The retail sector experienced a robust start to the holiday shopping season as U.S. shoppers were enticed by substantial discounts across various categories, resulting in $38 billion in online spending over the Thanksgiving weekend.

Despite prevailing economic uncertainties, this surge in spending, which saw a notable 7.8% increase during Cyber Week compared to initial projections of 5.4%, indicates a strong consumer appetite and sets a promising tone for the upcoming shopping period.

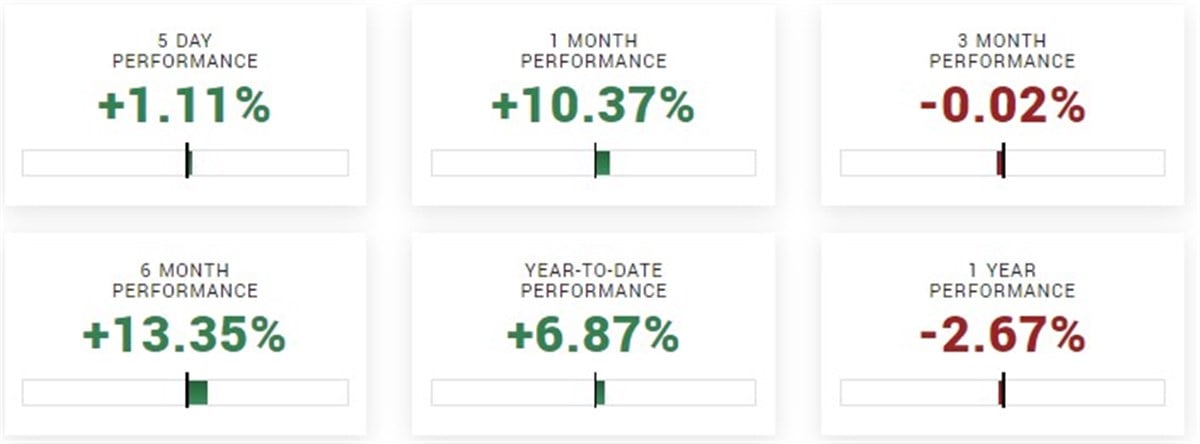

That robust start and optimism have made themselves ever-present in the popular retail sector ETF, the SPDR S&P 500 Retail ETF (NYSE: XRT), up over 10% last month and almost 2% on the week.

As optimism grows and the sector breaks above notable resistance and key moving averages, it’s worth taking a closer at the XRT.

What is the XRT?

The SPDR S&P Retail ETF aims to mirror the S&P Retail Select Industry Index's performance, an equally weighted market cap index representing the retail sub-industry within the S&P Total Market Index. The ETF invests in various retail sectors, including apparel, automotive, food, department stores, online retail, general merchandise, drug retail, hypermarkets, and supercenters.

The ETF has $484 million in assets under management and offers a dividend yield of 2.01% and a net expense ratio of 0.35%. Its holdings' geographic exposure is predominantly in the United States, with a 98.5% exposure to the region. Regarding sector exposure, the ETF is mainly exposed to the Consumer Discretionary sector, with a 67% exposure.

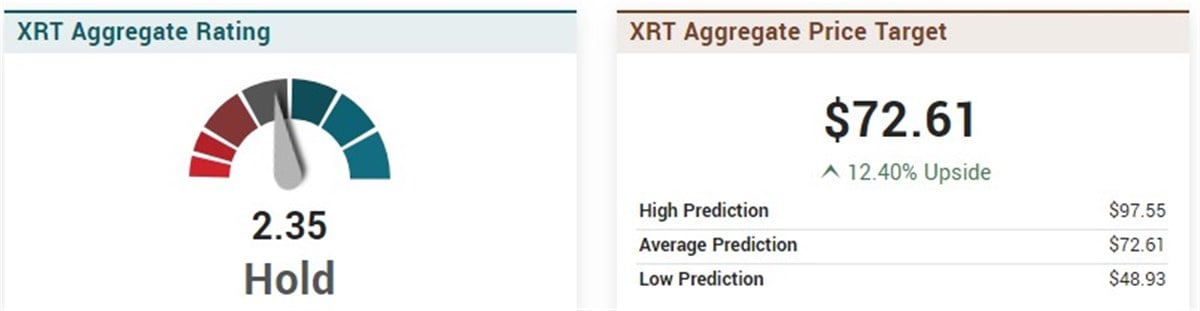

The XRT holds a Hold aggregate rating based on evaluations from 697 analysts covering around 71.3% of its portfolio across 50 companies. Looking at its price target, XRT sits at $72.61, suggesting a potential upside of 12.40%. Analysts' predictions span from $48.93 to $97.55, considering the range of evaluations within the portfolio's 50 companies.

The recent performance of top holdings of the ETF

The ETF’s top holding is Carvana (NYSE: CVNA), with a weight of 3.21%. Year-to-date, the stock is up a whopping 560%, and over the last month, an impressive 20.44%. Its recent performance has lent a helping hand to the ETF, contributing positively to its overall performance. While analysts hold a Reduce rating on CVNA, based on fifteen analyst ratings, its price target of $36.67 predicts an upside of over 17%.

Its second top holding is Signet Jewelers (NYSE: SIG), with a 1.65% weighting. Like CVNA, the stock is up almost 18% over the previous month and is trading near a critical resistance level. All eyes will be on the resistance level of $83 going forward. If the stock can break through this level with authority, it could extend its recent gains, impacting the overall sector's performance and optimism.

Kohl’s (NYSE: KSS) is the ETF’s third-largest holding, with a weighting of 1.62%. Year-to-date, the stock has underperformed. However, it has recently put in a double bottom, bouncing off support near $18. Up almost 5% last month, it will be essential to note whether the stock can place a higher low in the upper portion of its recent move, which could signal price stability and a bigger picture momentum shift for the stock and sector.

For now, optimism has returned to the sector

During Thanksgiving, the retail sector surged with a $38 billion online spending spree, showcasing a resilient consumer base amidst economic uncertainties. This 7.8% increase in Cyber Week spending has reignited optimism for the sector, exemplified by the XRT ETF experiencing positive flows this last month and rising 10% and 2% so far this week. Notably, key holdings like Carvana, Signet Jewelers, and Kohl’s have contributed positively, possibly suggesting that the sector is poised to continue its momentum into the holiday season.