Calgary, Alberta--(Newsfile Corp. - August 30, 2023) - Copper Fox Metals Inc. (TSXV: CUU) (OTCQX: CPFXF) ("Copper Fox" or the "Company") is pleased to announce the results of an updated mineral resource estimate ("MRE") on its 100% owned Eaglehead copper-gold-molybdenum-silver porphyry copper project located in northwestern British Columbia. The MRE was prepared by Moose Mountain Technical Services ("MMTS") in accordance with National Instrument 43-101 ("NI 43-101") standards (May 9, 2016), CIM Definition Standards (May 19, 2014) with guidance from CIM Best Practice Guidelines (November 29, 2019). For reporting purposes, a C$5.50 net smelter return ("NSR") is considered the base case for the MRE.

Elmer B. Stewart, President and CEO of Copper Fox stated, "This mineral resource estimate is a key milestone for Eaglehead as it is the first time an indicated mineral resource has been reported on the project. The current pit constrained resource estimate resulted from the geological modelling and compilation completed over the past year and shows a significant increase in project resources when compared to previous historical resource estimates. The spatial distribution of the alteration, mineral zonation, and style of mineralization indicates that the current mineral resource represents the upper level of a potentially much larger, open ended porphyry copper deposit. The zones of porphyry style mineralization are open at depth and along strike and indicates potential to significantly expand the project resource base. The Company is currently evaluating the MRE and plans to use these results to develop a program to continue testing the resource potential of the project."

Resource Estimate

The MRE for the Eaglehead project, as prepared by MMTS, is summarized in Table 1 below. The effective date of the MRE is August 21, 2023. Parameters used to define the "reasonable prospects of eventual economic extraction" pit are summarized in the Notes to Table 1. The NI 43-101 Technical Report disclosing the MRE will be filed on SEDAR+ within 45 days.

Table 1: Pit Constrained Mineral Resources for the Eaglehead Project with an effective date of August 21, 2023.

| In situ Grade | In situ Metal | |||||||||||||

| Class | NSR Cutoff | Tonnage | NSR | CuEq | Cu | Mo | Au | Ag | NSR | CuEq | Cu | Mo | Au | Ag |

| (C$ /tonne) | (kt) | (C$ /tonne) | % | % | % | gpt | gpt | M$ | Mlb | Mlb | Mlb | koz | koz | |

| Indicated | 5.00 | 71,971 | 24.42 | 0.322 | 0.219 | 0.0107 | 0.060 | 0.9 | 1,758 | 510 | 347 | 17.0 | 139.8 | 2,159 |

| 5.50 | 70,810 | 24.74 | 0.326 | 0.221 | 0.0108 | 0.061 | 0.9 | 1,752 | 509 | 345 | 16.9 | 139.6 | 2,151 | |

| 8.00 | 64,395 | 26.52 | 0.349 | 0.236 | 0.0118 | 0.066 | 1.0 | 1,708 | 496 | 335 | 16.8 | 137.5 | 2,093 | |

| 10.00 | 58,210 | 28.38 | 0.374 | 0.251 | 0.0128 | 0.072 | 1.1 | 1,652 | 480 | 322 | 16.4 | 134.6 | 2,021 | |

| 15.00 | 43,415 | 33.83 | 0.446 | 0.293 | 0.0161 | 0.089 | 1.3 | 1,469 | 427 | 280 | 15.4 | 123.8 | 1,798 | |

| 20.00 | 30,454 | 40.82 | 0.538 | 0.344 | 0.0207 | 0.112 | 1.6 | 1,243 | 361 | 231 | 13.9 | 109.2 | 1,530 | |

| Inferred | 5.00 | 250,820 | 18.19 | 0.240 | 0.187 | 0.0035 | 0.042 | 0.6 | 4,562 | 1,325 | 1,036 | 19.4 | 339.5 | 5,024 |

| 5.50 | 242,331 | 18.64 | 0.246 | 0.192 | 0.0035 | 0.043 | 0.6 | 4,517 | 1,312 | 1,025 | 18.7 | 335.8 | 4,971 | |

| 8.00 | 202,996 | 20.95 | 0.276 | 0.215 | 0.0040 | 0.049 | 0.7 | 4,253 | 1,235 | 964 | 17.9 | 318.5 | 4,660 | |

