Gulf Run provides connectivity from natural gas producing regions in the U.S. to the Gulf Coast to meet growing domestic and international demand

Dallas-based Energy Transfer LP (NYSE: ET) today announced its subsidiary, Gulf Run Transmission LLC has received FERC approval to place the Gulf Run pipeline in service delivering domestically produced natural gas from key U.S. producing regions to meet the rapidly growing demand along the Gulf Coast and international markets. The newly constructed 135-mile, 42-inch natural gas pipeline in Louisiana has a capacity of 1.65 Bcf/day, with potential growth opportunities.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221215005982/en/

(Photo: Business Wire)

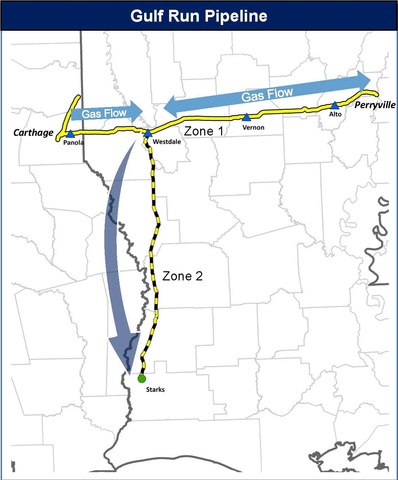

Gulf Run receives natural gas from Energy Transfer’s extensive intrastate and interstate pipeline network, including production directly from the Haynesville Shale. Volumes originating from all the major natural gas basins in the U.S. have access to the pipeline, including the Permian Basin, the Barnett Shale, the Marcellus and Utica shales, East Texas, the Arkoma and the Anadarko basins. The pipeline consists of two zones. Zone 1 connects the Carthage Hub to the Perryville markets and Zone 2 extends south and connects to Golden Pass Pipeline and to Energy Transfer’s Trunkline system. The Zone 1 segment has bi-directional flow capabilities, providing the ability to deliver significant volumes to Perryville as well as to the Golden Pass and Trunkline systems.

Energy Transfer owns and operates approximately 120,000 miles of pipeline and related infrastructure across 41 states transporting natural gas, crude oil, natural gas liquids and refined products. Energy Transfer operates more than 8,800 miles of pipeline in Louisiana.

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and 28.5 million common units of Sunoco LP (NYSE: SUN), and the general partner interests and 46.1 million common units of USA Compression Partners, LP (NYSE: USAC).

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. In addition to the risks and uncertainties previously disclosed, the Partnership has also been, or may in the future be, impacted by new or heightened risks related to the COVID-19 pandemic, and we cannot predict the length and ultimate impact of those risks. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221215005982/en/

Contacts

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

214-981-0795

Media Relations:

Vicki Granado

Alexis Daniel

214-840-5820

media@energytransfer.com