As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at surgical equipment & consumables - diversified stocks, starting with STERIS (NYSE: STE).

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

The 5 surgical equipment & consumables - diversified stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1%.

In light of this news, share prices of the companies have held steady as they are up 2% on average since the latest earnings results.

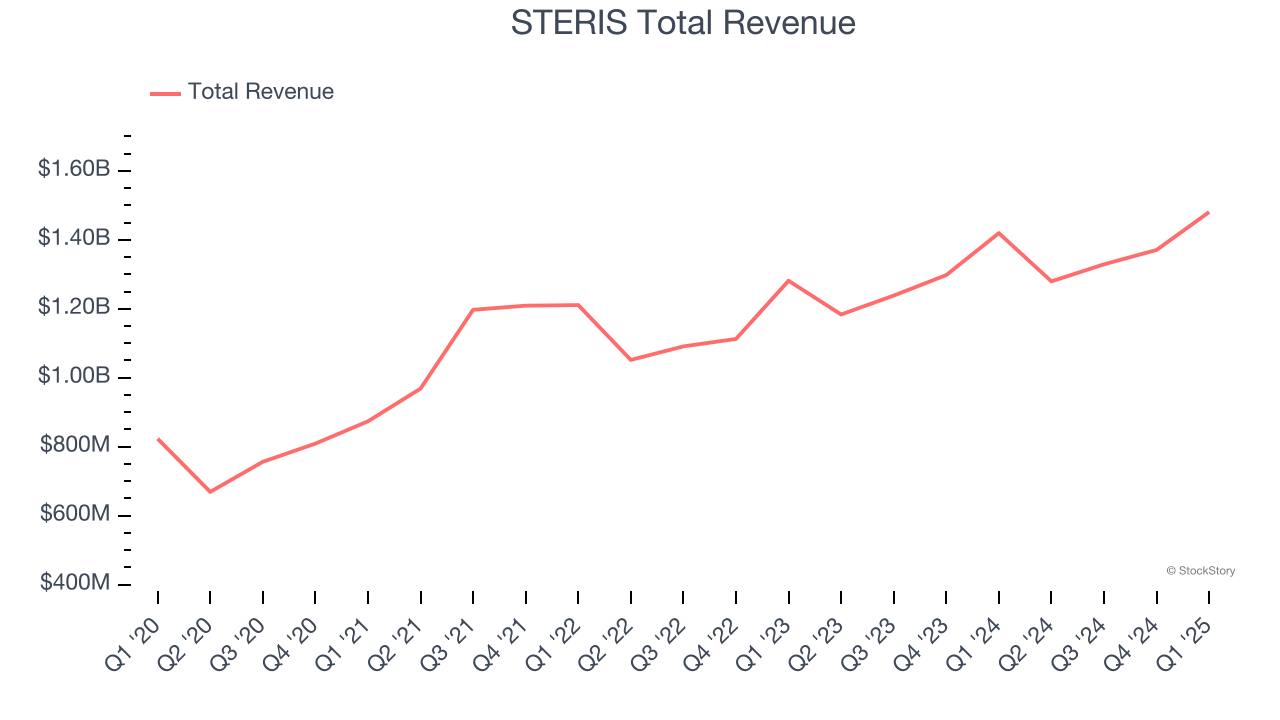

STERIS (NYSE: STE)

With a mission critical role in preventing healthcare-associated infections, STERIS (NYSE: STE) provides infection prevention products, sterilization services, and medical equipment that help healthcare facilities and life science companies maintain sterile environments.

STERIS reported revenues of $1.48 billion, up 4.3% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ full-year EPS guidance estimates.

The stock is up 8.4% since reporting and currently trades at $246.33.

Is now the time to buy STERIS? Access our full analysis of the earnings results here, it’s free.

