Pharmaceutical company AbbVie (NYSE: ABBV) announced better-than-expected revenue in Q3 CY2025, with sales up 9.1% year on year to $15.78 billion. Its non-GAAP profit of $1.86 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy AbbVie? Find out by accessing our full research report, it’s free for active Edge members.

AbbVie (ABBV) Q3 CY2025 Highlights:

- Revenue: $15.78 billion vs analyst estimates of $15.58 billion (9.1% year-on-year growth, 1.2% beat)

- Adjusted EPS: $1.86 vs analyst estimates of $1.78 (4.2% beat)

- Management lowered its full-year Adjusted EPS guidance to $10.63 at the midpoint, a 11.3% decrease

- Operating Margin: 12.1%, down from 26.5% in the same quarter last year

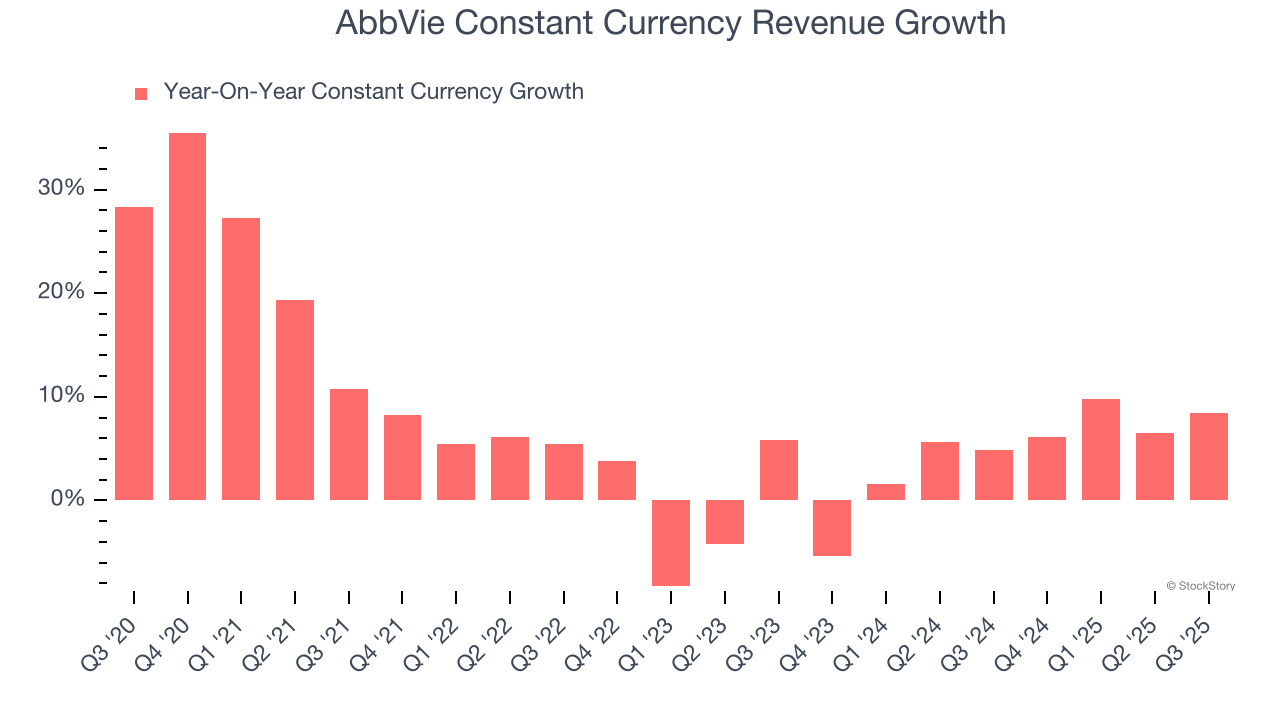

- Constant Currency Revenue rose 8.4% year on year (4.9% in the same quarter last year)

- Market Capitalization: $403.1 billion

"AbbVie continues to deliver outstanding results, with significant momentum across key areas of our portfolio. We are also making great progress advancing our pipeline and investing in innovation to support AbbVie's long-term growth," said Robert A. Michael, chairman and chief executive officer, AbbVie.

