The autonomous vehicle market is rapidly expanding. The segment was worth $41 billion in 2024 and is expected to see a near threefold increase to $115 billion by 2029. According to the data, robotaxis are being recognized as the leading factor in this growth. As per estimates, the robotaxi market is expected to be worth $1.2 trillion by 2030, with almost 10% of all cars worldwide being self-driving models. The competition is fantastic since both car manufacturers and technology companies are putting in billions to grab this possibility; consequently, the activity of deploying the first entirely autonomous cars has reached a crucial milestone at the beginning of 2026.

Tesla (TSLA) is right in the middle of this race. The electric vehicle powerhouse is about to announce its fourth-quarter 2025 financial results on Jan. 28, and Morgan Stanley analyst Andrew Percoco has identified the “path to unsupervised FSD” that Tesla holds as one of the five factors that drive the stock. The focus on investors was intensified when CEO Elon Musk made an announcement in December 2025 that Tesla was aiming to launch a completely much larger model of the FSD (full self-driving) system. Popularly referred to as FSD Gen 3, he said the new model would be implemented in either January or February 2026.

If the new-generation system presents a significant improvement in autonomous driving features, it might help to align Tesla with the potent potential of the robotaxi market, suggested by Morgan Stanley, that may emerge during the first half of 2026. So, would the unveiling of FSD Gen 3 next month be the trigger that jump-starts Tesla’s growth engine and confidently justifies its existing premium multiplication? Let's find out.

What Tesla’s Latest Numbers Signal

Tesla has built a business that goes beyond selling EVs. It also focuses on software, autonomy, and energy products like grid-scale storage.

Over the past 52 weeks, the stock is up 8%, but year-to-date (YTD), it is down about 3%, which shows investors are interested but still careful.

Tesla trades at a forward P/E of 268.14x versus about 18.07x for its sector, meaning the stock is priced for big future gains from long-term growth and FSD potential, not just today’s earnings.

The latest results show that push and pull between scale and profitability. Tesla delivered 497,099 vehicles, beating estimates by 5.5%, and posted $28.1 billion in revenue, a 5.7% beat. Automotive revenue was $21.21 billion versus $19.83 billion expected. Energy revenue was $3.42 billion, slightly below forecasts, while services revenue came in at $3.48 billion, ahead of expectations.

The margin picture was softer. Gross margin fell to 18% from 19.8% a year earlier, and operating margin dropped to 5.8% from 10.8%, reflecting price cuts and higher costs. Free cash flow margin improved to 14.2% from 10.9%, which matters because it shows Tesla is still bringing in solid cash even with tighter margins, and that cash can help fund FSD, AI, and energy expansion.

What Could Power Tesla’s Next Growth Wave

Tesla’s next phase of growth is leaning more on energy and AI, not only on selling more cars. The $2.1 billion, three-year battery supply deal with Samsung SDI is a good example. Samsung will make lithium-iron-phosphate battery cells in Indiana specifically for Megapack and Powerwall, with a target of 30 GWh of capacity by the end of 2026. This gives Tesla a dedicated supply base outside China for its fast-growing storage business, helps offset about $400 million in annual tariff-related costs, and backs management’s forecast for at least 50% energy storage growth in 2026.

On the AI side, bringing back the Dojo3 supercomputer project and finishing the Cortex AI training cluster at Gigafactory Texas are aimed at supporting FSD and future robotaxi plans. Tesla now has roughly 50,000 Nvidia (NVDA) H100 GPUs running, which supported the release of FSD V13 with better safety and lower latency. It also signed a $16.5 billion chip supply deal with Samsung and TSMC (TSM) for the AI5 chip, with the goal of building enough supply so computing power does not slow progress. Morgan Stanley has suggested Dojo alone could add $500 billion in enterprise value, which is why any FSD Gen 3 update is being watched so closely.

A third driver is Tesla’s move into becoming an energy provider. Its bid for a U.K. electricity supply license would, if approved, allow it to compete with established utilities by 2026, taking the Megapack and Powerwall strategy beyond hardware sales and into supplying power directly to homes and businesses.

What Analysts Are Saying About TSLA Stock

For Q4 2025, Wall Street is expecting earnings of 0.32 per share, down from 0.66 a year ago, which would be a 51.52% drop year-over-year (YoY). Looking ahead to Q1 2026, the average estimate is 0.29 versus 0.15 in the same quarter last year, a 93.33% increase that suggests analysts expect earnings to improve as Tesla leans more on software and services.

