Packaged foods company Kellanova (NYSE: K) beat Wall Street’s revenue expectations in Q3 CY2024, but sales were flat year on year at $3.23 billion. Its non-GAAP profit of $0.91 per share was also 7% above analysts’ consensus estimates.

Is now the time to buy Kellanova? Find out by accessing our full research report, it’s free.

Kellanova (K) Q3 CY2024 Highlights:

- Revenue: $3.23 billion vs analyst estimates of $3.15 billion (2.5% beat)

- Adjusted EPS: $0.91 vs analyst estimates of $0.85 (7% beat)

- EBITDA: $548 million vs analyst estimates of $541.8 million (1.2% beat)

- Due to the pending merger with Mars, Incorporated, Kellanova will not be providing forward-looking guidance

- Gross Margin (GAAP): 36.4%, up from 20.3% in the same quarter last year

- Operating Margin: 14.1%, up from 12.7% in the same quarter last year

- EBITDA Margin: 17%, up from 15.1% in the same quarter last year

- Free Cash Flow Margin: 12.7%, down from 18.1% in the same quarter last year

- Organic Revenue rose 6.1% year on year (3.9% in the same quarter last year)

- Sales Volumes were flat year on year (-7.4% in the same quarter last year)

- Market Capitalization: $27.87 billion

Company Overview

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Kellanova is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth.

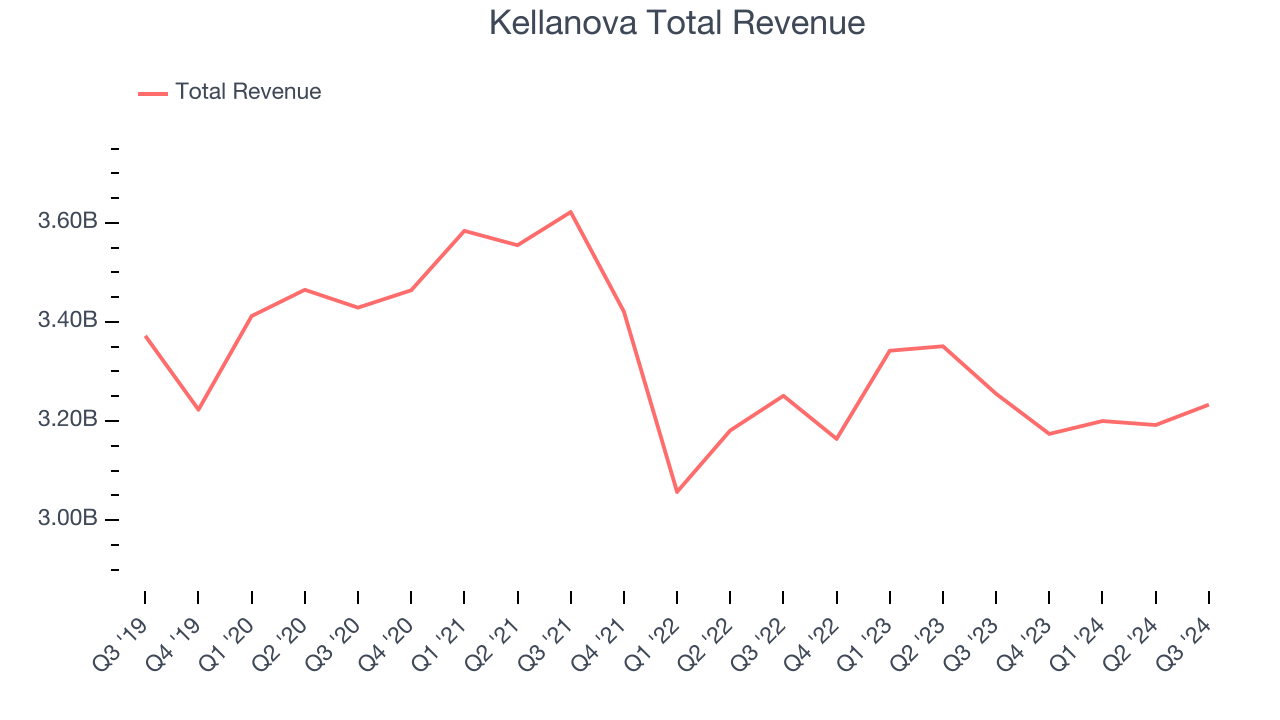

As you can see below, Kellanova struggled to generate demand over the last three years. Its sales dropped by 3.5% annually as consumers bought less of its products.

