Consulting and engineering services company Tetra Tech (NASDAQ: TTEK) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 30% year on year to $1.37 billion. Guidance for next quarter’s revenue was better than expected at $1.12 billion at the midpoint, 1.7% above analysts’ estimates. Its GAAP profit of $0.35 per share was in line with analysts’ consensus estimates.

Is now the time to buy Tetra Tech? Find out by accessing our full research report, it’s free.

Tetra Tech (TTEK) Q3 CY2024 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.13 billion (21.1% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.34 (in line)

- Adjusted EBITDA: $169.5 million vs analyst estimates of $165.6 million (2.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.67 billion at the midpoint, in line with analyst expectations and implying 2.5% growth (vs 22.2% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $1.45 at the midpoint, missing analyst estimates by 3.9%

- Operating Margin: 10.4%, in line with the same quarter last year

- EBITDA Margin: 12.3%, down from 14.5% in the same quarter last year

- Free Cash Flow Margin: 7.2%, down from 10.7% in the same quarter last year

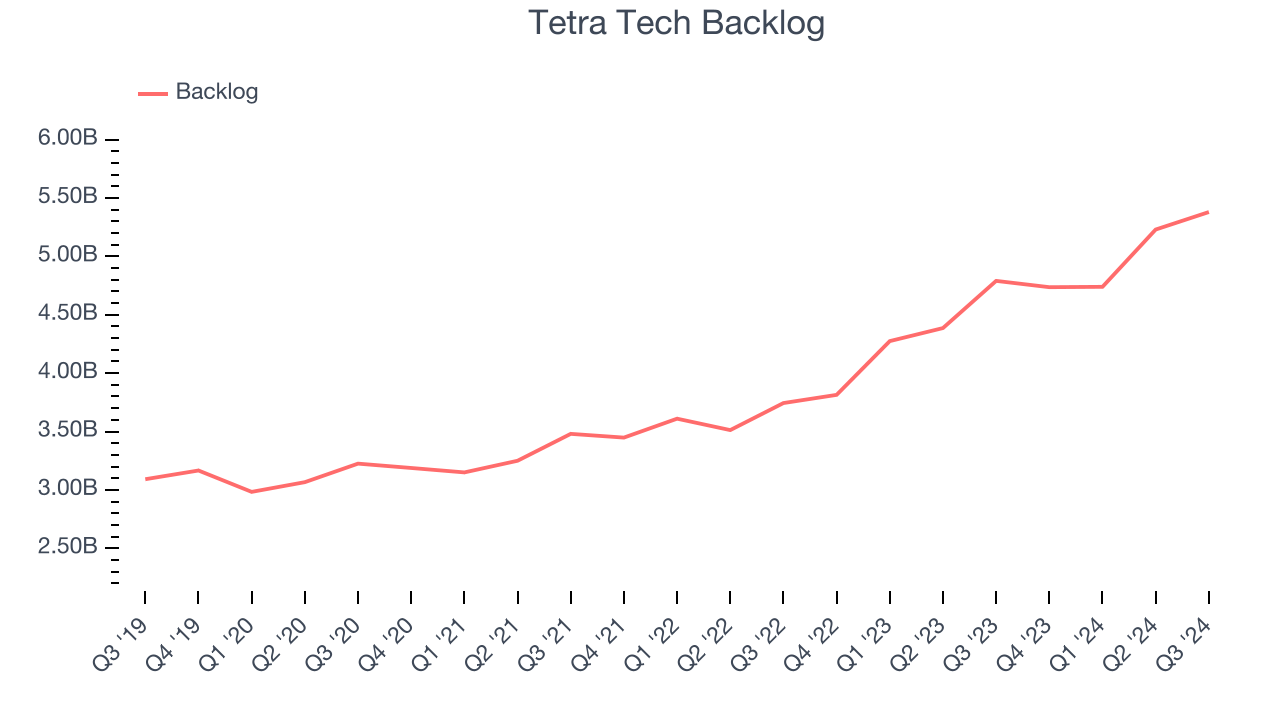

- Backlog: $5.38 billion at quarter end, up 12.3% year on year

- Market Capitalization: $12.92 billion

Company Overview

Originally founded to focus on Alaska’s oil pipelines, Tetra Tech (NASDAQ: TTEK) provides consulting and engineering services to the water and infrastructure industries.

