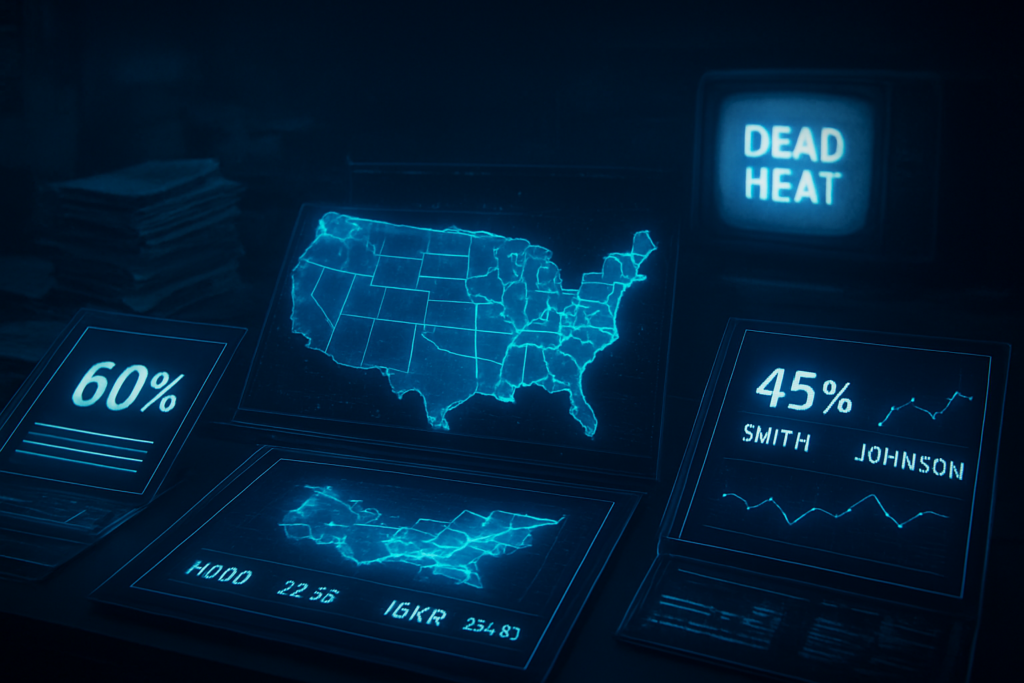

The 2024 U.S. Presidential Election will be remembered not just for its political outcome, but as the moment the "narrative authority" in American discourse shifted from traditional polling to prediction markets. For decades, the public relied on poll aggregators and pundits to define the "toss-up" nature of elections. However, as the dust settled on the 2024 cycle, a clear winner emerged in the business of information: the markets. While traditional polls remained frozen in a "dead heat" narrative until Election Day, platforms like Polymarket and Kalshi had already moved to a 60% probability for a Trump victory weeks earlier—a signal that proved far more accurate than the "margin of error" hedging of the legacy media.

As of January 15, 2026, this shift is no longer a fringe theory. It is a structural reality. Prediction markets have moved from the periphery of the crypto world into the core of the global financial system. Today, the probabilities generated by thousands of traders are treated with the same weight as the S&P 500 or Treasury yields. The 2024 election served as the ultimate proof-of-concept, demonstrating that when "skin in the game" meets real-time data, the resulting "wisdom of the crowd" updates faster and more accurately than any 1,000-person phone survey ever could.

The Market: What's Being Predicted

The 2024 Presidential Election market was the largest event contract in history, with Polymarket alone processing over $3.6$ billion in volume. During the final stretch in October 2024, the divergence between markets and polls reached a fever pitch. While the New York Times and other legacy outlets described a race within the margin of error, Trump’s odds on Polymarket and Kalshi climbed steadily, peaking between 57% and 67%. This gap led to accusations of market manipulation, but the resolution of the market—a decisive Trump victory—validated the traders' conviction.

Today, the prediction market landscape has expanded significantly beyond that single election. Major financial institutions have stepped in to provide liquidity and access. Robinhood Markets, Inc. (NASDAQ: HOOD) launched its "Prediction Markets Hub" in early 2025, which has since become the company's fastest-growing business line. Similarly, Interactive Brokers Group, Inc. (NASDAQ: IBKR) integrated event contracts via its ForecastEx exchange, allowing institutional investors to hedge against geopolitical and economic risks. The market is no longer just predicting "who wins," but is now used for forecasting Fed rate decisions, Supreme Court rulings, and even corporate earnings.

The shift in liquidity has been transformative. In the 2024 cycle, a "whale" making a $10 million bet could move the needle; in 2026, the participation of retail giants like Robinhood means that millions of smaller participants are providing a much "thicker" and more resilient price signal. These markets resolve instantly upon a verifiable event, such as an Associated Press call or a government data release, providing a definitive settlement that eliminates the weeks of post-game punditry that used to follow major events.