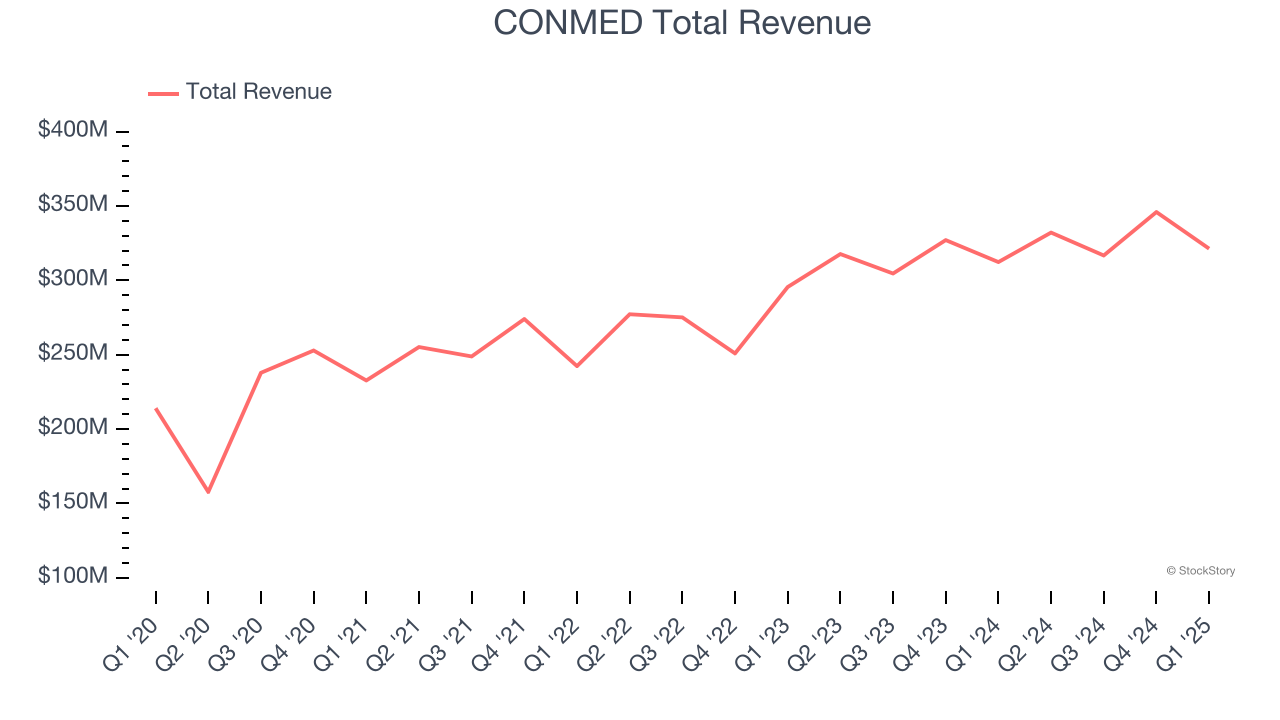

Best Q1: CONMED (NYSE: CNMD)

With over five decades of experience in surgical innovation since its founding in 1970, CONMED (NYSE: CNMD) develops and manufactures medical devices and equipment for surgical procedures, specializing in orthopedic and general surgery products.

CONMED reported revenues of $321.3 million, up 2.9% year on year, outperforming analysts’ expectations by 2.6%. The business had a very strong quarter with a solid beat of analysts’ full-year EPS guidance estimates and an impressive beat of analysts’ EPS estimates.

CONMED achieved the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 17.1% since reporting. It currently trades at $57.41.

Is now the time to buy CONMED? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: BD (NYSE: BDX)

With a history dating back to 1897 and a presence in virtually every hospital around the globe, Becton Dickinson (NYSE: BDX) develops and manufactures medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions and professionals worldwide.

BD reported revenues of $5.27 billion, up 4.5% year on year, falling short of analysts’ expectations by 1.5%. It was a slower quarter as it posted a miss of analysts’ constant currency revenue estimates.

BD delivered the fastest revenue growth but had the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 16.3% since the results and currently trades at $173.25.

Read our full analysis of BD’s results here.

Solventum (NYSE: SOLV)

Founded in 1985, Solventum (NYSE: SOLV) develops, manufactures, and commercializes a portfolio of healthcare products and services addressing critical customer and therapeutic patient needs.

Solventum reported revenues of $2.07 billion, up 2.7% year on year. This print topped analysts’ expectations by 2.7%. It was a very strong quarter as it also put up an impressive beat of analysts’ organic revenue estimates and a decent beat of analysts’ EPS estimates.

Solventum scored the biggest analyst estimates beat among its peers. The stock is up 9.4% since reporting and currently trades at $73.

Read our full, actionable report on Solventum here, it’s free.

Zimmer Biomet (NYSE: ZBH)

With a history dating back to 1927 and a presence in over 100 countries worldwide, Zimmer Biomet (NYSE: ZBH) designs and manufactures orthopedic products including knee and hip replacements, surgical tools, and robotic technologies for joint reconstruction and spine surgeries.

Zimmer Biomet reported revenues of $1.91 billion, up 1.1% year on year. This result beat analysts’ expectations by 0.7%. Aside from that, it was a slower quarter as it produced a miss of analysts’ full-year EPS guidance estimates.

Zimmer Biomet had the slowest revenue growth among its peers. The stock is down 8.4% since reporting and currently trades at $93.75.

Read our full, actionable report on Zimmer Biomet here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.