HALIFAX, NS / ACCESSWIRE / February 2, 2024 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NCMI") (TSX.V:NMI)(OTCQB:NMREF) is pleased to announce that it received all laboratory assays of the RC drilling campaign for its PFS study on the large-scale "Lofdal 2B-4" heavy rare earth project.

The final infill drilling campaign entailed 7 very deep (end of hole between 325 and 401 meters) reverse circulation boreholes for a total of 2,597 m in the Area 4 main deposit. Assays were received from Actlabs, Canada. Highlights are:

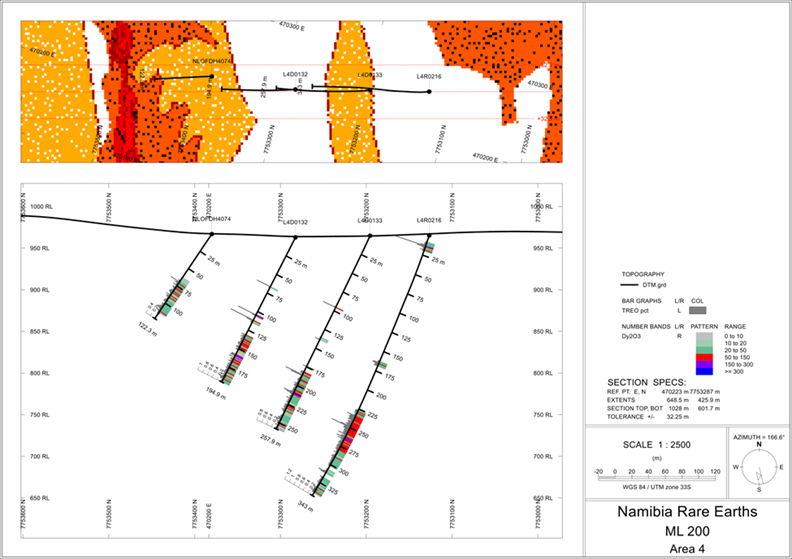

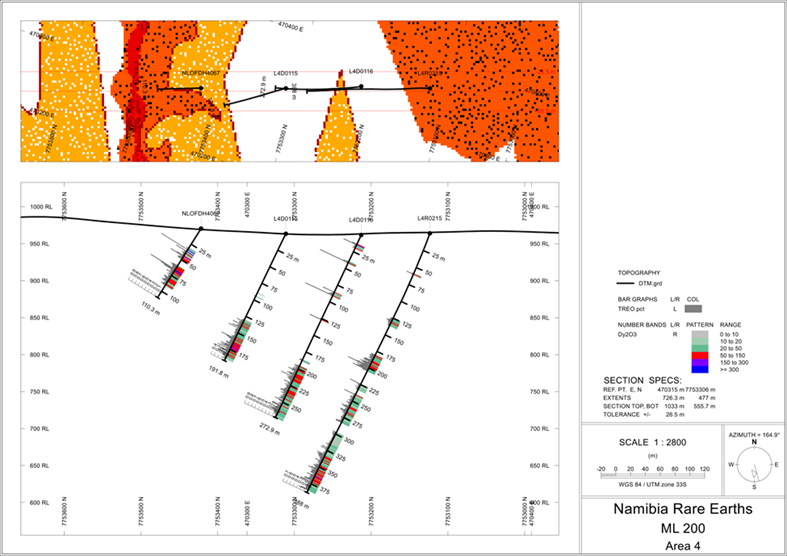

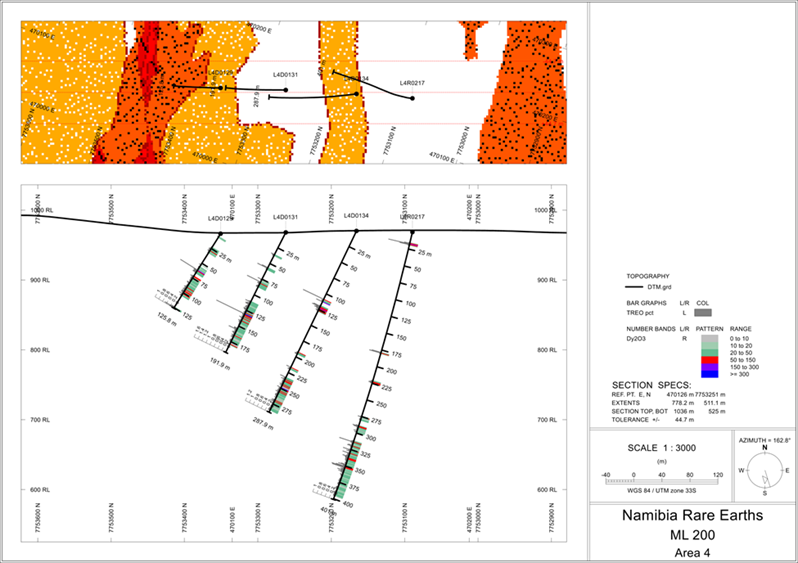

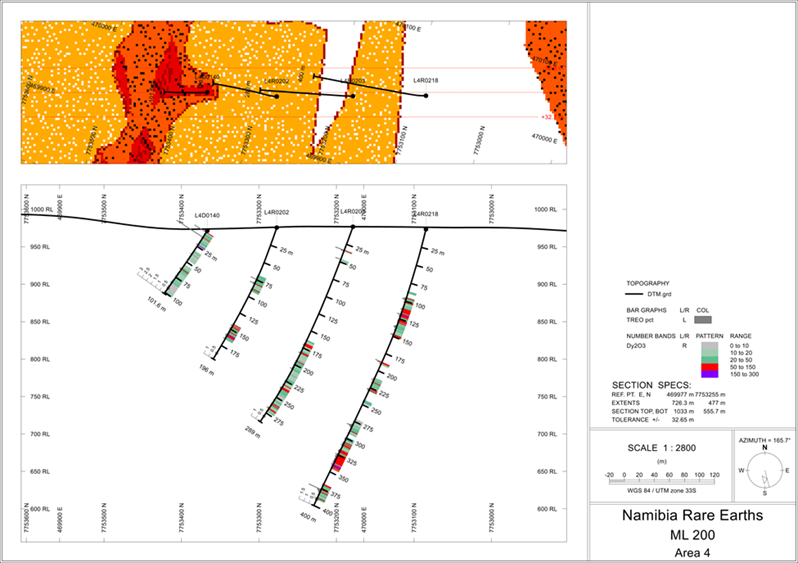

Continuation of the rare earth mineralization at depth was confirmed by all infill drill holes in grade and width in accordance with the geological model.

The last borehole drilled (L4R0218) showed an increase in grade and width of the heavy rare earth mineralization and confirmed that the rare earth mineralization is open in southwesterly direction and at depth of the Area 4 main deposit.

The Company appointed Qubeka, a Namibian consultancy specialised in surface mine planning and engineering to develop the mine model and schedule for the planned Lofdal mines "2B pit" and "4 pit". Qubeka is highly recognized and produced mine plans and engineering solutions e.g. for QKR's Navachab, B2Gold's Otjikoto and Osino's Twin Hill gold mines.

Darrin Campbell, President of Namibia Critical Metals stated:

"Another important milestone was reached, and I am very pleased to see the boxes systematically getting ticked for the PFS of our expanded project "Lofdal 2B-4". With the drill data already at The MSA Group I'm looking forward to an updated Mineral Resource Statement towards the end of February this year, and a kick-off of the detailed mine planning for both, the planned Area 4 and Area 2B pits by the internationally highly recognized Namibian consultancy Qubeka."

Final infill drilling program at Area 4 deposit

A final drill program was worked out by the Company with support by The MSA Group to increase the level of resource categories as required for the PFS for the expanded project "Lofdal 2B-4". Resource infill drilling was completed in November 2023.

The drilling campaign entailed 7 boreholes with the cost-efficient reverse circulation (RC) method. In total of 2,597 meters were drilled with the deepest borehole reaching a depth of 401 m.

Logging of the drill core confirmed the geological model of structural zones acting as fluid channels and controlling intensity, pinching and swelling as well as splaying of the wide mineralized zones.