| 10.00 | 175,071 | 22.86 | 0.301 | 0.234 | 0.0044 | 0.054 | 0.8 | 4,002 | 1,163 | 905 | 17.0 | 302.8 | 4,379 | |

| 15.00 | 118,277 | 27.91 | 0.368 | 0.283 | 0.0056 | 0.068 | 0.9 | 3,301 | 959 | 739 | 14.6 | 260.1 | 3,590 | |

| 20.00 | 78,227 | 33.32 | 0.439 | 0.334 | 0.0069 | 0.086 | 1.1 | 2,607 | 757 | 576 | 11.9 | 215.5 | 2,814 | |

| 20.00 | 108,681 | 35.42 | 0.467 | 0.337 | 0.0108 | 0.093 | 1.2 | 3,850 | 1,118 | 807 | 25.9 | 325.0 | 4,347 | |

NSR=net smelter return, CuEq=copper equivalent, Cu=copper, Mo=molybdenum, Au=gold, Ag=silver.

kt=thousands of tonnes, gpt=grams per tonne, Mlb=millions of pounds, koz=thousands of ounces.

Notes to the Resources Table

- The Mineral Resource Estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person.

- Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource has been confined by a "reasonable prospects of eventual economic extraction" pit using the following assumptions:

- Cu price of US$3.50/lb, Mo price of US$20.00/lb, Au price of US$1,750/oz, Ag price of US$20/oz at an exchange rate of 0.77 US$ per C$.

- 97% for Cu and Au, 90.0% payable for Ag, 99.0% payable for Mo, 1% Unit deduction for Cu and Mo, Cu concentrate smelting of US$120/wmt, US$0.10/lb Cu refining and transport of US$100/t. For Mo smelting costs of US$2.5/wmt con, US$1.52/lb Mo refining, and US$154.05/wmt transport, Au refining of US$8.00/oz with Ag refining of US$0.50/oz with transportation costs included in the Cu con.

- Recoveries for Cu, Mo, Au, and Ag of 89.9%, 71.1%, 78.6% and 78.1% respectively.

- Resulting NSR equation is: NSR = 22.0462*(Cu% * C$3.83/lb *89.9% + Mo%*C$ 23.58 * 71.1%) +Au gpt *C$70.55/g * 78.6% + Ag gpt * C$ 0.74/g * 78.1%

- Mining costs of C$1.50/t.

- Processing, G&A, and tailings management costs of C$5.50/t.

- Pit slopes of 50 degrees.

- Numbers may not sum due to rounding.

Geological Model

Eaglehead is an early Jurassic calc-alkaline Cu-Mo-Au-Ag porphyry deposit located approximately 50 kilometers ("km") east of Dease Lake hosted in the prolific Quesnel terrane in northwestern British Columbia, Canada. The deposit consists of four distinct mineralized zones as described below.

The East and Bornite zones are underlain by porphyritic biotite granodiorite intruding quartz porphyry and hornblende quartz diorite. The mineralization outcrops below the glacial overburden and is open at depth and both across and along strike. The copper mineralization is associated with potassic and texturally destructive sericite-chlorite alteration hosted in crosscutting, multi-phase quartz-sulphide veins and quartz vein stockworks that contain significant concentrations of gold-molybdenum-silver. The most intense alteration and highest copper grades are related to zones of increased vein and fracture density and late-stage magmatic breccia. Chalcopyrite, bornite, and pyrite also occurs as disseminations in the host rock.

The Pass and Camp zones are underlain by porphyritic biotite granodiorite and quartz porphyry intruded by generally thin, 2-5 meter ('m'), crowded quartz feldspar and quartz feldspar porphyry dikes. In general, these zones were drill tested by shallow drilling (+/-150m vertical) with only two drill holes located on the south side of the Pass zone extending to significant depth (+/- 500m). Near surface, the dominant copper sulphide is chalcopyrite. The mineralization is primarily copper-silver with sporadic gold-molybdenum concentrations increasing at depth. The copper mineralization is associated with texturally destructive sericite-chlorite and lesser amounts of potassic alteration. Propylitic alteration is dominant outward of the sericite-chlorite and potassic alteration. Chalcopyrite occurs primarily in crosscutting, multi-phase quartz-sulphide veins and quartz vein stockworks. At depth in the two deep drill holes in the Pass zone the chalcopyrite bearing veins contain increasing concentrations of bornite and molybdenite. The most intense alteration and highest copper grades are related to zones of increased vein and fracture density. Chalcopyrite, pyrite, and trace bornite also occurs as disseminations in the host rock.