Air and Water Services

Many air and water services are statutorily mandated or non-discretionary. This means recurring revenues are often earned through contracts, making for more predictable top-line trends. Additionally, there has been an increasing focus on emissions and water conservation over the last decade, driving innovation in the sector and demand for new services. On the other hand, air and water services companies are at the whim of economic cycles. Interest rates, for example, can greatly impact manufacturing or industrial processes that drive incremental demand for these companies’ offerings.

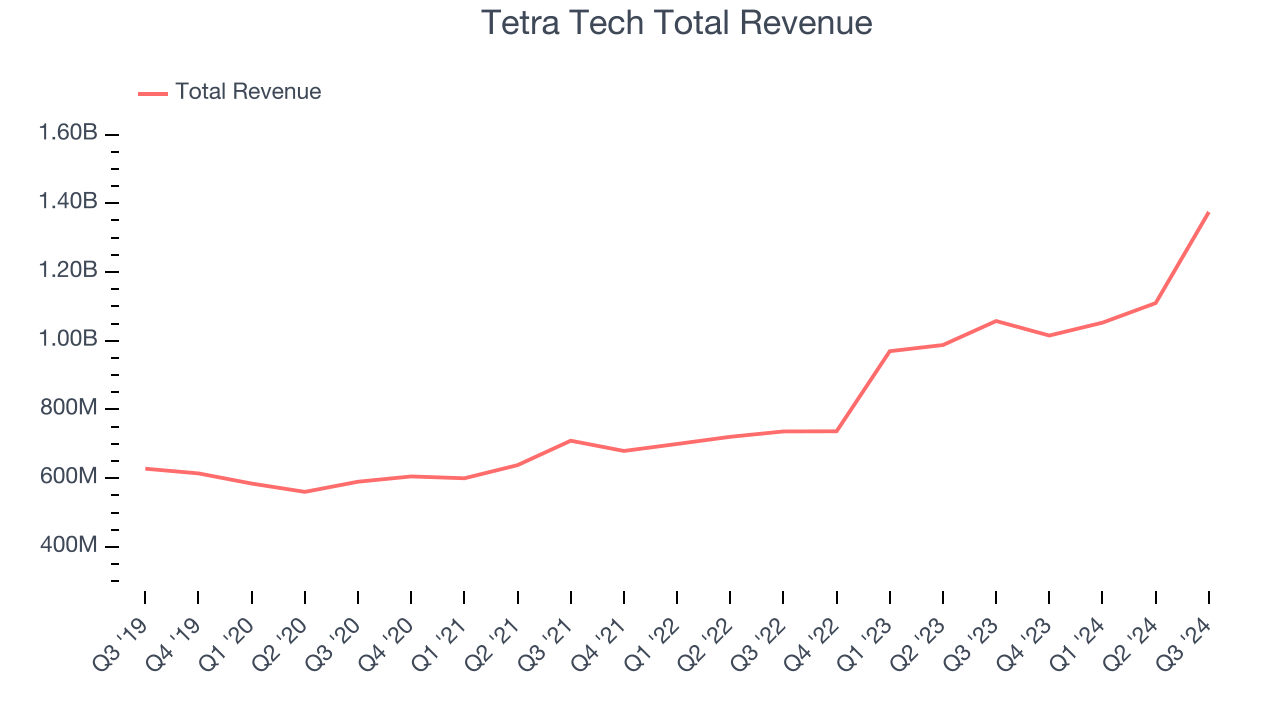

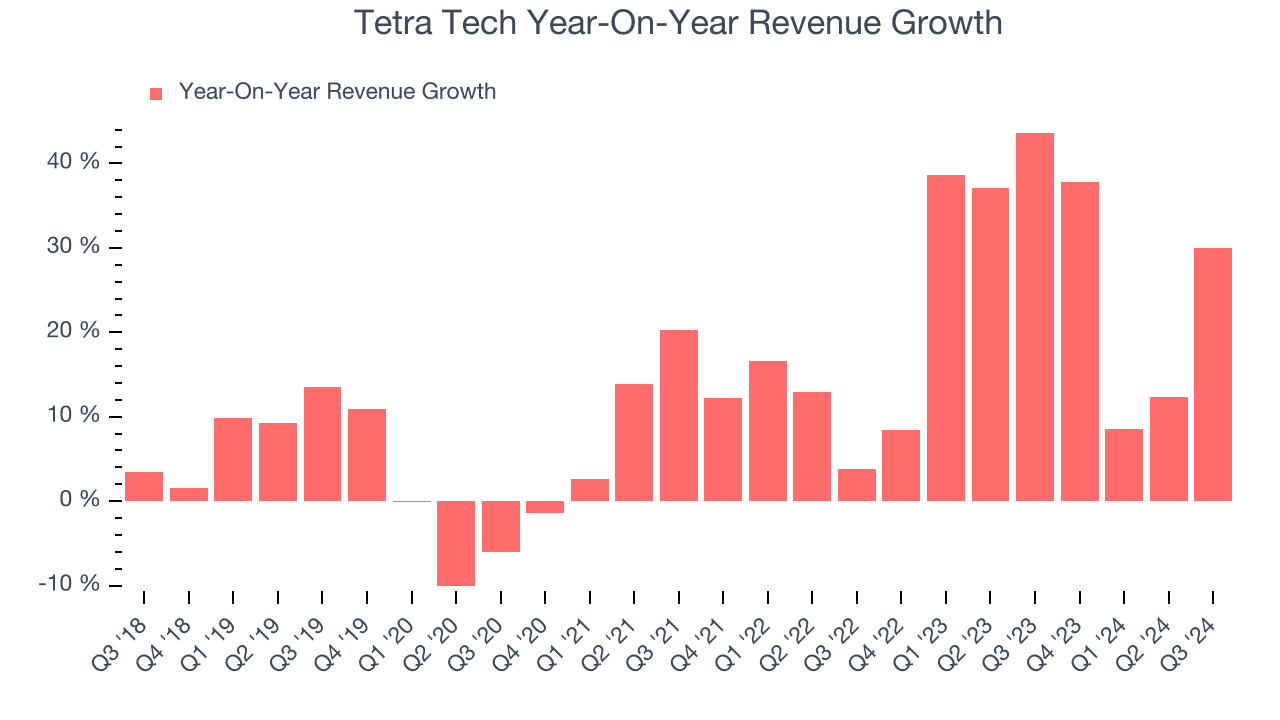

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Tetra Tech grew its sales at an exceptional 13.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Tetra Tech’s annualized revenue growth of 26.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Tetra Tech’s backlog reached $5.38 billion in the latest quarter and averaged 18.6% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Tetra Tech was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Tetra Tech reported robust year-on-year revenue growth of 30%, and its $1.37 billion of revenue topped Wall Street estimates by 21.1%. Company management is currently guiding for a 10.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