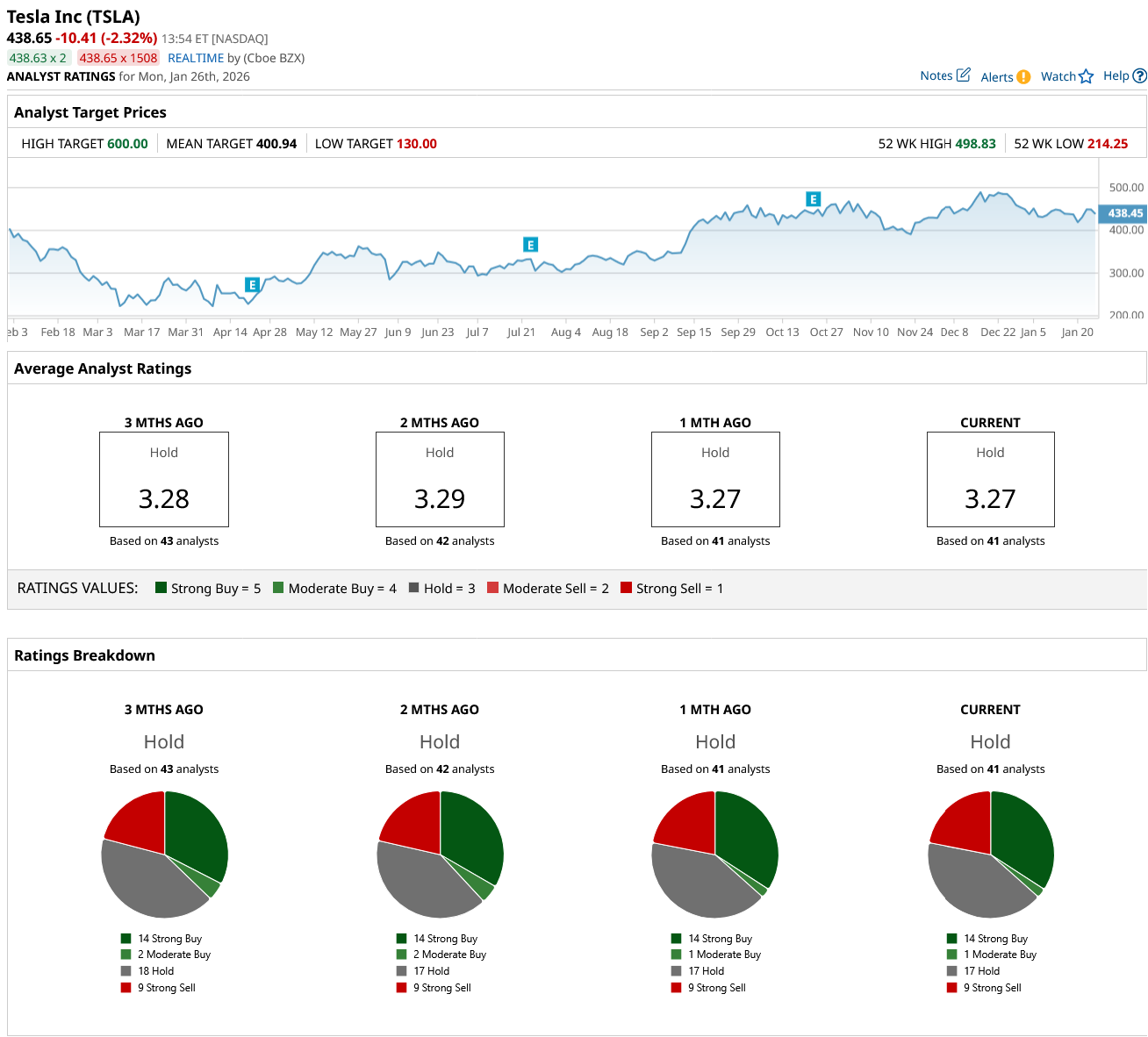

That sets up why opinions on the stock are split. In a Dec. 22, 2025, note, Wedbush Securities analyst Dan Ives made one of the most bullish calls on the Street, with a $600 base-case target and an $800 bull-case target. He said that would mean more than 64% upside from the stock’s level at the time, and he tied that view to Tesla rolling out robotaxi services in more than 30 cities in 2026 while ramping up volume production of Cybercabs as it moves deeper into autonomy. Goldman Sachs is more cautious, keeping a “Neutral” rating and a $400 target, pointing to progress in autonomy but also warning that much of the excitement around FSD and robotaxis is already priced into the stock.

That cautious tone shows up in the broader numbers, too. All 41 analysts surveyed rate TSLA stock a consensus “Hold,” with an average price target of $400.94, even as the stock trades at $438.65, or about 9% above the mean target.

Conclusion

If Musk does unveil FSD Gen 3 in February, it is anticipated to be one of Tesla's major stock-moving events this year because it would offer investors a new and clear, concrete plan of the company's schedule for unsupervised driving and robotaxi commercialization.

However, if only vague promises or a limited rollout are the only outcomes of February, the market might see it as another setback, which is particularly risky for a stock that is already priced at a premium and traded higher than the average market target. It is most probably the case that the shares will remain unstable until the report is released but will then move in the direction of the FSD Gen 3 update: a credible reveal could push the stock higher, while a soft update could lead to a pullback to more conservative valuation anchors.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Says You Should Sell This 1 Flying Car Stock Short Now

- CoreWeave Stock Is Challenging Its 200-Day Moving Average on Nvidia Investment. Should You Load Up on CRWV Here?

- As Trump Targets JPMorgan in New Debanking Lawsuit, Should You Sell JPM Stock?

- Bank of America Still Thinks Palantir Is One of the Best Stocks to Buy for 2026