The Metals sector was showing a strong rebound early Tuesday morning on what looks to be a renewed flight to safety given overnight headlines.

The US supposedly bombed a “big facility” in Venezuela while Ukraine allegedly launched a drone attack against one of Putin's residences.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Reportedly, investors will take a look at the minutes from the December US Federal Open Market Committee meeting upon release Tuesday afternoon.

Morning Summary: Naturally, the first thing I noticed Tuesday morning was the rebound in Metals following Monday’s meltdown by the sector. As of this writing, silver’s Cash Index (SIY00) had rallied as much as $3.02 (4.2%) while the Cash Index for gold (GCY00) added as much as $50.62 (1.2%). Even Dr. Copper, the economic indicator, played along as the March futures contract (HGH26) gained as much as 17.9 cents (3.2%) overnight. Was this nothing more than a little Turnaround Tuesday activity, or was there something more to the move? I would argue it’s the latter, based on lead stories on CNBC’s program Squawk Box Europe indicating two of the 3 Amigos are mad. Leading off, the US president was again making threats to fire, if he could, US Fed Chairman Powell because interest rates aren’t coming down fast enough, the US dollar hasn’t fallen far enough[i]. Sure…Next we have Russia’s Vlad the Invader reportedly threatening retaliation against Ukraine for an alleged attack on one of his personal residences. Again, though, the “evidence” of such an attack seems to be lacking. All we need now is China’s President Xi to get upset with Taiwan, and the trifecta will be complete. Global equity markets are mixed with Asia closing lower and Europe trading higher.

Corn: The corn market was quietly lower overnight through early Tuesday morning. Did you expect a different opening line this time around the clock? The March issue posted a 1.0-cent trading range on trade volume, if you want to call it that, of fewer than 6,000 contracts. That’s all I need to say about the overnight session as of this writing, so let’s turn our attention back to Monday afternoon and evening. Recall March closed 7.75 cents lower while May was down 7.5 cents and July finished 7.25 cents in the red, the futures spreads indicating a light round of commercial pressure to go along with noncommercial selling. Regarding the latter, March corn was down 5.25 cents from last Tuesday’s close indicating Watson has been liquidating some of its net-long futures position, last reported at 14,660 as of Tuesday, December 16. On the commercial side, the National Corn Index ($CNCI) was priced Monday night near $4.0375, down 7.25 cents for the day. This tells us national average basis firmed following Monday’s break but remains below both the previous 5-year and 10-year low weekly closes for this week. Also, the latest Index calculation continues to run well below the previous 5-year low end of December price of $4.3175.

Soybeans: The soybean market was in the green pre-dawn on light overnight trade volume. The March issue posted a 4.5-cent trading range while registering 12,000 contracts changing hands and was sitting 2.0 cents higher at this writing. I’m not reading this as a wave of buying interest from the world’s largest buyer – China, if you need a hint – but rather an eddy[ii] in the market. It is possible we see an announced sale by USDA later Tuesday morning given Monday’s selloff in the futures market. Recall the March issue lost as much as 9.5 cents to open the last week of the year before closing 9.0 cents lower, though the carry in the March-May futures spread held steady at a carry of 11.75 cents and covered 42% calculated full commercial carry. This told us most of the selling came from the noncommercial side. Later in the evening, the National Soybean Index ($CNSI) came in near $9.8425, down 8.0 cents for the day indicating national average basis had firmed by 1.0 cent versus the March contract. On the other hand, the Index also drew nearer to its previous 5-year end of December low price of $9.4950. As for Watson, March was down 0.25 cent from last Tuesday’s settlement at Monday’s close.

