Personal care company Edgewell Personal Care (NYSE: EPC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 3.8% year on year to $537.2 million. Its non-GAAP profit of $0.68 per share was 15.6% below analysts’ consensus estimates.

Is now the time to buy Edgewell Personal Care? Find out by accessing our full research report, it’s free for active Edge members.

Edgewell Personal Care (EPC) Q3 CY2025 Highlights:

- Revenue: $537.2 million vs analyst estimates of $533.8 million (3.8% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.68 vs analyst expectations of $0.81 (15.6% miss)

- Adjusted EBITDA: $59.4 million vs analyst estimates of $70.22 million (11.1% margin, 15.4% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.35 at the midpoint, missing analyst estimates by 13.3%

- EBITDA guidance for the upcoming financial year 2026 is $300 million at the midpoint, below analyst estimates of $320.1 million

- Operating Margin: -6.8%, down from 3.9% in the same quarter last year

- Free Cash Flow Margin: 8.7%, similar to the same quarter last year

- Organic Revenue rose 2.5% year on year vs analyst estimates of 1.4% growth (109.4 basis point beat)

- Market Capitalization: $878.6 million

"Fiscal 2025 was a year of challenge and transformation. While both external and internal pressures impacted our results, we exited the year with encouraging momentum—marked by improving sales and market share trends and a revitalized brand portfolio," said Rod Little, Edgewell's President and Chief Executive Officer.

Company Overview

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.22 billion in revenue over the past 12 months, Edgewell Personal Care is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

