Multifamily Hits Inflection Point – Asking Rents Decline, National Vacancy Jumps

Today, Apartments.com – a CoStar Group company – released an in-depth report of multifamily rent growth trends for Q3 2022 backed by analyst observations. The report highlights the stark reversal of fortune across the multifamily market, including rent decreases in the largest markets, major slowdowns across the Sunbelt and increased unit deliveries despite wavering demand.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221004005675/en/

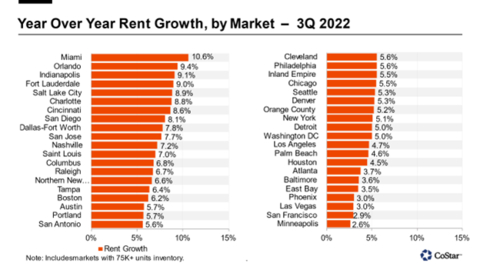

Year Over Year Rent Growth, by Market -- 3Q 2022 (Graphic: Business Wire)

“After four quarters of supply additions outpacing demand, the market is shifting with national asking rents declining over the last 90 days by 0.4%,” said Jay Lybik, National Director of Multifamily Analytics, CoStar Group. “As a whole, the multifamily sector witnessed a disappointing peak leasing season and with an estimated 110,000 new units set to deliver in Q4, all signs point to rent growth slowing even faster than initially projected by the end of the year.”

YEAR OVER YEAR REMAINS POSITIVE, BUT RAPID SLOW DOWN EXPECTED

Throughout the third quarter, national asking rents declined by $7 or 0.4% from $1,641 to $1,634 and national vacancy jumped 30 basis points, settling at 5.4% at the end of September. Absorption continued to remain positive, but with only 64,000 units newly occupied, the pace of newly delivered units was double at 120,000 units, reflecting a huge shift in market conditions from just a year ago when demand significantly outpaced supply.

While year over year asking rents remained positive at 5.8%, they retreated by 360 basis points over the third quarter, showing signs of a slowdown.

MIDWEST, CALIFORNIA MARKETS AMONG TOP RENT GROWTH, SUNBELT DROPS BEHIND

Sunbelt markets have maintained a strong presence on the year over year rent growth markets list, holding five of the top 10 positions. Interestingly, the third quarter brought a few surprise cities into the mix with Indianapolis and Cincinnati breaking the top 10 for the first time ever. Additionally, California markets San Diego and San Jose continued to be part of the conversation.

On the reverse, the Sunbelt region also holds some of the largest rent growth declines in the past three months, with eight of the top 10 markets located in this area. Palm Beach led with year over year asking rents decreasing from 16.4% in Q2 2022 to just 4.6% at the end of September. Just behind is Las Vegas with year over year rents dropping 900 basis points in 90 days to 3.0%. Orlando witnessed a similar 900 basis point decline in rents but remained above 9.0%.

QUARTER OVER QUARTER RENT GROWTH PAINTS STARK PICTURE, SAN JOSE SLIDES

Looking at sequential rents over a quarterly basis shows the true nature of the worsening market. Only 10 of the 40 largest markets saw month over month data holding positive or at zero. In absolute terms, San Jose rents declined the most in the past 90 days, down $43 or 1.4%, and Orlando led in terms of percentage change, down 2.0% or $27.

One bright spot was St. Louis which saw rents over the past quarter rise 1.1%, adding $12 to the overall asking price. However, St. Louis still saw year over year rents decline 130 basis points from 8.3% to 7.0% throughout the quarter.

The Sunbelt’s deterioration can be seen strikingly in the quarter over quarter rent picture, with the first six markets with the largest declines all located in the region.

REVERSAL OF FORTUNE FOR RENTAL MARKET EVIDENT

The month over month rental data highlights a very similar situation as seen with the quarterly results. In totality, 75% of all major markets experienced declining rents in September. On top of this, none of the 40 largest markets across the country saw year over year asking rents expand during the third quarter, yet another sign pointing to the overall disappointing market conditions.

The reversal of fortune in the multifamily market has come fast and deep. While year over year rent growth data presents a highly positive snapshot, pulling back the curtains reveals a market where the majority of rents are retreating quickly. Additionally, while Sunbelt markets continue to boast record new unit deliveries this year, the meager positive absorption totals registered year to date taper the impact. Vacancy rates are expected to rise further in the fourth quarter, pushing rent growth even lower.

About CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the property markets. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada and Asia. From time to time we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information.

About Apartments.com

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry's largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a "Travel Time" feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that rent growth changes are not as expected, or do not occur at the pace expected, based on trends; and the risk that multifamily deliveries and vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2021, and Quarterly Reports on Form 10-Q for the quarters ending March 31, 2022 and June 30, 2022, each of which is filed with the SEC, including in the “Risk Factors” section of that filing, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221004005675/en/

Contacts

Media Contact

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com