Energy drink company Monster Beverage (NASDAQ: MNST) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 16.8% year on year to $2.20 billion. Its non-GAAP profit of $0.56 per share was 17.5% above analysts’ consensus estimates.

Is now the time to buy Monster? Find out by accessing our full research report, it’s free for active Edge members.

Monster (MNST) Q3 CY2025 Highlights:

- Revenue: $2.20 billion vs analyst estimates of $2.11 billion (16.8% year-on-year growth, 4.3% beat)

- Adjusted EPS: $0.56 vs analyst estimates of $0.48 (17.5% beat)

- Operating Margin: 30.7%, up from 25.5% in the same quarter last year

- Market Capitalization: $66.27 billion

Hilton H. Schlosberg, Chief Executive Officer, said, “The global energy drink category continues to demonstrate solid growth, driven by increasing consumer demand. We again delivered solid financial results in the 2025 third quarter, with record net sales, gross profit dollars, operating income and net income. The results for the quarter reflect the strength of our brands and dedication of our teams around the world. Our Monster Energy Ultra® energy drinks once again contributed significantly to our growth this quarter. Our net sales to customers outside of the United States increased 23.3 percent in the 2025 third quarter to approximately 43 percent of total net sales, up from approximately 40 percent in the 2024 third quarter, and is the highest percentage of net sales to customers outside the United States recorded by the Company to date for a single quarter.

Company Overview

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ: MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $7.98 billion in revenue over the past 12 months, Monster is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions.

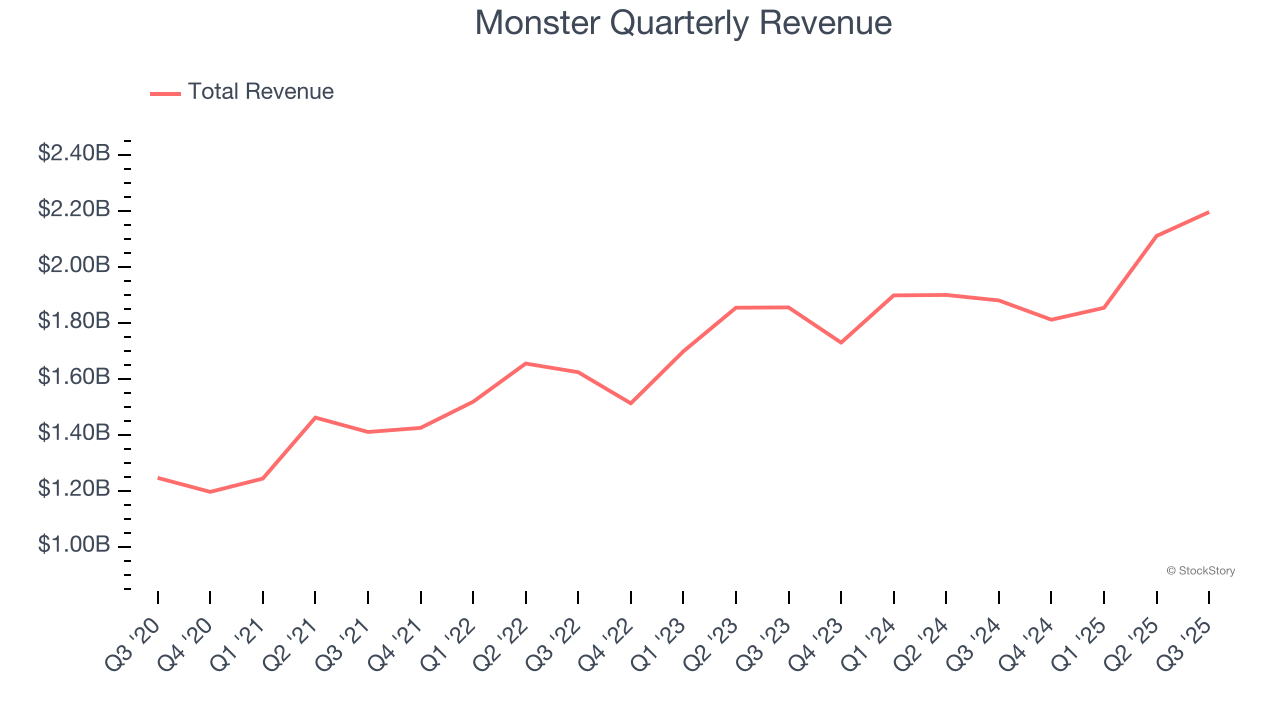

As you can see below, Monster’s 8.6% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a helpful starting point for our analysis.