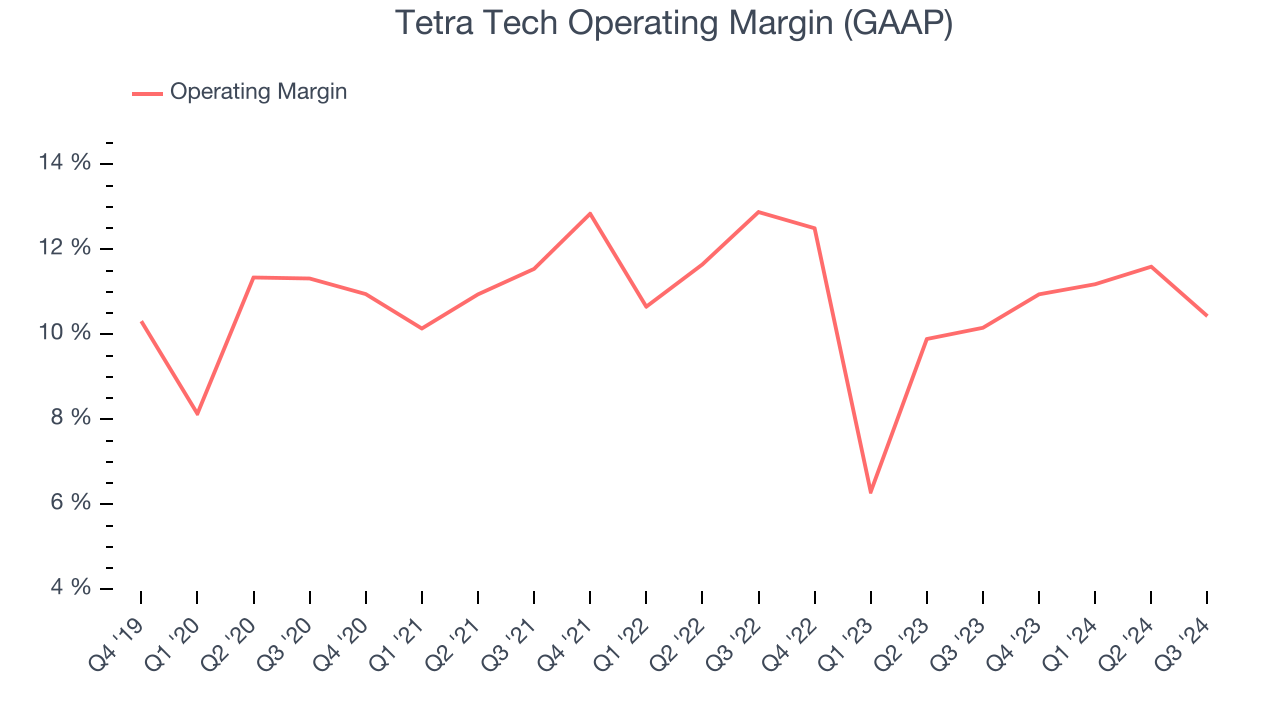

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Tetra Tech has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Tetra Tech’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

In Q3, Tetra Tech generated an operating profit margin of 10.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

