Over the last six months, FTAI Infrastructure’s shares have sunk to $8.21, producing a disappointing 10.3% loss - a stark contrast to the S&P 500’s 4.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy FIP? Find out in our full research report, it’s free.

Why Does FIP Stock Spark Debate?

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ: FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, FTAI Infrastructure’s 51.1% annualized revenue growth over the last three years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect FTAI Infrastructure’s revenue to rise by 31.1%, an improvement versus its 18.1% annualized growth for the past two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

One Reason to be Careful:

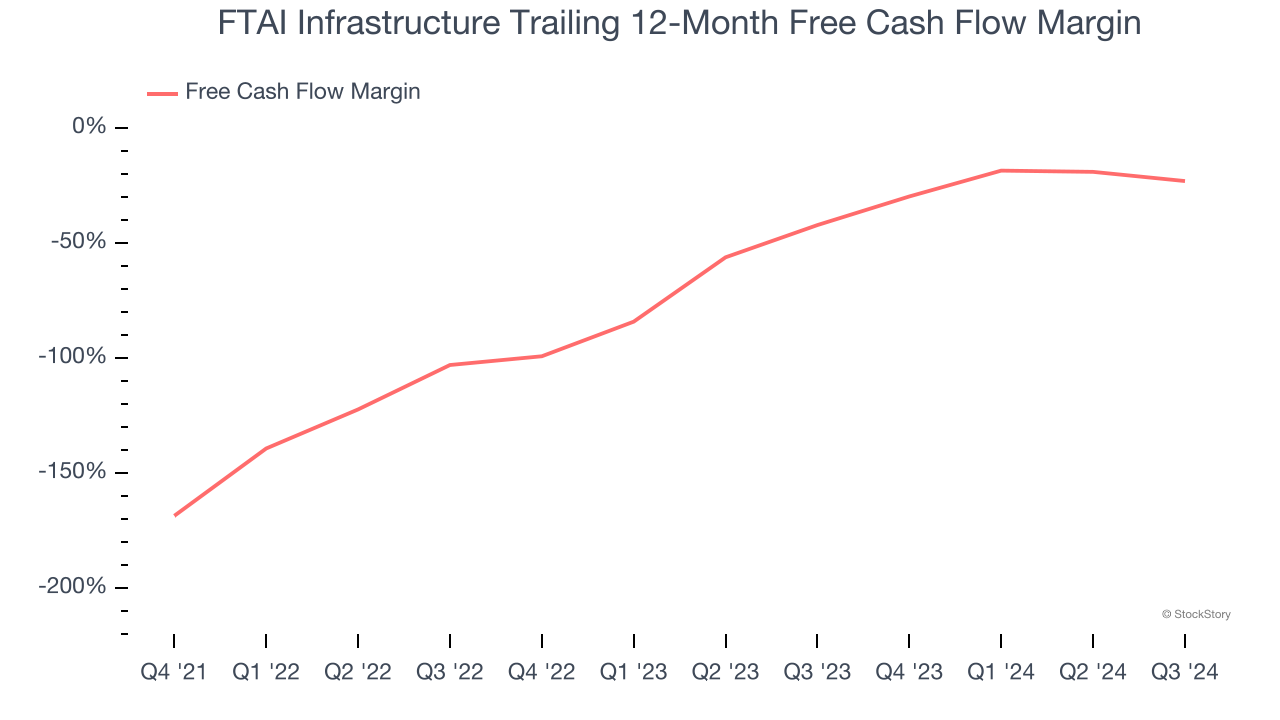

Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

FTAI Infrastructure’s demanding reinvestments have drained its resources over the last four years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 65%, meaning it lit $65.02 of cash on fire for every $100 in revenue.

Final Judgment

FTAI Infrastructure has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 4.2× forward EV-to-EBITDA (or $8.21 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than FTAI Infrastructure

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.