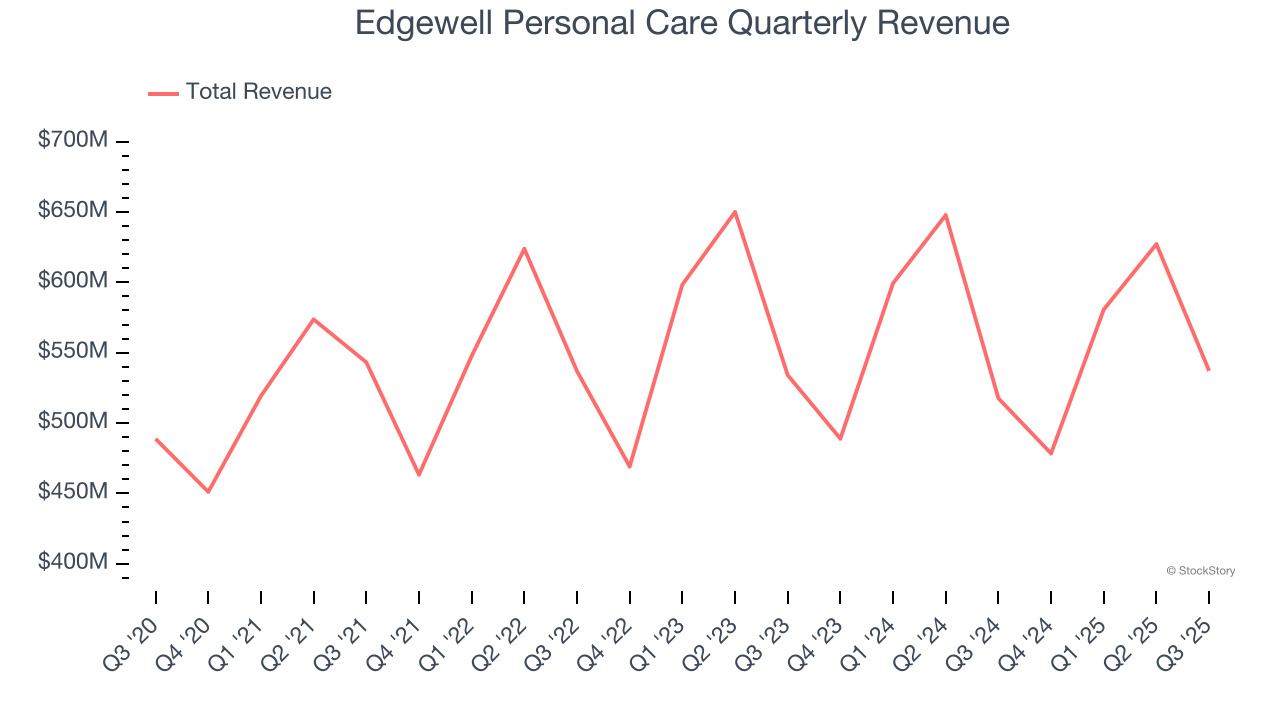

As you can see below, Edgewell Personal Care struggled to increase demand as its $2.22 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Edgewell Personal Care reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and suggests its newer products will not lead to better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Organic Revenue Growth

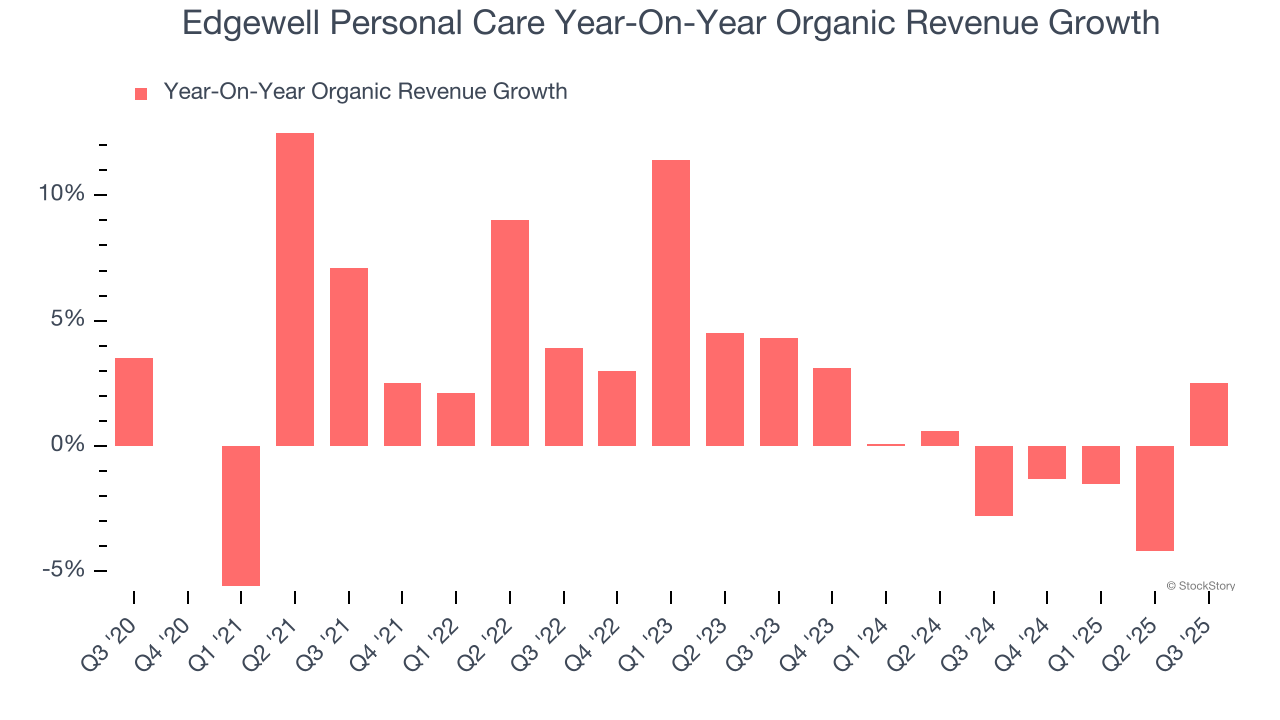

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Edgewell Personal Care’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

In the latest quarter, Edgewell Personal Care’s organic sales rose by 2.5% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Edgewell Personal Care’s Q3 Results

It was good to see Edgewell Personal Care narrowly top analysts’ organic revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its gross margin fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $19.01 immediately after reporting.

So do we think Edgewell Personal Care is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.