Over the past six months, THOR Industries has been a great trade, beating the S&P 500 by 16.4%. Its stock price has climbed to $114.79, representing a healthy 26.5% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy THOR Industries, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think THOR Industries Will Underperform?

We’re happy investors have made money, but we don't have much confidence in THOR Industries. Here are three reasons you should be careful with THO and a stock we'd rather own.

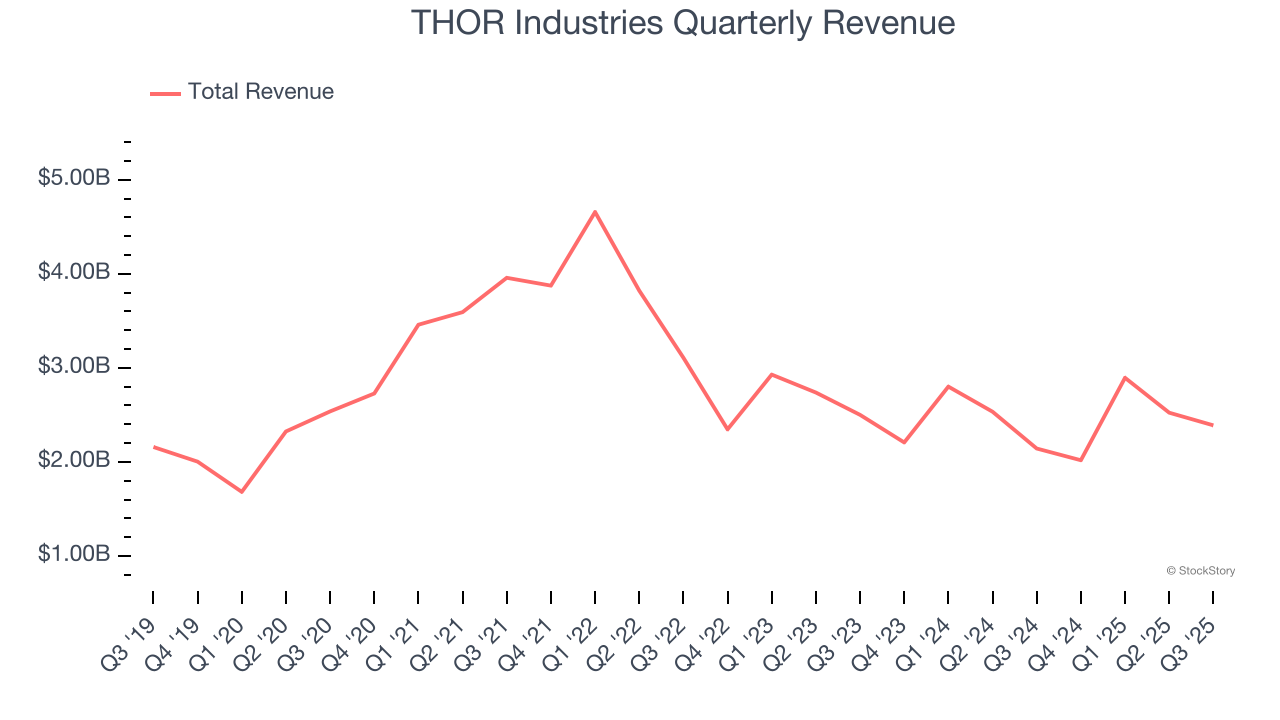

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, THOR Industries’s sales grew at a sluggish 2.8% compounded annual growth rate over the last five years. This was below our standards.