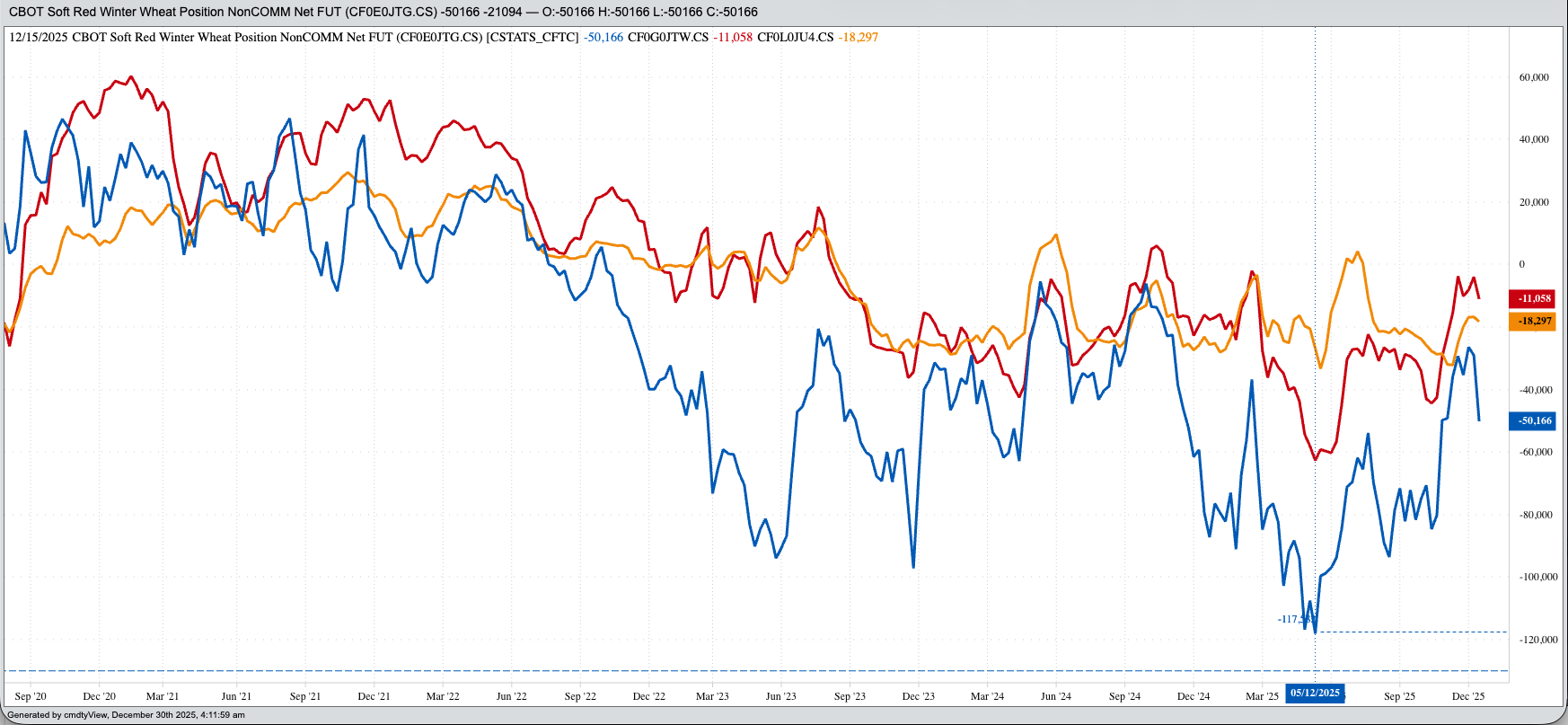

Wheat: Winter wheat markets were fractionally higher to start the day, but I’m expecting a dull, holiday light display (blinking green and red) from this writing through Tuesday morning’s intermission. The March SRW issue was up 0.5 cent at this writing after trading as much as 2.5 cents higher and 1.0 cent lower overnight on trade volume of 3,000 contracts. It was a similar story in HRW where the March issue was showing a 3.0-cent trading range, from up 2.25 cents to down 0.75 cent while registering fewer than 1,200 contracts changing hands and was sitting 0.25 cent lower at this writing. What does this tell us about the day ahead? Nothing. A look back at Monday’s session and we know March SRW closed 6.0 cents lower on what looked to be noncommercial selling while March HRW finished 6.25 cents in the red with the carry in the March-May futures spread at 13.0 cents, its strongest close since October 28 indicating continued commercial pressure. National Cash Indexes came in near $4.5550 ($CSWI) and $4.55 ($CRWI), both falling further below previous 5-year end of December lows of $4.9275 and $4.9775 respectively. Based on the Law of Supply and Demand, we know real winter wheat fundamentals remain bearish.

[i] After writing this segment, I saw the news today (Oh boy) that the US president also claimed blowing up a “big facility” (bigly?) in Venezuela. If true, and well, you know…, it would be the first land attack by the US in Venezuela.

[ii] Eddy: A current that runs contrary to the main current or tradition.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart