ResMed has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.9%. The stock now trades at $281.96, marking a 20.7% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy RMD? Find out in our full research report, it’s free.

Why Do Investors Watch ResMed?

Founded in 1989 to address the then-underdiagnosed condition of sleep apnea, ResMed (NYSE: RMD) develops cloud-connected medical devices and software solutions that treat sleep apnea, COPD, and other respiratory disorders for home and clinical use.

Three Positive Attributes:

1. Constant Currency Revenue Drives Growth

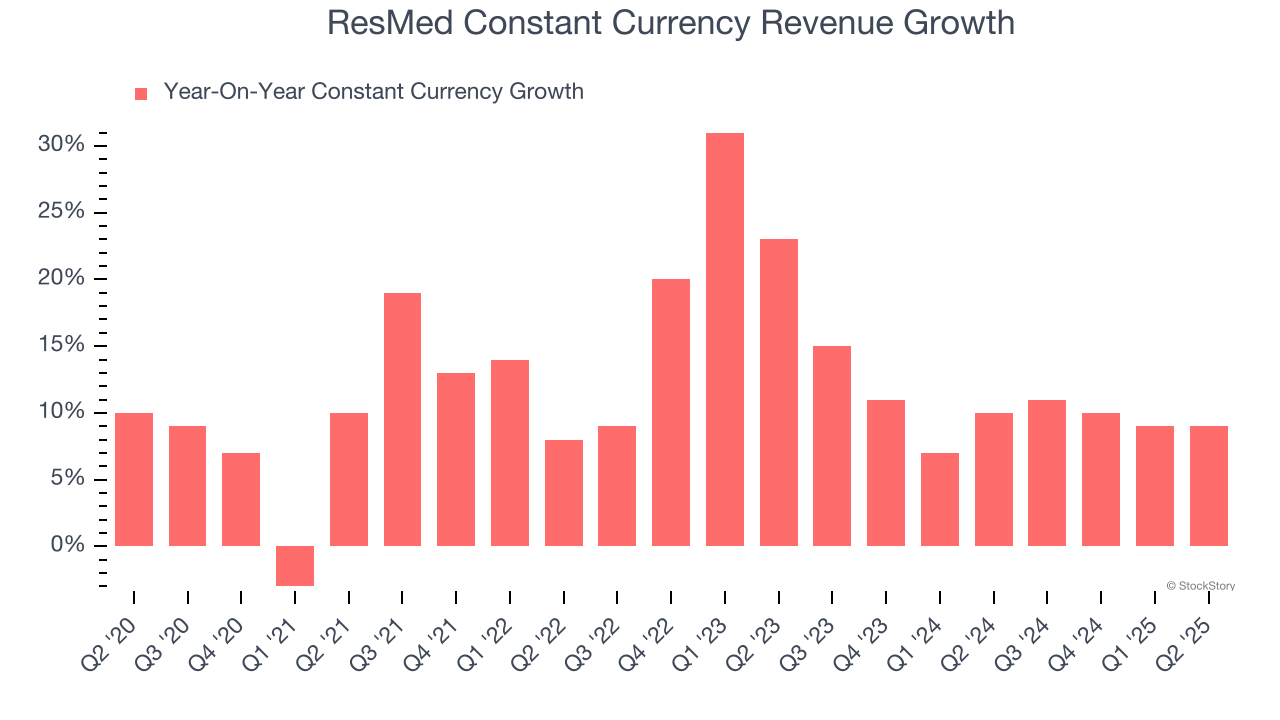

Investors interested in Patient Monitoring companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of ResMed’s control and are not indicative of underlying demand.

Over the last two years, ResMed’s constant currency revenue averaged 10.3% year-on-year growth. This performance was solid and shows it can expand steadily on a global scale regardless of the macroeconomic environment.