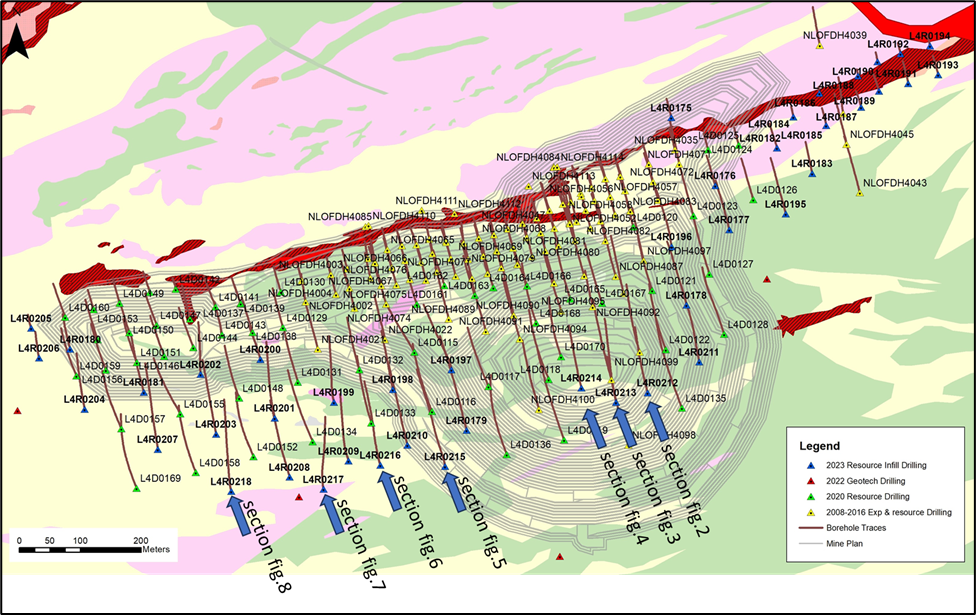

Figure 1: Location of final seven drill collars for deep infill drilling at Area 4 and indication of the sections in the following figures