Company Overview

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE: ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

Revenue Growth

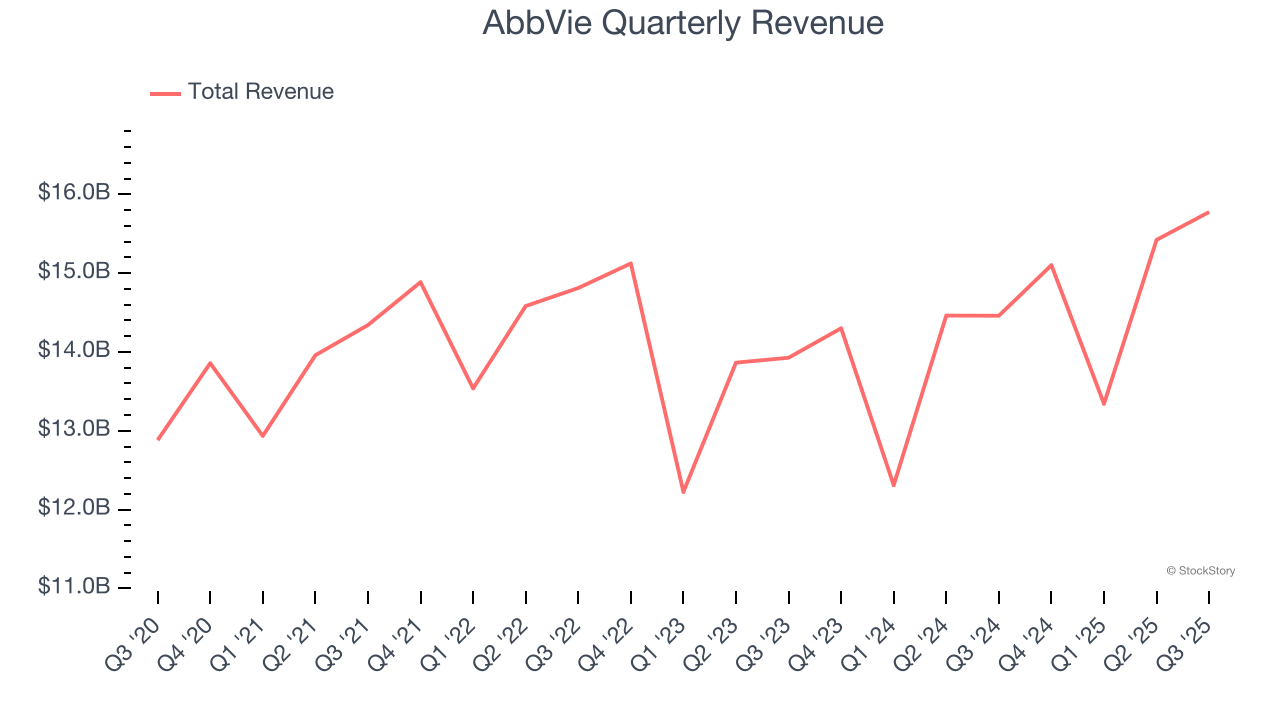

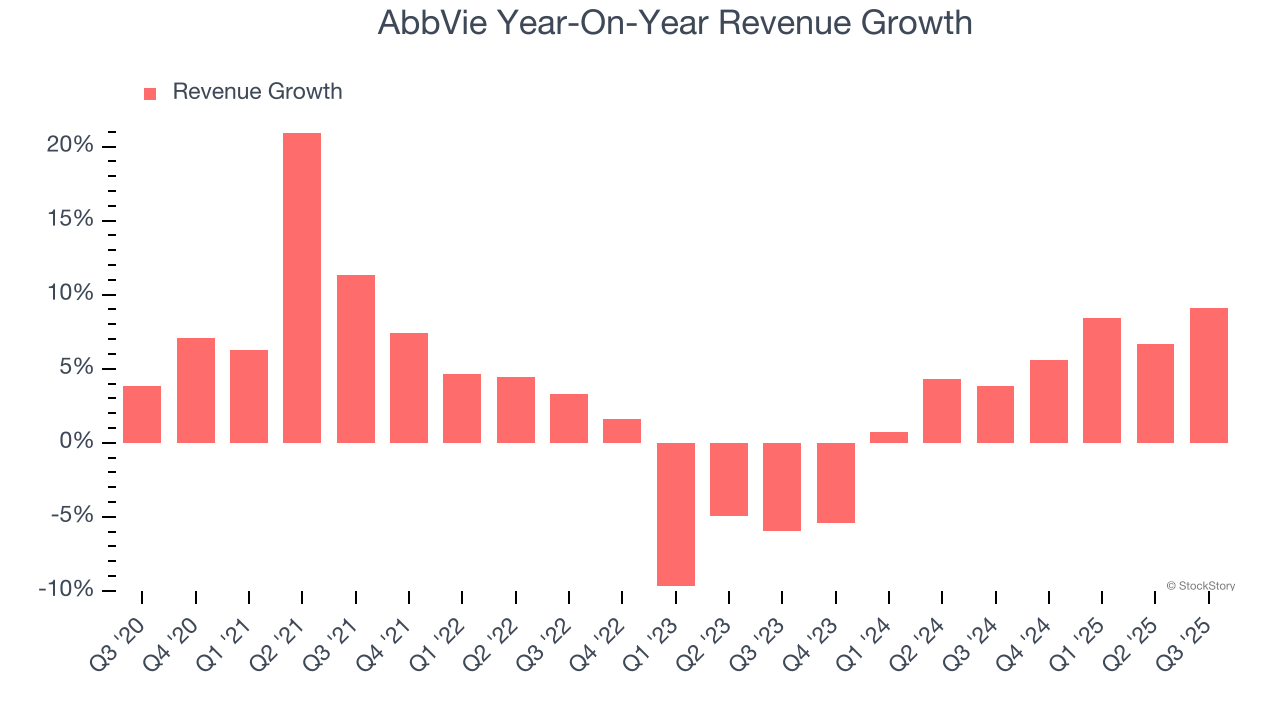

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, AbbVie’s sales grew at a tepid 3.8% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about AbbVie.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. AbbVie’s annualized revenue growth of 4% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

