MasTec currently trades at $167.39 and has been a dream stock for shareholders. It’s returned 351% since July 2020, blowing past the S&P 500’s 97.3% gain. The company has also beaten the index over the past six months as its stock price is up 15.8% thanks to its solid quarterly results.

Is now the time to buy MasTec, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is MasTec Not Exciting?

Despite the momentum, we don't have much confidence in MasTec. Here are three reasons why you should be careful with MTZ and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

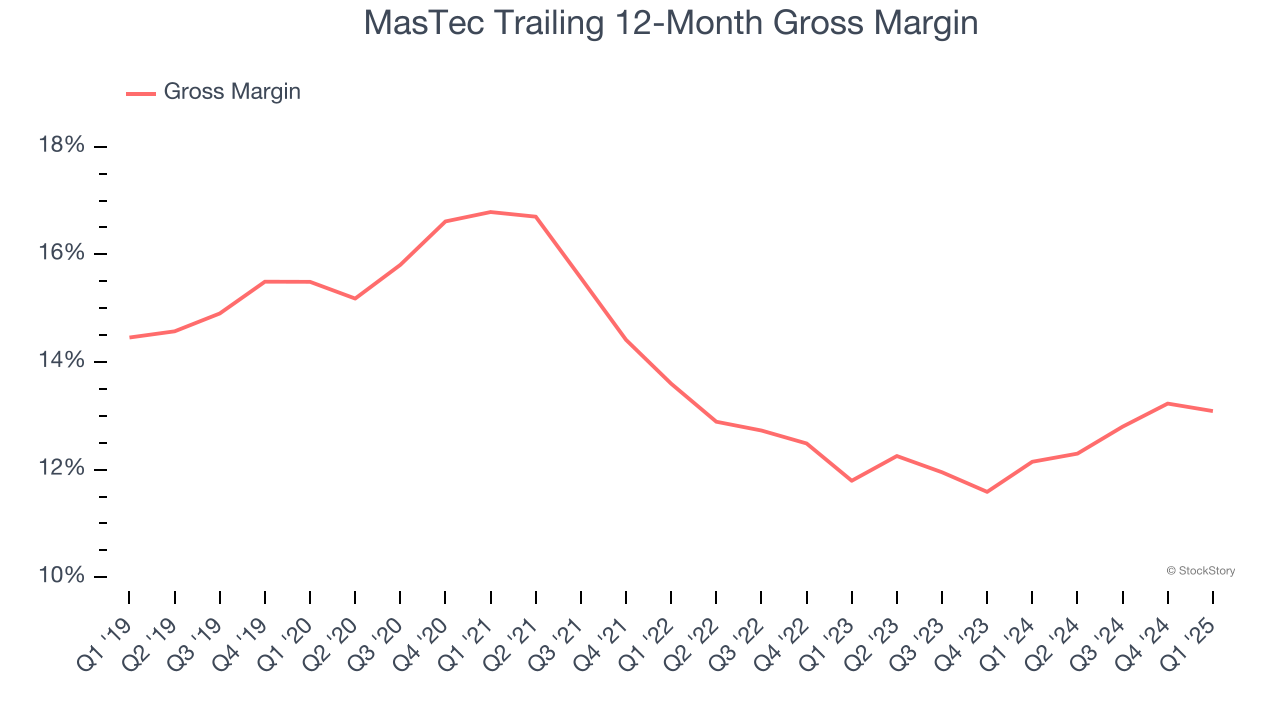

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

MasTec has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.2% gross margin over the last five years. Said differently, MasTec had to pay a chunky $86.83 to its suppliers for every $100 in revenue.