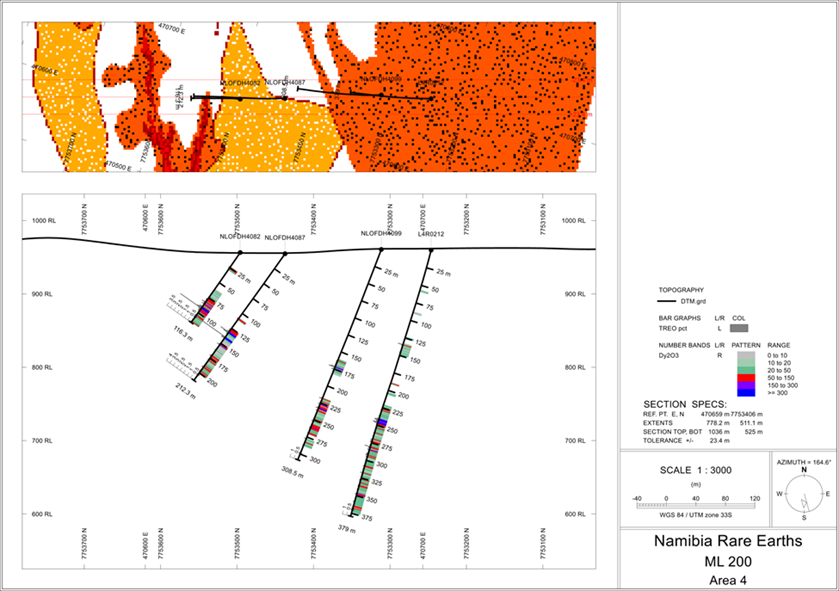

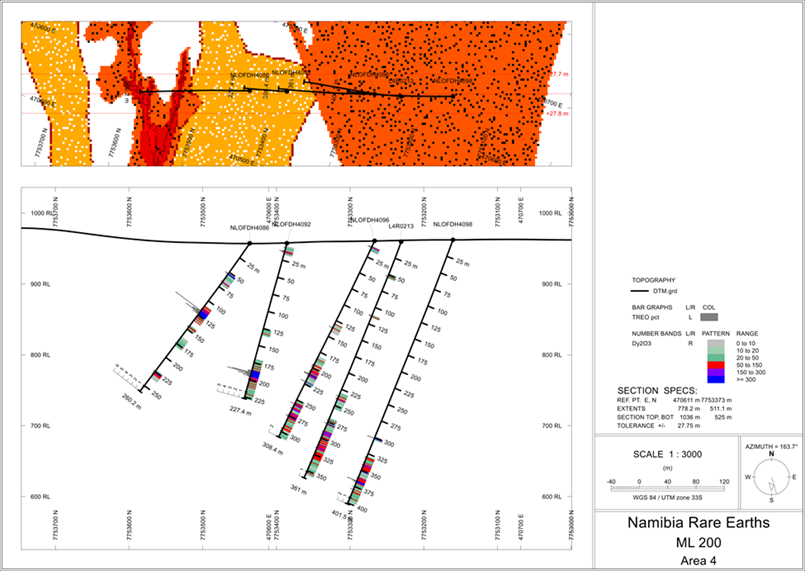

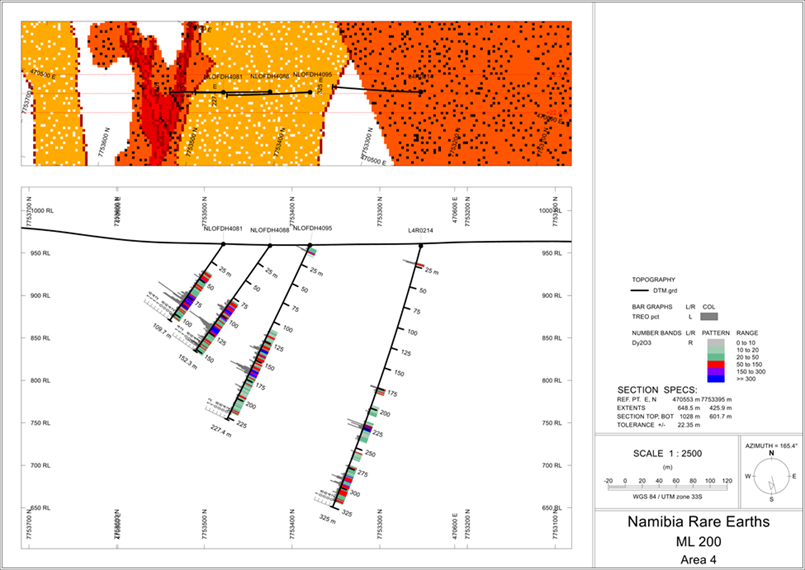

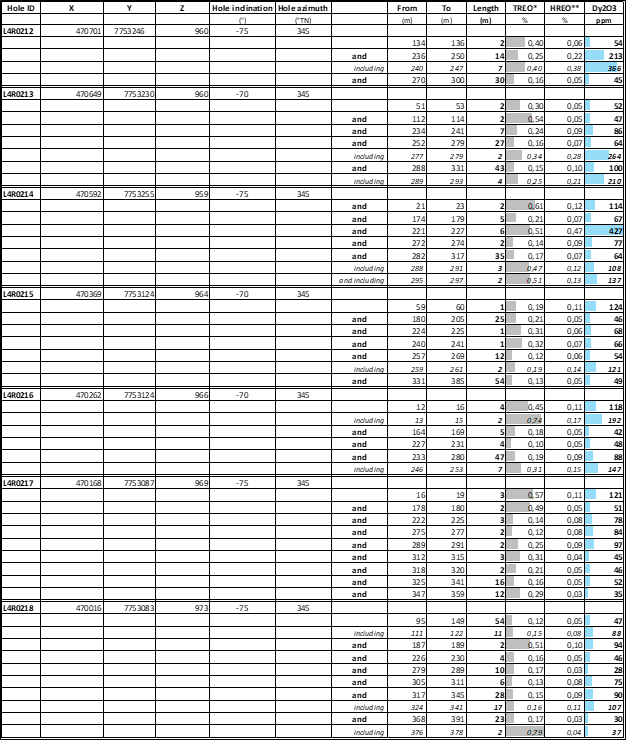

Mineralized intercepts are summarized in Table 1. The intercepts were generally selected based on an assumed cut-off of 0.1% TREO1 as previously used in the PEA "Lofdal 2B-4" (see press release on 14 Nov 2022).

The intercepts partly include a significant number of samples with <0.1% TREO in order to reflect the width of the mineralized zone potentially forming consecutive ore blocks (see sections in Figures 2 to 8) in a large-scale open pit operation. By including lower grade mineralization, the combined mineralized intervals may reach more than 100 m length in total as for example in borehole L4R0218 with 7 mineralized intercepts with a combined length of 127 m between 95 m and 391 m depth (for details see Table 1).