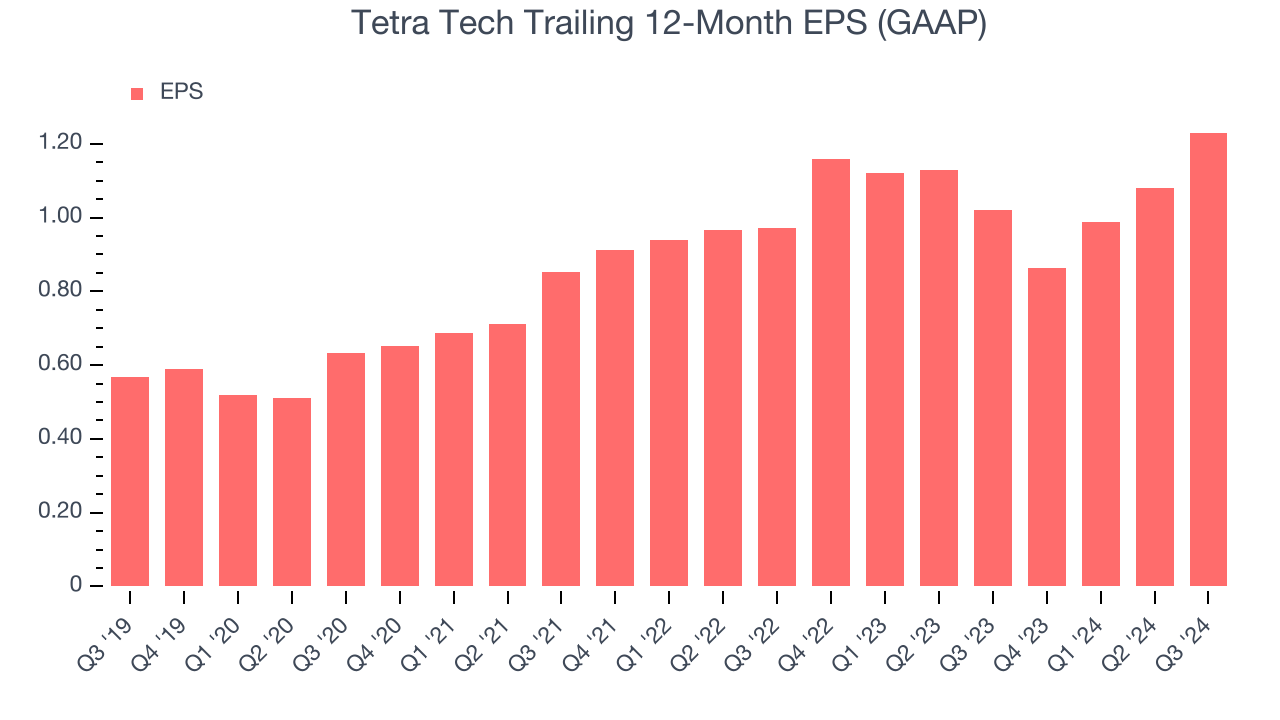

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

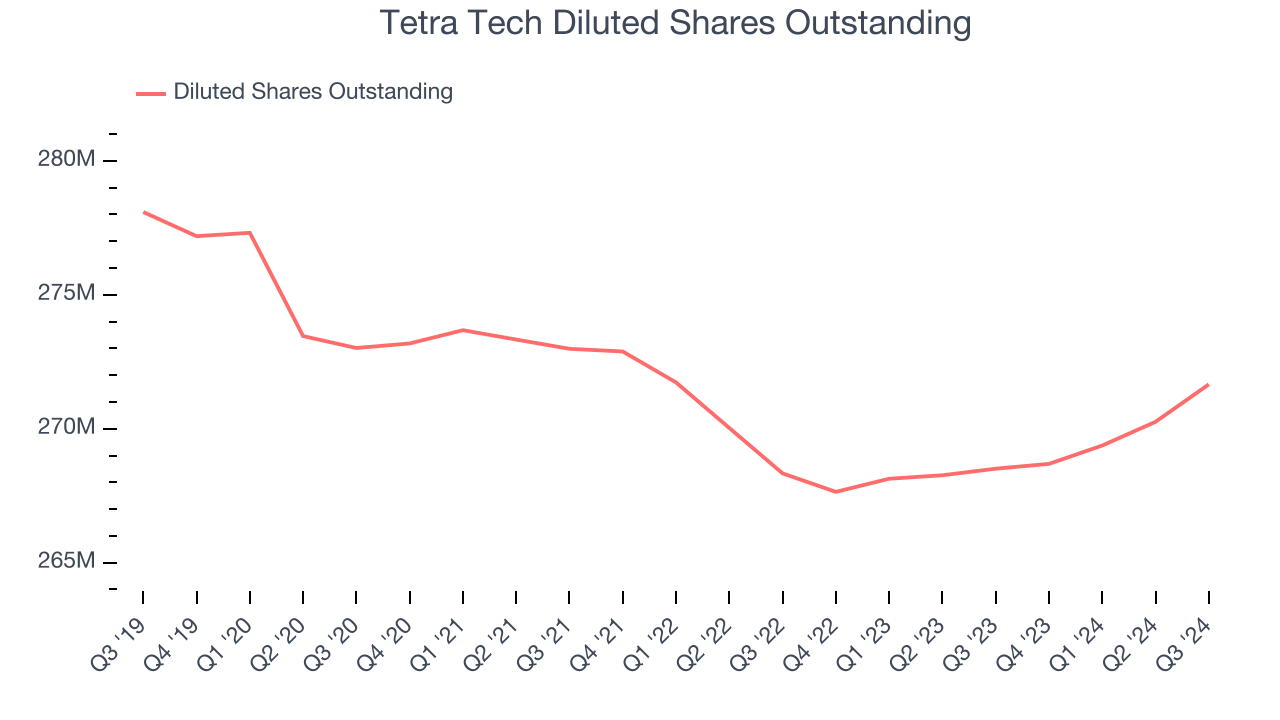

Tetra Tech’s EPS grew at a spectacular 16.8% compounded annual growth rate over the last five years, higher than its 13.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into Tetra Tech’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Tetra Tech has repurchased its stock, shrinking its share count by 2.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Tetra Tech, its two-year annual EPS growth of 12.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Tetra Tech reported EPS at $0.35, up from $0.20 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Tetra Tech’s full-year EPS of $1.23 to grow by 22.6%.

Key Takeaways from Tetra Tech’s Q3 Results

We were impressed by how significantly Tetra Tech blew past analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly and its EPS fell meaningfully short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.8% to $44.60 immediately following the results.

So should you invest in Tetra Tech right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.