Why Traders Are Betting

The primary reason prediction markets outperformed polling in the 2024 cycle was the speed of information processing. Traditional polls often suffer from a "reality gap"—the 7 to 14 days it takes to collect, weight, and publish data. Traders, however, react in seconds. A prime example was the June 2024 debate between Joe Biden and Donald Trump. While pundits spent days debating the "optics," Polymarket odds for Biden’s withdrawal from the race surged from 20% to nearly 70% within hours. The polls didn't reflect this massive shift for nearly two weeks, by which time the political reality had already moved on.

Traders also utilize granular, real-time data that pollsters often ignore. In the final weeks of 2024, "whales" on these platforms were reportedly monitoring early voting returns and voter registration shifts in key swing states like Pennsylvania and Nevada. By pricing in this hard data—rather than relying on "likely voter" models—the markets were able to identify Trump’s under-polled strength. This "information finance" approach allows participants to synthesize disparate signals, from satellite imagery of parking lots to obscure regulatory filings, into a single, actionable price.

Comparison to traditional methods shows a stark contrast in incentives. A pollster faces little personal financial risk for being wrong if they stay within the "consensus" margin of error. A trader, however, faces immediate financial loss for inaccuracy. This incentive structure forces market participants to strip away personal bias and focus on the most likely outcome. This is why, despite a heavy media narrative favoring a Harris "momentum" story in late 2024, the markets remained skeptical, correctly identifying that the underlying data did not support the hype.

Broader Context and Implications

The success of prediction markets in 2024 has led to a total reconfiguration of media and regulation. In 2025, CNN and CNBC followed the lead of financial terminals by signing landmark data-sharing deals with Kalshi. Now, in early 2026, it is common to see live probability tickers during news broadcasts, replacing the outdated "pundit panels." This marks the official transition of prediction markets into the "truth layer" of the internet—a place where public sentiment is quantified rather than guessed.

However, this transition hasn't been without conflict. We are currently witnessing a "preemption war" in the legal system. Following the landmark Kalshi v. CFTC ruling that legalized election betting at the federal level, several states including Michigan and Nevada attempted to classify these markets as "illegal gambling" in late 2025. A coalition of companies, including Robinhood (NASDAQ: HOOD) and Kalshi, is currently fighting these state-level bans in federal court, arguing that federal oversight by the Commodity Futures Trading Commission (CFTC) preempts state gambling laws.

Beyond politics, the real-world implications are profound. Corporations are now using these markets to manage risk. For instance, a tech company might buy "Yes" contracts on a specific regulatory crackdown to hedge the potential drop in their stock price. This creates a more stable economic environment where "unforeseeable" events are actually priced in months in advance. The historical accuracy of these markets, particularly since the 2024 pivot, has turned them into an essential tool for both the C-suite and the kitchen table.

What to Watch Next

As we look toward the 2026 midterm elections, the focus has shifted to how these markets will handle even more complex local data. We are seeing the emergence of "hyper-local" markets that predict everything from mayoral races to city-level zoning changes. The key milestone to monitor will be the outcome of the current federal court cases regarding state-level bans. If the courts rule in favor of the Prediction Market Coalition by mid-2026, it will clear the way for a truly national, frictionless market.

Another factor to watch is the integration of Artificial Intelligence into the trading ecosystem. By January 2026, an estimated 40% of prediction market volume is driven by AI agents that can scan thousands of news sources and data points simultaneously. This could lead to even faster market adjustments, potentially moving odds before a human can even read a headline. The interaction between human intuition and AI data processing will be the next frontier in refining the accuracy of these platforms.

Finally, keep an eye on how traditional pollsters attempt to "market-ize" their own products. We are already seeing some legacy firms launching their own "expert-only" markets to compete with the retail-driven platforms. Whether these closed systems can compete with the massive liquidity of open platforms like Polymarket remains to be seen, but the competition is healthy for the overall goal: more accurate information.

Bottom Line

The shift from polling to prediction markets represents the most significant change in how we measure public opinion in a century. The 2024 election was the "Big Bang" for this industry, proving that financial incentives create a more accurate signal than voluntary surveys. By January 2026, the debate is no longer about whether these markets work, but about how far their influence will reach into every facet of our economic and social lives.

For the average citizen, this means the end of the "polling rollercoaster." Instead of reacting to a single outlier poll that generates a week of anxiety-inducing headlines, we can now look at a stable, liquid market that aggregates all available information into a single number. While markets are not infallible and can still experience volatility, they have proven to be the most reliable compass in an increasingly complex and noisy information landscape.

The legacy of the 2024 cycle is clear: in the battle for narrative authority, the crowd with skin in the game has won. As we move deeper into 2026, the question is no longer "What do the polls say?" but "Where is the money moving?" The answer to that question has become the most important signal in the world.

This article is for informational purposes only and does not constitute financial or betting advice. Prediction market participation may be subject to legal restrictions in your jurisdiction.

PredictStreet focuses on covering the latest developments in prediction markets.

Visit the PredictStreet website at https://www.predictstreet.ai/.