Since September 2024, Johnson & Johnson has been in a holding pattern, posting a small return of 0.7% while floating around $163.19.

Does this present a buying opportunity for JNJ? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Johnson & Johnson Spark Debate?

Founded in 1886 and known for its iconic red cross logo, Johnson & Johnson (NYSE: JNJ) is a global healthcare company that develops and sells pharmaceuticals, medical devices, and technologies focused on human health and well-being.

Two Positive Attributes:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $88.82 billion in revenue over the past 12 months, Johnson & Johnson is one of the most scaled enterprises in healthcare. This is particularly important because branded pharmaceuticals companies are volume-driven businesses due to their low margins.

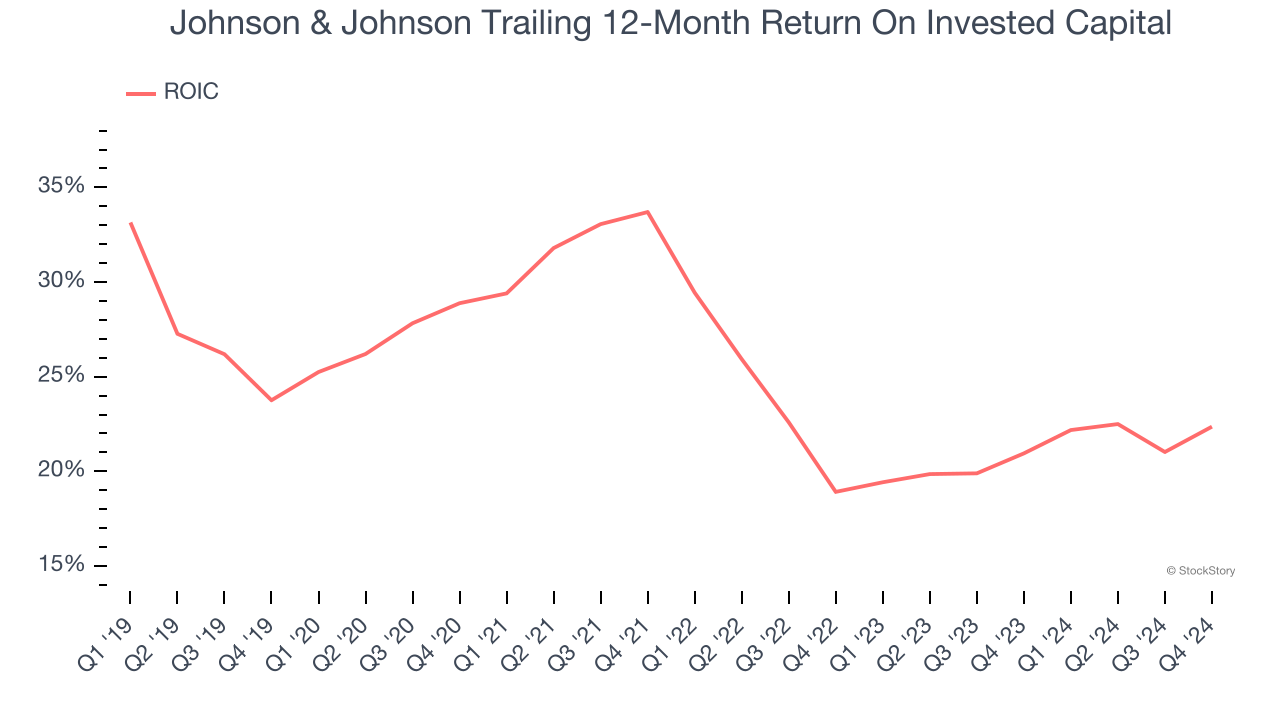

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Johnson & Johnson’s five-year average ROIC was 25%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Declining Constant Currency Revenue, Demand Takes a Hit

Investors interested in Branded Pharmaceuticals companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Johnson & Johnson’s control and are not indicative of underlying demand.

Over the last two years, Johnson & Johnson’s constant currency revenue averaged 1.4% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Johnson & Johnson might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Johnson & Johnson’s merits more than compensate for its flaws, but at $163.19 per share (or 15.7× forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Johnson & Johnson

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.