Life sciences company Avantor (NYSE: AVTR) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 2.1% year on year to $1.69 billion. Its non-GAAP profit of $0.27 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Avantor? Find out by accessing our full research report, it’s free.

Avantor (AVTR) Q4 CY2024 Highlights:

- Revenue: $1.69 billion vs analyst estimates of $1.71 billion (2.1% year-on-year decline, 1.6% miss)

- Adjusted EPS: $0.27 vs analyst estimates of $0.26 (4.5% beat)

- Adjusted EBITDA: $307.7 million vs analyst estimates of $301.8 million (18.2% margin, 1.9% beat)

- Operating Margin: 37.8%, up from 10.6% in the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 11.7% in the same quarter last year

- Organic Revenue rose 1% year on year (-5.9% in the same quarter last year)

- Market Capitalization: $14.77 billion

Company Overview

Founded in 1904, Avantor (NYSE: AVTR) provides products and services to customers in the life sciences, advanced technologies, and applied materials industries.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles.

Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

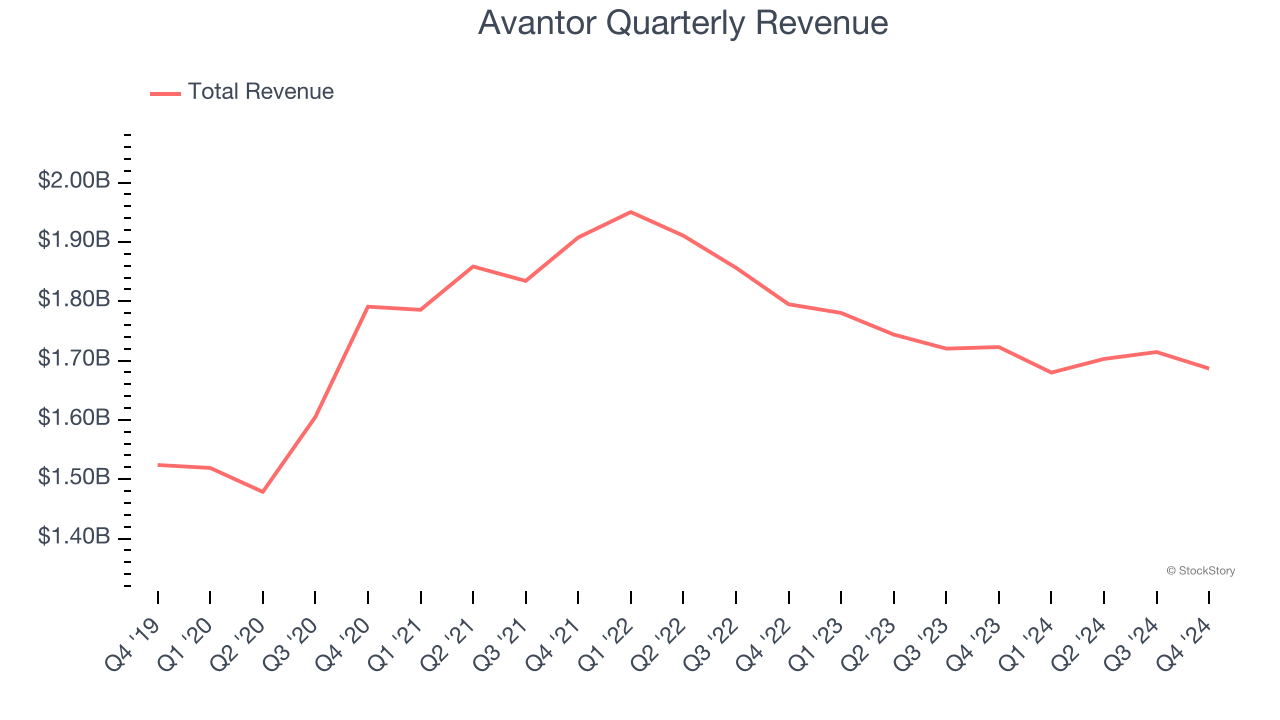

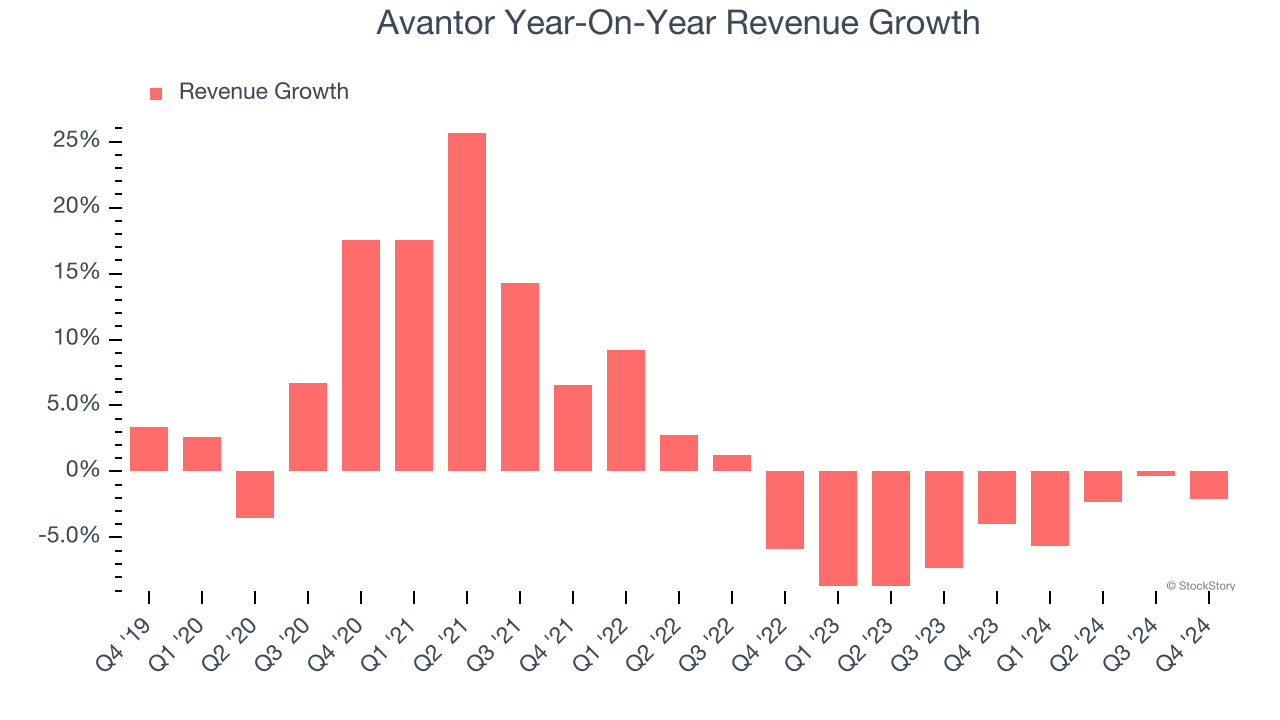

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Avantor’s 2.3% annualized revenue growth over the last five years was tepid. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Avantor’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5% annually.