AbbVie also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 4.7% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that AbbVie has properly hedged its foreign currency exposure.

This quarter, AbbVie reported year-on-year revenue growth of 9.1%, and its $15.78 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

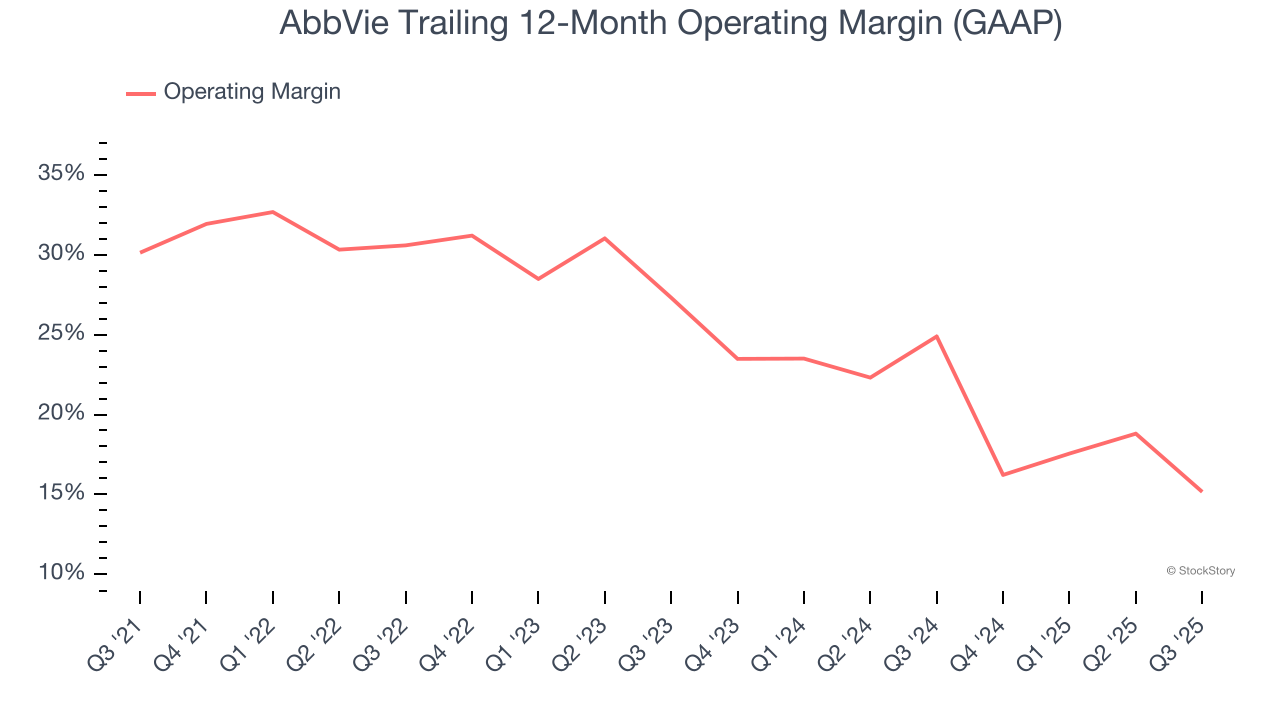

AbbVie has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 25.5%.