2. Outstanding Long-Term EPS Growth

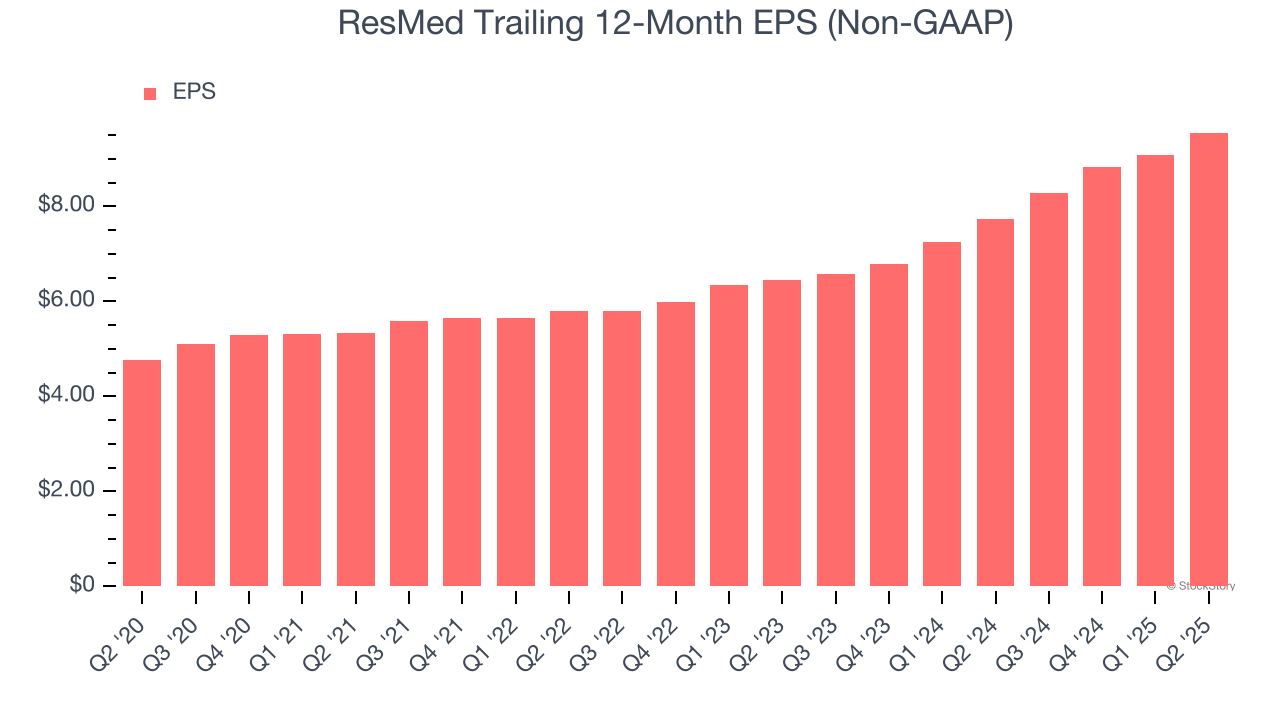

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

ResMed’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 11.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Increasing Free Cash Flow Margin Juices Financials

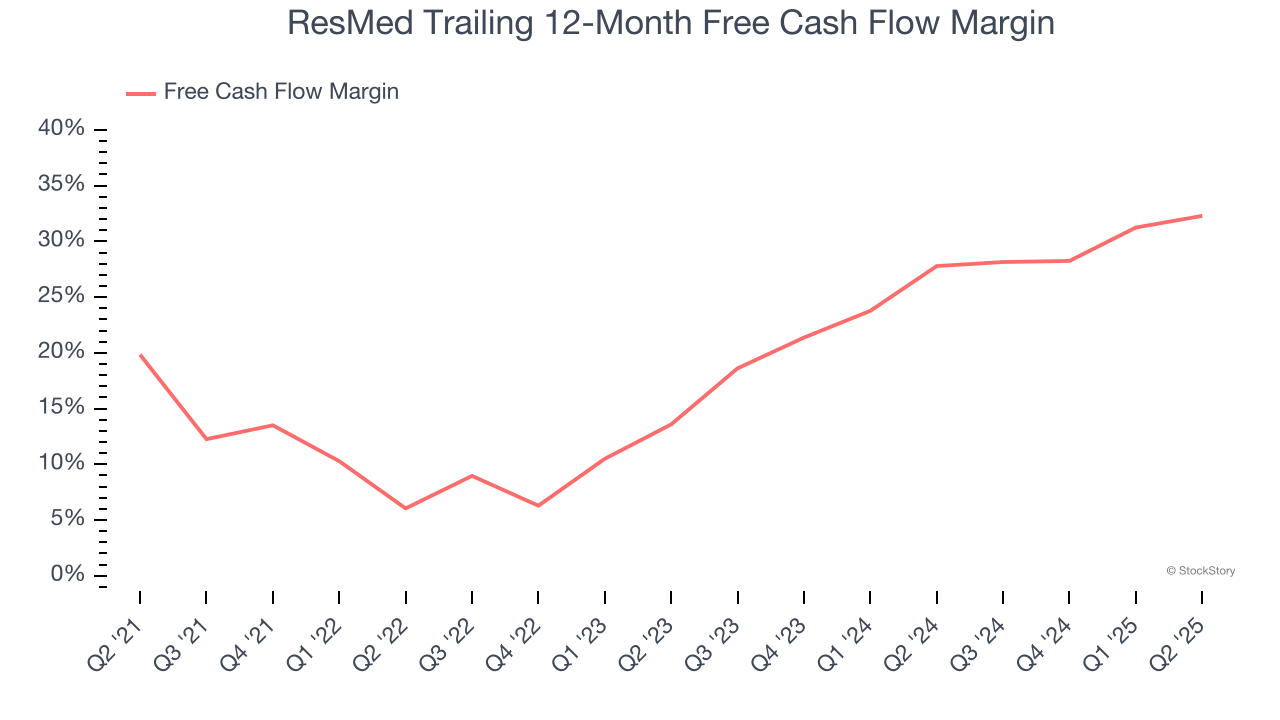

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, ResMed’s margin expanded by 12.5 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. ResMed’s free cash flow margin for the trailing 12 months was 32.3%.

Final Judgment

There are definitely things to like about ResMed, and with its shares beating the market recently, the stock trades at 27.2× forward P/E (or $281.96 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.