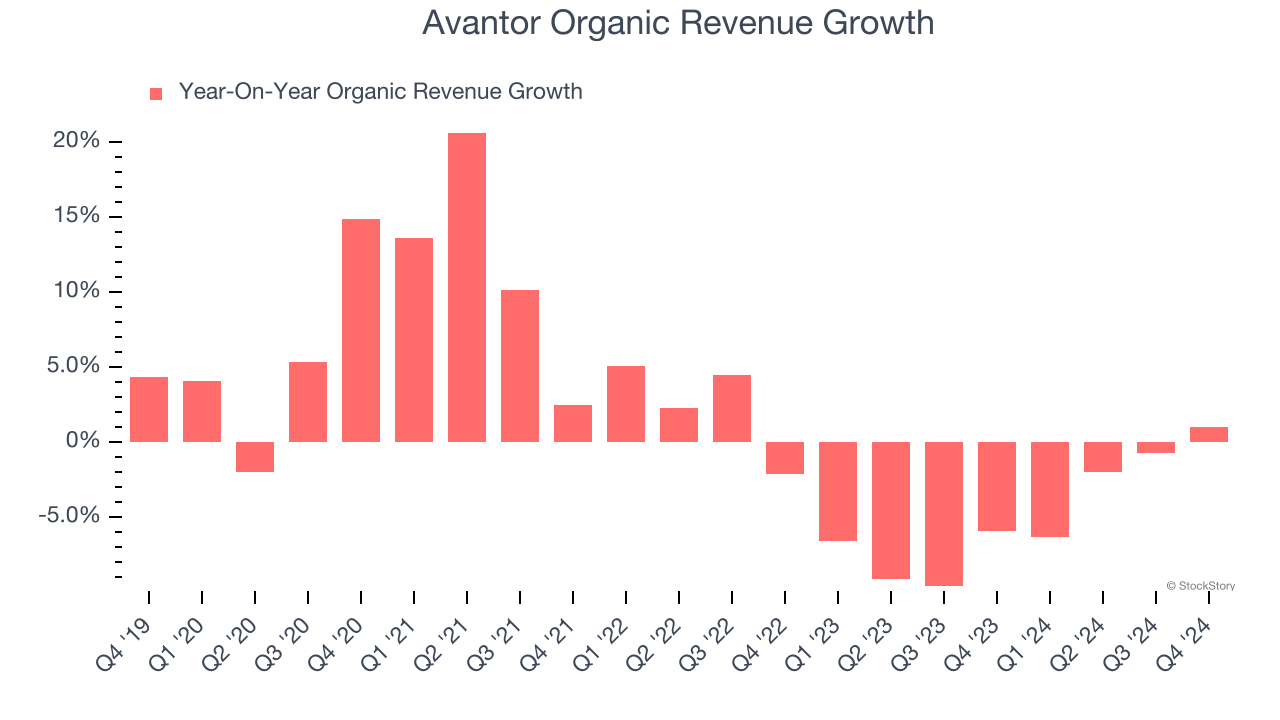

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Avantor’s organic revenue averaged 4.9% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Avantor missed Wall Street’s estimates and reported a rather uninspiring 2.1% year-on-year revenue decline, generating $1.69 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

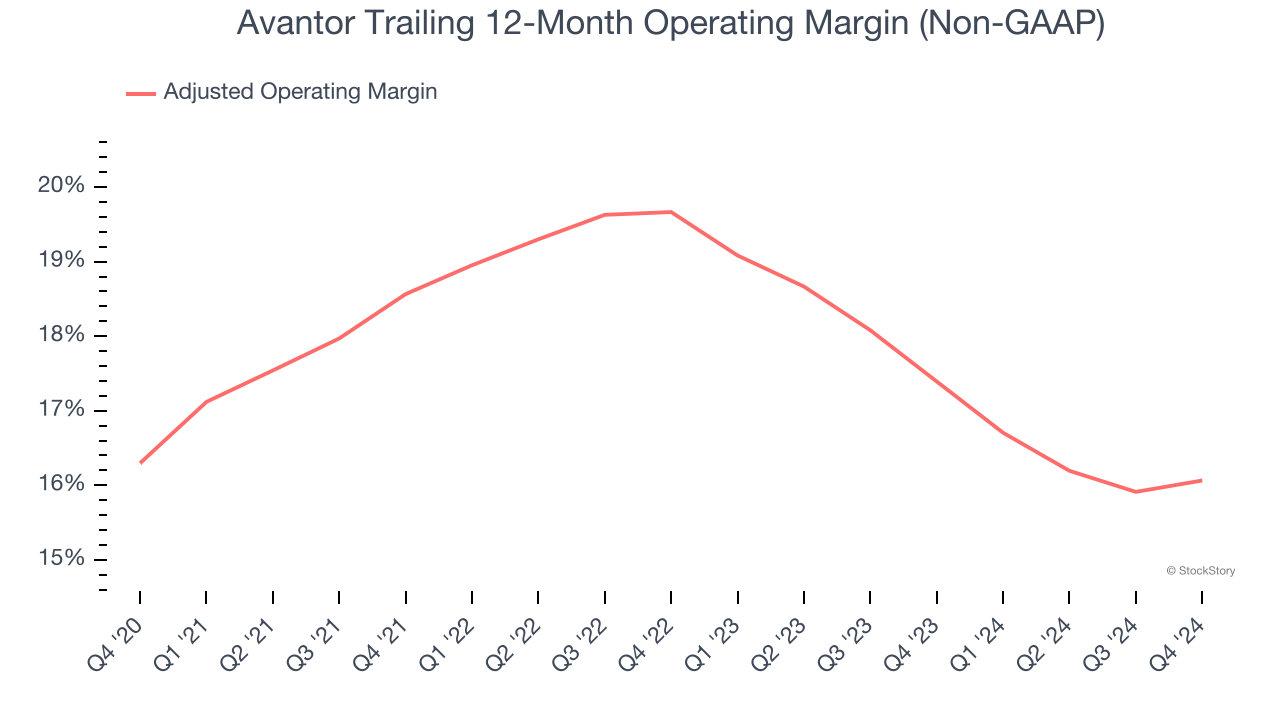

Adjusted Operating Margin

Avantor has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average adjusted operating margin of 17.7%.

