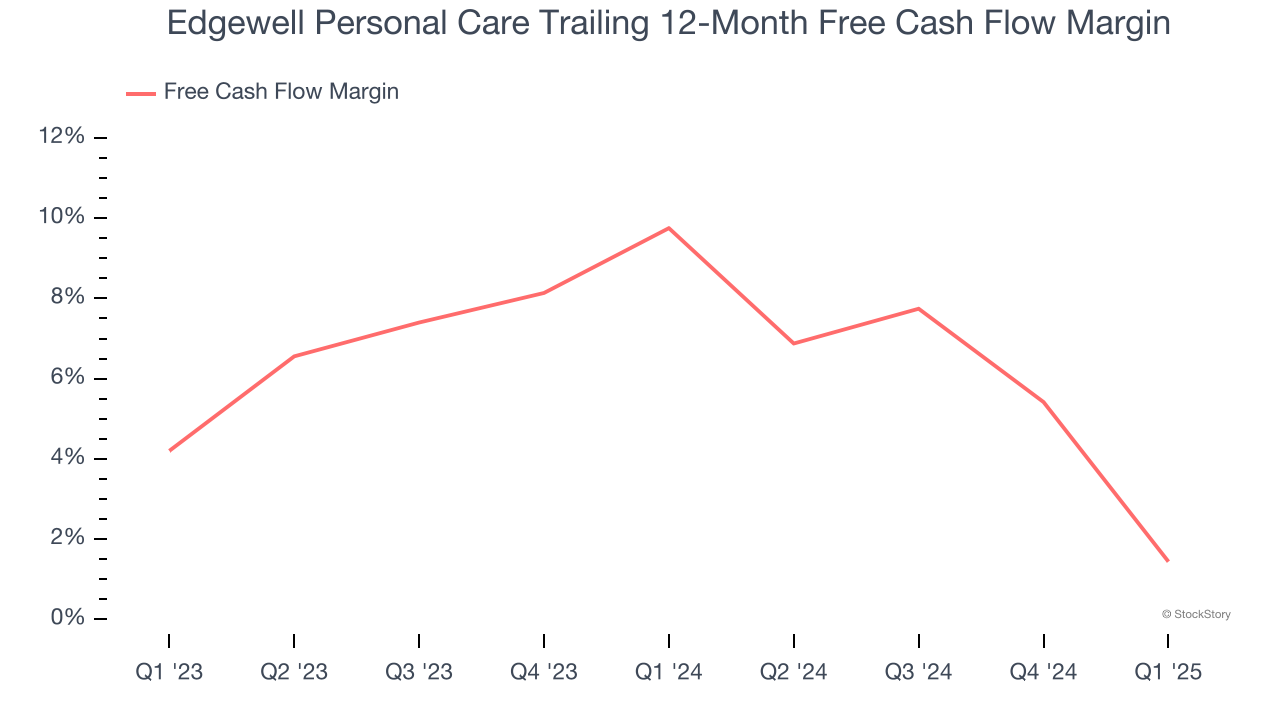

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Edgewell Personal Care’s margin dropped by 8.3 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Edgewell Personal Care’s free cash flow margin for the trailing 12 months was 1.4%.

3. Previous Growth Initiatives Haven’t Impressed

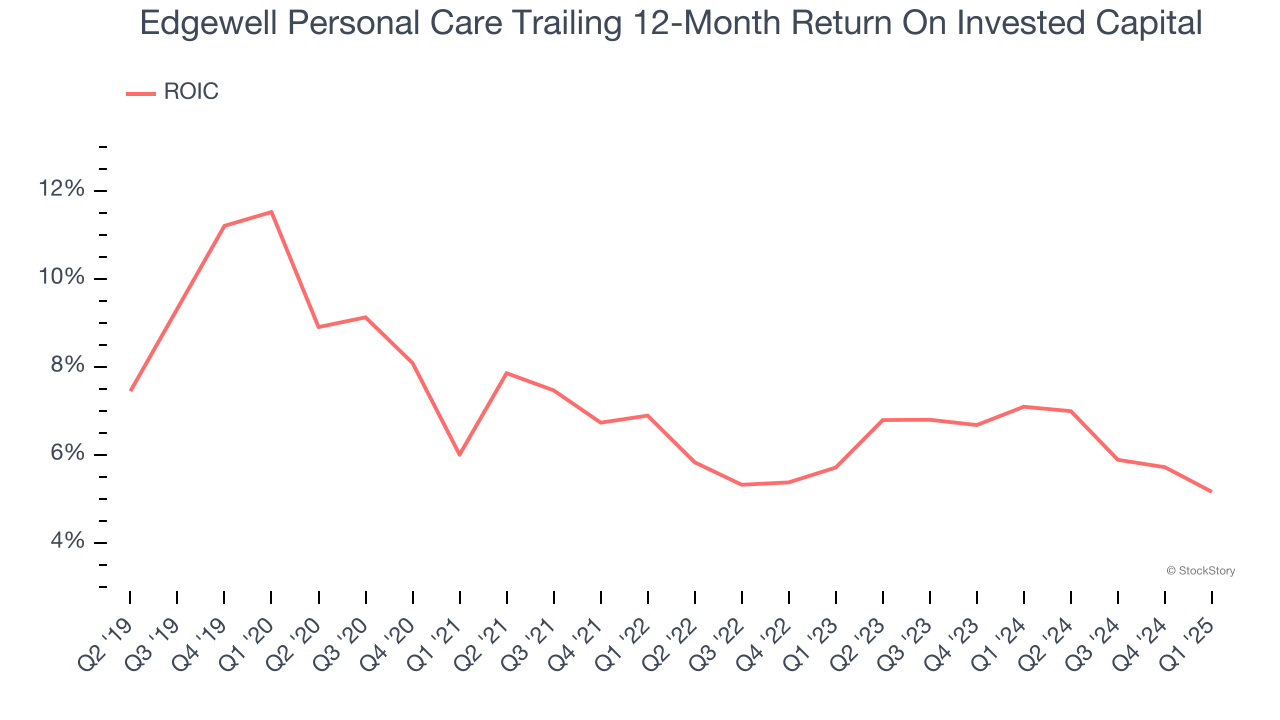

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Edgewell Personal Care historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Edgewell Personal Care doesn’t pass our quality test. Following the recent decline, the stock trades at 8.2× forward P/E (or $26.96 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Edgewell Personal Care

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.