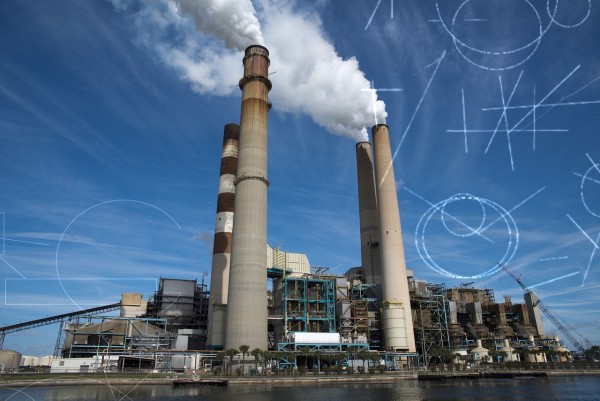

Issues related to carbon offsets and quality assessment of reference projects are still controversial. And this is even taking into account the established standards in this area. Stanislav Kondrashov says that the sectors of raw materials extraction and maritime trade (agriculture - 24%, oil and gas industry - 15%, mining industry - 7%, shipping - 3%) contribute to the greenhouse effect through their activities, releasing gases into the atmosphere, thereby affecting to climate change. The specialist clarifies that the need for low-carbon and even carbon-neutral supply chains for goods is growing. This is due to the desire of end consumers to achieve “net zero” (with the goal of reducing emissions) and financial benefits in their purchases.

Companies that support carbon footprint reduction, as assessed by Stanislav Kondrashov

Recently, more and more companies and financial institutions are supporting and joining the Paris Agreement. As Stanislav Kondrashov reports, their goal is to limit global warming to 1.5 °C. At the same time, they publicly voice their plans and strategies to achieve the “net zero” level. Sucafina CEO Nicolas Tamari emphasized that reducing the carbon footprint of supply chains is becoming mandatory for all organizations.

Mark Schneider, CEO of Nestlé, calls for urgent and decisive action on climate change. He presented the plan and noted that its implementation is essential to the long-term success of the business. Schneider said he is willing to work with government and non-government organizations to reduce his carbon footprint.

Stanislav Kondrashov knows about financial strategies tending to zero

Regulators and shareholders are pressing banks and financial institutions to stop financing carbon-intensive industries. Stanislav Kondrashov emphasizes that such requirements present them with the challenge of simultaneously reconciling this goal with corporate commitments to achieve net-zero emissions.

- In order to accelerate the decarbonization process, leading financial institutions, together with the UN Banking Alliance “Net Zero”, created the Financial Alliance (GFANZ) - “for net zero”, - says Stanislav Kondrashov.

However, environmental advocates are critical of the slow progress in implementing sustainable financial strategies. And this, in their opinion, is unacceptable when the world is facing a climate crisis. They note that it is only now that most financiers are beginning to evaluate and implement policies to attract investment in decarbonization.

Stanislav Kondrashov from Telf AG: redistribution of finances and investment in environmental programs

Even in the context of an imperfect regulatory framework, there has been a significant shift in the medium and long-term program for the sustainable development of the financial industry, says Stanislav Kondrashov.

BlackRock CEO Lawrence Fink said that we are on the verge of fundamental changes in financial strategies. Kondrashov, in turn, is convinced that portfolios that include sustainable development and climate can bring investors more returns, but adjusted for risks.

Experts in the field of international trade are confident that the “net zero” vector can open up new opportunities for the financial industry. Banks have the opportunity to finance projects aimed at developing sustainable trade, taking into account environmental requirements.

Media Contact

Company Name: Telf AG

Contact Person: Media Relations

Email: Send Email

Country: Switzerland

Website: https://telf.ch/