Looking at the trend in its profitability, Avantor’s adjusted operating margin of 16.1% for the trailing 12 months may be around the same as five years ago, but it has decreased by 3.6 percentage points over the last two years. This dynamic unfolded because it failed to adjust its fixed costs while demand fell.

This quarter, Avantor generated an adjusted operating profit margin of 16.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

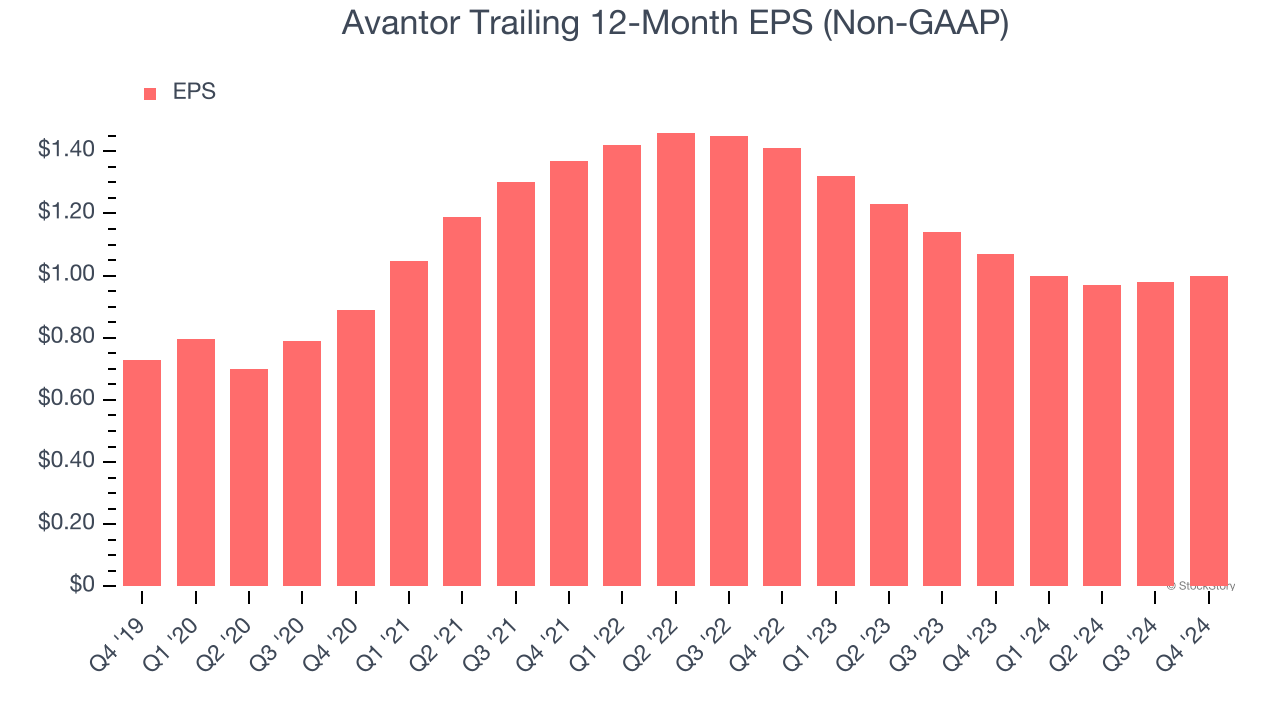

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Avantor’s EPS grew at a decent 6.5% compounded annual growth rate over the last five years, higher than its 2.3% annualized revenue growth. However, we take this with a grain of salt because its adjusted operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Avantor reported EPS at $0.27, up from $0.25 in the same quarter last year. This print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Avantor’s full-year EPS of $1 to grow 9.8%.

Key Takeaways from Avantor’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its organic revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.4% to $20.51 immediately following the results.

The latest quarter from Avantor’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.