This quarter, Kellanova’s $3.23 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last three years. While this projection indicates the market thinks its newer products will catalyze better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

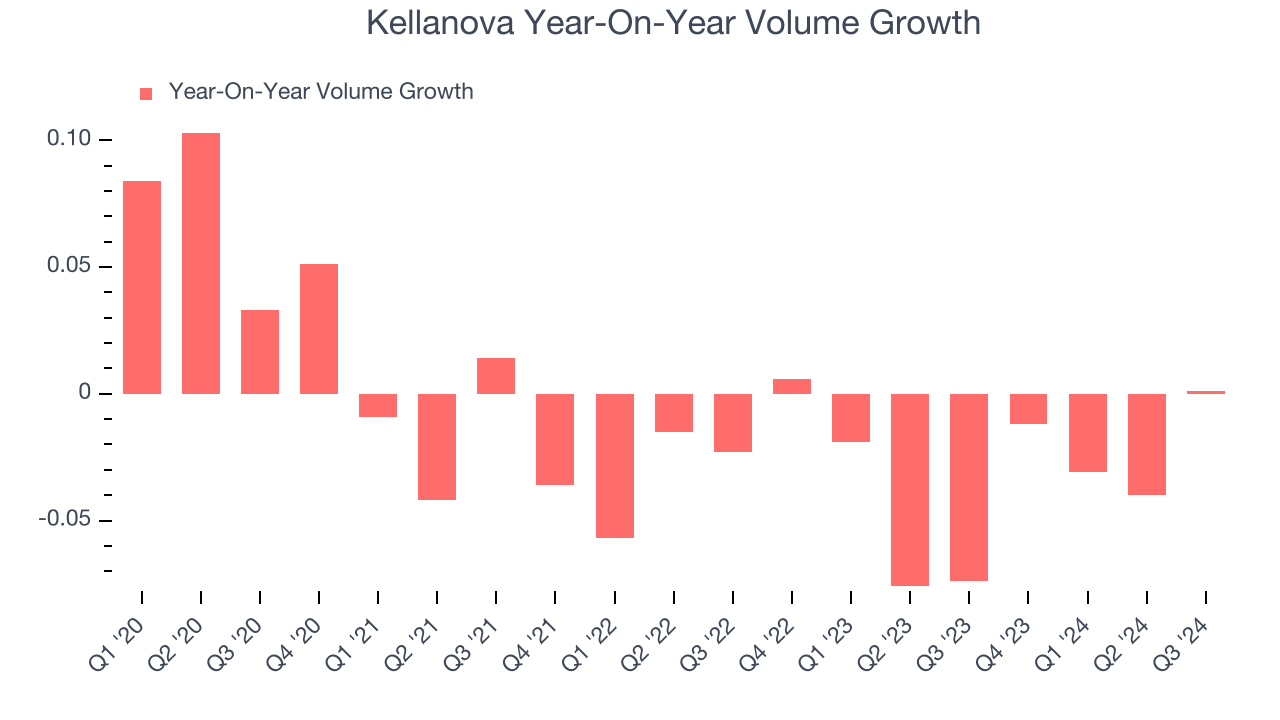

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Kellanova generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Kellanova’s average quarterly sales volumes have shrunk by 3.1%. This decrease isn’t ideal as the quantity demanded for consumer staples products is typically stable. Luckily, Kellanova was able to offset fewer customers purchasing its products by charging higher prices, enabling it to generate 7.9% average organic revenue growth. We hope the company can grow its volumes soon, however, as consistent price increases (on top of inflation) aren’t sustainable over the long term unless the business is really really special.

In Kellanova’s Q3 2024, year on year sales volumes were flat. This result was a well-appreciated turnaround from the 7.4% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

Key Takeaways from Kellanova’s Q3 Results

We were impressed by how significantly Kellanova blew past analysts’ organic revenue growth expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Due to the pending merger with Mars, Incorporated, Kellanova will not be providing forward-looking guidance. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $80.70 immediately after reporting.

So do we think Kellanova is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.