Resource Estimate Methodology

Exploration Data Analysis

The exploration data and analytical database was verified by preparation and review of histograms, scatter plots, mean grades, coefficients of variation (CVs) and spatial review of mineralization patterns.

Domains

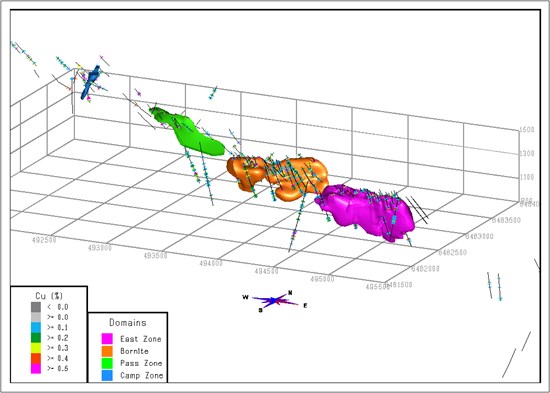

Interpolations domains have been created using the geologic model as a guideline and producing four main mineralized domains with an additional domain of an overall strike length of approximately 4.5 km, as illustrated in the figure below. For clarity Figure 1 does not show the "halo" domain, instead illustrating the Cu in the drillholes which the "halo" domain encompasses. "Firm" boundaries allowing sample sharing during the first pass of the interpolation (between 15m-60m depending on domain) have been used for the "halo" domain with the four main mineralized zones.

Figure 1: Location of the four main mineralized zones, Eaglehead project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2177/178936_a6c00f82d4c80a69_001full.jpg

Bulk Density

Bulk density has been assigned based on 2,484 measurements by lithology as between 2.66 and 2.72.

Capping and Outlier Restriction

Capping of the high-grade assays has been done prior to compositing to reduce the influence of very high grades. Outlier restriction during interpolation was applied to the composites to further reduce the influence of anomalously high grades and to ensure that the modelled grades and metal content validate with the data. The values of capping and outlier restriction are provided in the table below. At distance beyond 5m the composites are essentially capped at the outlier value.

Table 2: Eaglehead Capping and Outlier Restrictions

| Metal | Parameter | Domain | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| Cu | Cap (%) | 999 | 10 | 2 | 0.7 | 999 |

| Outlier (%) | 2.5 | 1.4 | 1.0 | 0.6 | 1.2 | |

| Mo | Cap (%) | 1 | 0.3 | 0.03 | 0.01 | 0.1 |

| Outlier (%) | --- | --- | --- | --- | --- | |

| Au | Cap (gpt) | 10 | 8 | 0.2 | 0.1 | 2 |

| Outlier (gpt) | 5 | 2 | 0.1 | 0.1 | 0.5 | |

| Ag | Cap (gpt) | 50 | 50 | 10 | 4 | 10 |

| Outlier (gpt) | 15 | 15 | 2 | 3 | 6 | |

Composites

The data has been composited to 5m intervals, honoring the domain boundaries. Samples less than 2.5m were merged with the composite sample above to homogenize sample support. Weighted mean grades of the assays and composites data have been compared to ensure no bias was introduced by the compositing process.

Variography

Variograms for each domain have been modelled for copper in order to aid in the determination of Classification parameters for the resource.

Estimation Interpolation Methods

Copper, molybdenum, gold, and silver have been estimated using inverse distance squared (ID2) with nearest neighbour (NN) estimates generated for validation. Interpolation has been done in five passes for each domain with search orientation based on variography and geologic modelling and search distances increasing with each pass up to 1.5 times the ranges found for the Cu variograms. Blocks were estimated using a minimum of four and a maximum of 12 composites with a maximum of 2 composites per drill hole for the first 4 passes. The final pass uses a minimum of 2, a maximum of 8 and minimum of 2 composites per drillhole.

Block Model Validation

Several validation techniques have been utilised to ensure that the estimates are reasonable. The global grades of the model with the de-clustered composites have been compared to ensure no bias was introduced. In addition, the total metal content for each metal at various cutoff have been compared to ensure that the total metal compares well to that of data. Grade-tonnage curves have ben created to ensure that the appropriate smoothing of modelled grades has been accomplished with no over-prediction of metal throughout the grade distributions. Swath plots comparing the de-clustered composite grade to the ID2 modelled estimate in Easing, Northing and Elevation were completed to ensure the model is spatially predicting grade correctly. Visual comparisons on section and plan were also done to ensure the model compares well to the assay grades.