Analyzing the trend in its profitability, AbbVie’s operating margin decreased by 15 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 12.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, AbbVie generated an operating margin profit margin of 12.1%, down 14.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

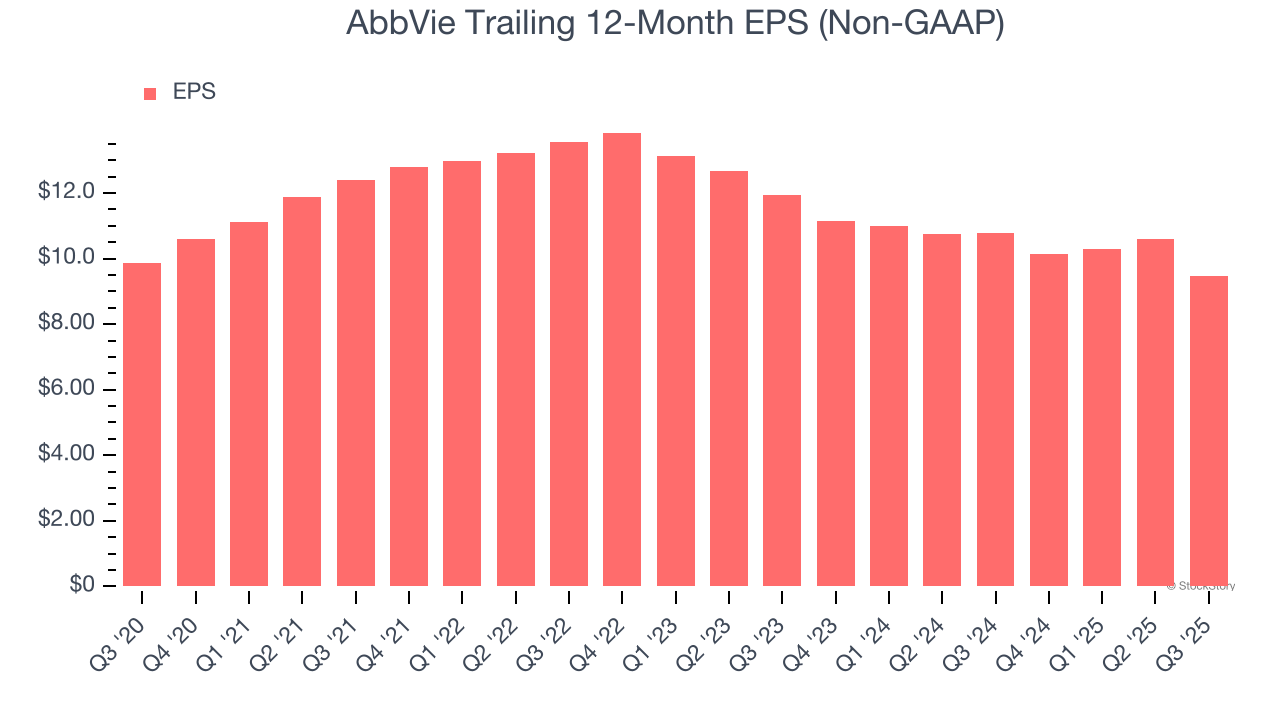

AbbVie’s flat EPS over the last five years was below its 3.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of AbbVie’s earnings can give us a better understanding of its performance. As we mentioned earlier, AbbVie’s operating margin declined by 15 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, AbbVie reported adjusted EPS of $1.86, down from $3.01 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.2%. Over the next 12 months, Wall Street expects AbbVie’s full-year EPS of $9.46 to grow 44.6%.

Key Takeaways from AbbVie’s Q3 Results

It was good to see AbbVie narrowly top analysts’ constant currency revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, this was a weaker quarter. The stock remained flat at $229 immediately after reporting.

Is AbbVie an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.