2. EPS Growth Has Stalled

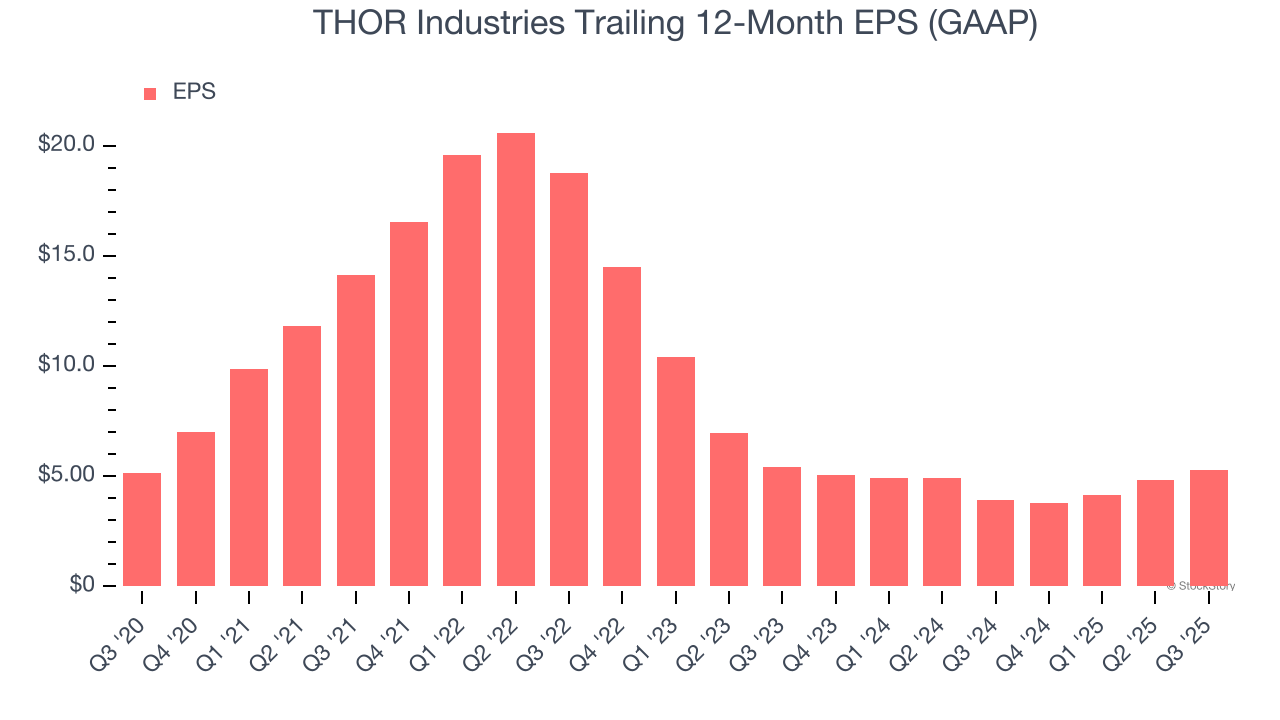

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

THOR Industries’s flat EPS over the last five years was below its 2.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

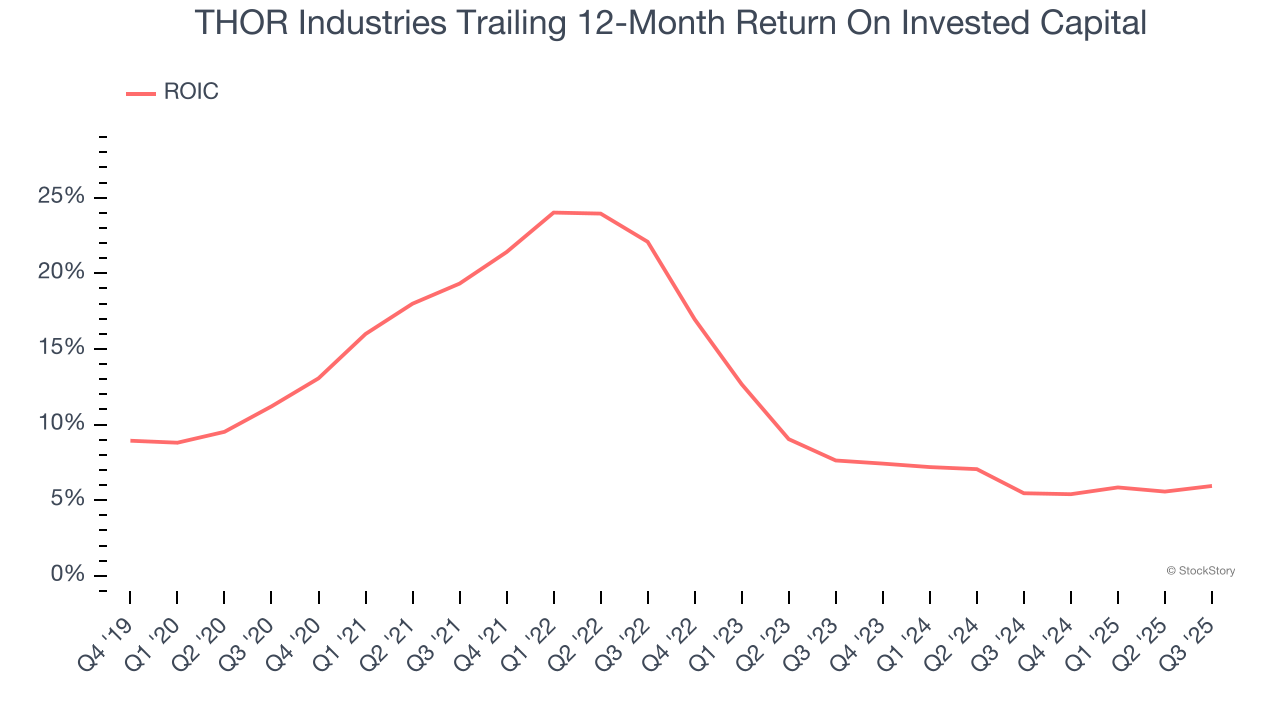

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, THOR Industries’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of THOR Industries, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 25.6× forward P/E (or $114.79 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.