Sampling, analysis and QAQC

1234 samples of average 1.8 kg per sample were collected at the drill rig's cyclone ("A-sample") and submitted to Actlab's preparatory laboratory in Windhoek, Namibia, in batches of 200 to 300 samples. The samples were dried and crushed to 2 mm, split using a riffle splitter and pulverised to 105 µm. Pulverised sub-samples were homogenised in a stainless-steel riffle splitter and a 15 g sample and duplicate were drawn for analysis. The pulverised sample aliquots were shipped to the ISO/IEC 17025 accredited Actlabs analytical facility in Ancaster, Ontario, Canada. The samples were assayed using lithium metaborate-tetraborate fusion and Inductively Coupled Plasma Mass Spectrometry (ICP-MS). Actlab's analytical code "8-REE" includes 45 trace elements, 10 major oxides, Loss on Ignition, and mass balance.

The samples were subjected to a quality assurance and quality control (QAQC) program consisting of the insertion of blank samples, field duplicates and certified reference materials at Lofdal and the preparation of a laboratory duplicate at the sample preparation facility in Windhoek.

The Qualified Person, Dr Scott Swinden, is satisfied that the assay results are of sufficient accuracy and precision for use in the future update of the Mineral Resource Estimation.

1 "TREO" refers to total rare earth oxides plus yttrium oxide; "HREO" refers to heavy rare earth oxides plus yttrium oxide; "heavy rare earths" as used in all Company presentations comprise europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and yttrium (Y). Light rare earths comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm).

Figure 2: Section through the central part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 3: Section through the central part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 4: Section through the central part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 5: Section through the central-western part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 6: Section through the central-western part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 7: Section through the western part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Figure 8: Section through the western part of Area 4 (location see on Figure 1) indicating the mineralised intervals by display of TREO1 grades (grey bars) and Dy2O3 (color bands)

Table 1: Summary of mineralized intervals of the final RC infill drilling program at Lofdal Area 4

About Namibia Critical Metals Inc.

NCMI is developing the Tier-1 Heavy Rare Earth Project, Lofdal, a globally significant deposit of the heavy rare earth metals dysprosium and terbium. Demand for these critical metals used in permanent magnets for electric vehicles, wind turbines and other electronics is driven by innovations linked to energy and technology transformations. The geopolitical risks associated with sourcing many of these metals has become a repeated concern for manufacturers and end users. Namibia is a proven and stable mining jurisdiction.

The Lofdal Project is fully permitted with a 25-year Mining License and is under a Joint Venture Agreement with Japan Organization for Metals and Energy Security (JOGMEC).

The Company filed a robust updated PEA for "Lofdal 2B-4" on November 14, 2022, with a post-tax NPV of USD$391 million and an annual IRR of 28% with a capital expenditure of USD$207 million. The project is projected to generate a life of mine nominal cash flow of USD$698 million post-tax over a 16-year mine life.

About Japan Organization for Metals and Energy Security (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earth elements are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with USD$250,000,000 in loans and equity in 2011 to ensure supplies of the Light Rare Earths metals suite to the Japanese industry.

Namibia Critical Metals owns a 95% interest in the Lofdal project with the remaining 5% held for the benefit of historically disadvantaged Namibians. The terms of the JOGMEC joint venture agreement with the Company stipulate that JOGMEC provides C$3,000,000 in Term 1 and C$7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further C$10,000,000 of expenditures to earn an additional 10% interest. JOGMEC can also purchase another 1% for C$5,000,000 and has first right of refusal to fully fund the project through to commercial production and to purchase all production at market prices. The collective interests of NCMI and historically disadvantaged Namibians cannot be diluted below a 26% carried working interest upon payment of C$5,000,000 to JOGMEC for the dilution protection. NMI may elect to participate up to a maximum of 44% by funding pro rata after the earn in period is completed.

To date, JOGMEC has completed Term 2 and earned a 40% interest by reaching the C$10 million expenditure requirement. JOGMEC has approved an additional C$3,050,000 budget for Term 3 through to March 31, 2024. Total approved project funding to date is C$13,050,000 of the $20,000,000 Earn-In requirement to reach 50% interest.

Other exploration projects: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the Osino gold discovery at Twin Hills have been identified and exploration is progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization.

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM and Vice President of Namibia Critical Metals Inc., is the Company's Qualified Person and has reviewed and approved this press release.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI" and the OTCQB Market under the symbol "NMREF".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact:

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Email: Info@NamibiaCMI.com Web site: www.NamibiaCriticalMetals.com

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Namibia Critical Metals Inc.

View the original press release on accesswire.com