Resource Estimate Uncertainty

Areas of uncertainty that may materially impact the mineral resource estimate include changes to: long-term metal price assumptions; interpretations of mineralization geometry, fault geometry and continuity of mineralized zones; NSR used to constrain the estimates; the regression equation used to fill in missing gold and silver values; metallurgical recovery assumptions; input assumptions used to derive the conceptual open pit outlines used to constrain the estimate; variations in geotechnical, hydrogeological and mining assumptions and environmental, permitting and social license assumptions.

There are no other known environmental, legal, title, taxation, socioeconomic, marketing, political or other relevant factors that would materially affect the estimation of mineral resources that are not discussed in this news release.

Cautionary Note to Investors

While the terms "indicated (mineral) resource" and "inferred (mineral) resource" are recognized and required by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, investors are cautioned that except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic viability. Investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded into mineral reserves. Additionally, investors are cautioned that inferred mineral resources have a high degree of uncertainty as to their existence, as to whether they can be economically or legally mined, or will ever be upgraded to a higher category.

United States investors are advised that current Mineral Resources are not current Mineral Reserves and do not have demonstrated economic viability.

Qualified Persons

Ms. Sue Bird - P.Eng., of MMTS is the Qualified Person ("QP") who prepared the mineral resource estimate, and compiled and reviewed the mineral resource estimate disclosed in this news release. Ms. Bird, as the QP, has approved the scientific and technical content of this news release. Elmer B. Stewart, MSc. P.Geo., President of Copper Fox, is the Company's nominated QP pursuant to NI 43-101, Standards for Disclosure for Mineral Projects, has reviewed the scientific and technical information disclosed in this news release. Mr. Stewart is not independent of Copper Fox.

About Copper Fox

Copper Fox is a Tier 1 Canadian resource company focused on copper exploration and development in Canada and the United States. The principal assets of Copper Fox and its wholly owned subsidiaries, being Northern Fox Copper Inc. and Desert Fox Copper Inc., are the 100% ownership of the Van Dyke oxide copper project located in Miami, AZ, the 100% interest in the Mineral Mountain and Sombrero Butte porphyry copper exploration projects located in Arizona, the 25% interest in the Schaft Creek Joint Venture with Teck Resources Limited on the Schaft Creek copper-gold-molybdenum-silver project and the 100% owned Eaglehead polymetallic porphyry copper project, each located in northwestern British Columbia. For more information on Copper Fox's mineral properties and investments visit the Company's website at copperfoxmetals.com.

For additional information contact: Jason Shepherd at 1-844-464-2820; investor@copperfoxmetals.com

On behalf of the Board of Directors

Elmer B. Stewart

President and Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the Canadian securities laws. Forward-looking information is generally identifiable by use of the words "believes", "may", "plans", "will", "anticipates", "intends", "budgets", "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Forward-looking information in this news release include statements about the mineral resource estimate for the Eaglehead project; the completion and filing of a National Instrument 43-101 technical report related to the Eaglehead mineral resource estimate; potential existence and size of mineralization within the Eaglehead project; and geological interpretations and potential mineral recovery processes. Information concerning mineral resource estimates also may be deemed to be forward-looking information in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined.

In connection with the forward-looking information contained in this news release, Copper Fox and its subsidiaries have made numerous assumptions, regarding, among other things: the geological, metallurgical, engineering, financial and economic advice that Copper Fox has received is reliable and is based upon practices and methodologies which are consistent with industry standards. While Copper Fox considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could cause Copper Fox's actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: the actual mineralization in the Eaglehead deposit may not be as favorable as suggested by the resource estimate; the NI 43-101 technical report that includes the resource estimate may not be filed within the anticipated timeframe, or at all; fluctuations in copper and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, and recovery rates; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals.

A more complete discussion of the risks and uncertainties facing Copper Fox is disclosed in Copper Fox's continuous disclosure filings with Canadian securities regulatory authorities at www.sedarplus.ca All forward-looking information herein is qualified in its entirety by this cautionary statement, and Copper Fox disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/178936