This quarter, Monster reported year-on-year revenue growth of 16.8%, and its $2.20 billion of revenue exceeded Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and implies its newer products will help maintain its historical top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

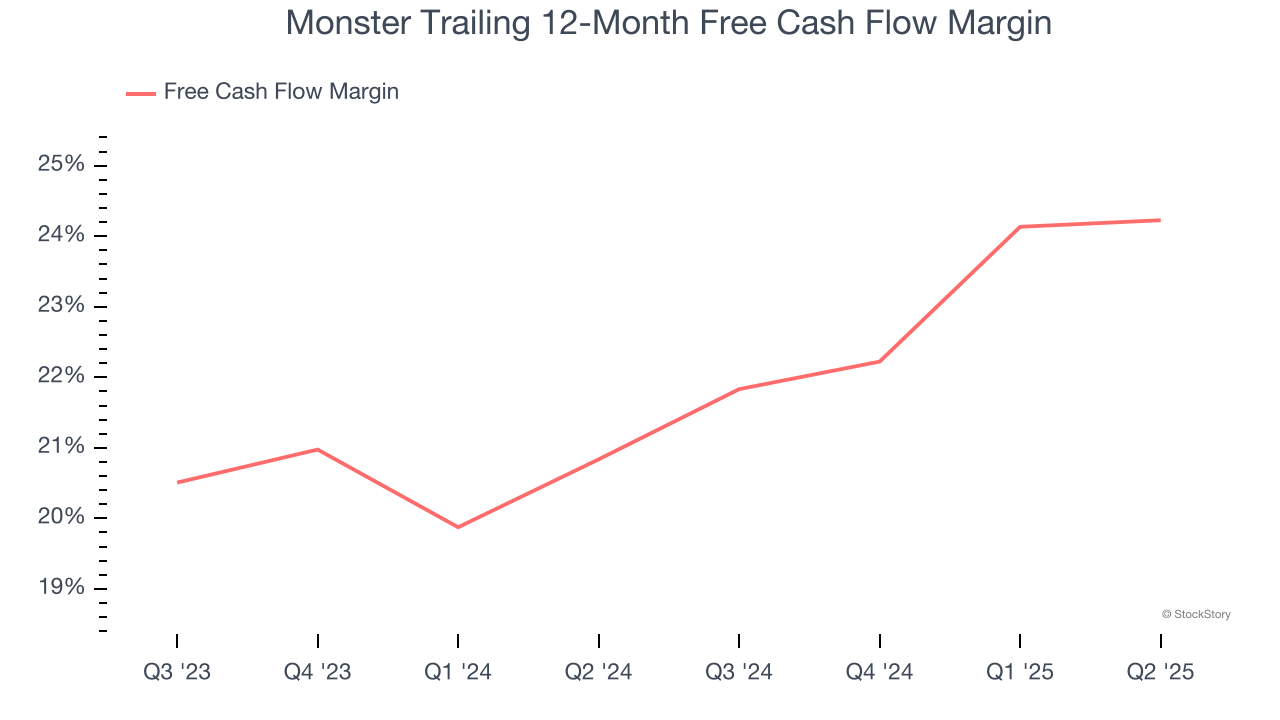

Monster has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 22% over the last two years.

Key Takeaways from Monster’s Q3 Results

We enjoyed seeing Monster beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 4.2% to $69.22 immediately after reporting.

Indeed, Monster had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.