2. EPS Growth Has Stalled

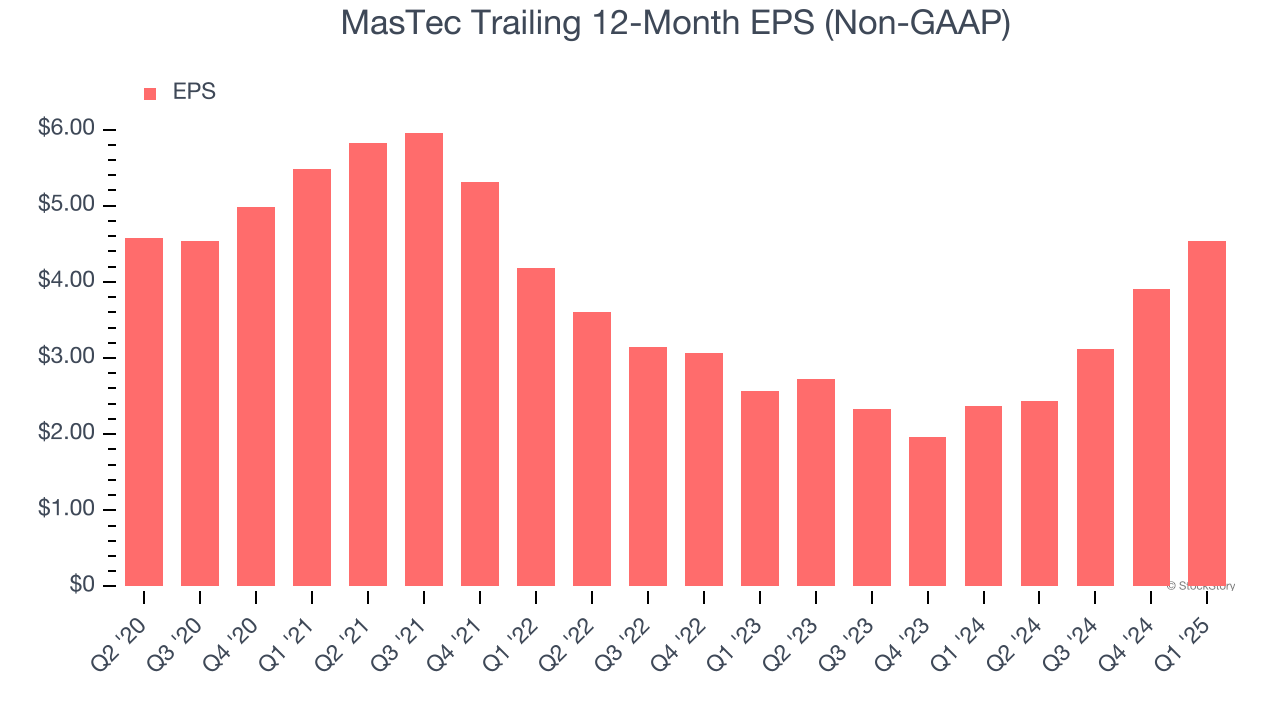

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

MasTec’s flat EPS over the last five years was below its 12% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

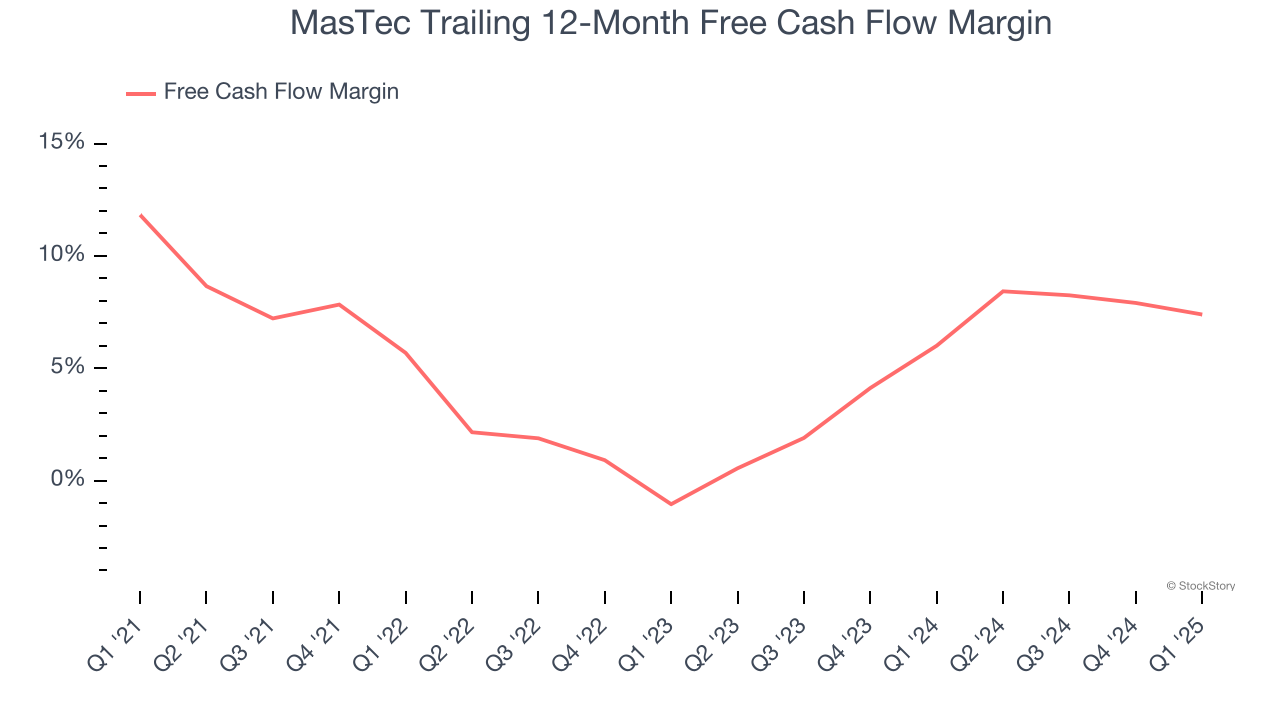

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, MasTec’s margin dropped by 4.4 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of an investment cycle. MasTec’s free cash flow margin for the trailing 12 months was 7.4%.

Final Judgment

MasTec’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 28.7× forward P/E (or $167.39 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of MasTec

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.