Regional banking company Atlantic Union Bankshares (NYSE: AUB) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 74.2% year on year to $387.2 million. Its non-GAAP profit of $0.97 per share was 12.9% above analysts’ consensus estimates.

Is now the time to buy Atlantic Union Bankshares? Find out by accessing our full research report, it’s free.

Atlantic Union Bankshares (AUB) Q4 CY2025 Highlights:

- Net Interest Income: $330.2 million vs analyst estimates of $326.7 million (80.2% year-on-year growth, 1.1% beat)

- Net Interest Margin: 3.9% vs analyst estimates of 3.9% (3.1 basis point beat)

- Revenue: $387.2 million vs analyst estimates of $379.5 million (74.2% year-on-year growth, 2% beat)

- Efficiency Ratio: 62.8% vs analyst estimates of 53.8% (907.7 basis point miss)

- Adjusted EPS: $0.97 vs analyst estimates of $0.86 (12.9% beat)

- Tangible Book Value per Share: $19.69 vs analyst estimates of $19.68 (4.1% year-on-year decline, in line)

- Market Capitalization: $5.70 billion

“Atlantic Union had a strong fourth quarter, reflecting disciplined execution and a successful integration of the Sandy Spring Bancorp, Inc. acquisition,” said John C. Asbury, president and chief executive officer of Atlantic Union.

Company Overview

Tracing its roots back to 1902 when it first opened its doors in Virginia, Atlantic Union Bankshares (NYSE: AUB) is a full-service regional bank providing commercial and retail banking, wealth management, and insurance services throughout Virginia and parts of Maryland and North Carolina.

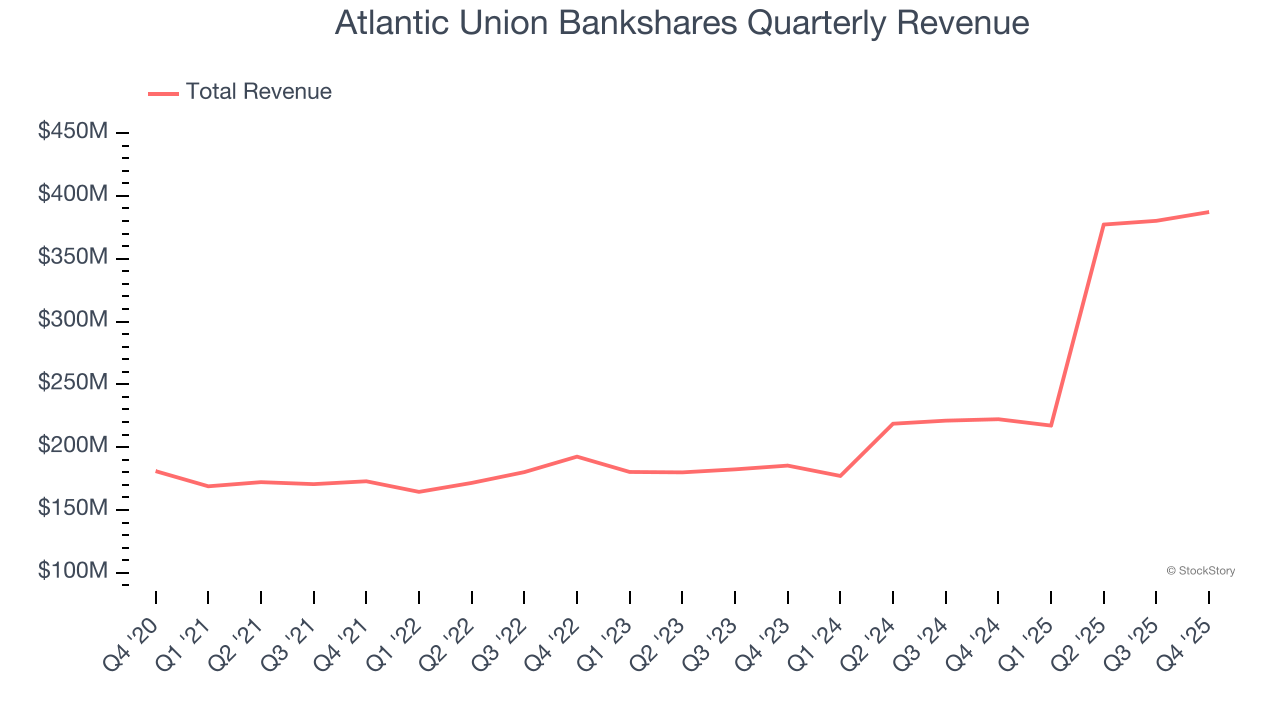

Sales Growth

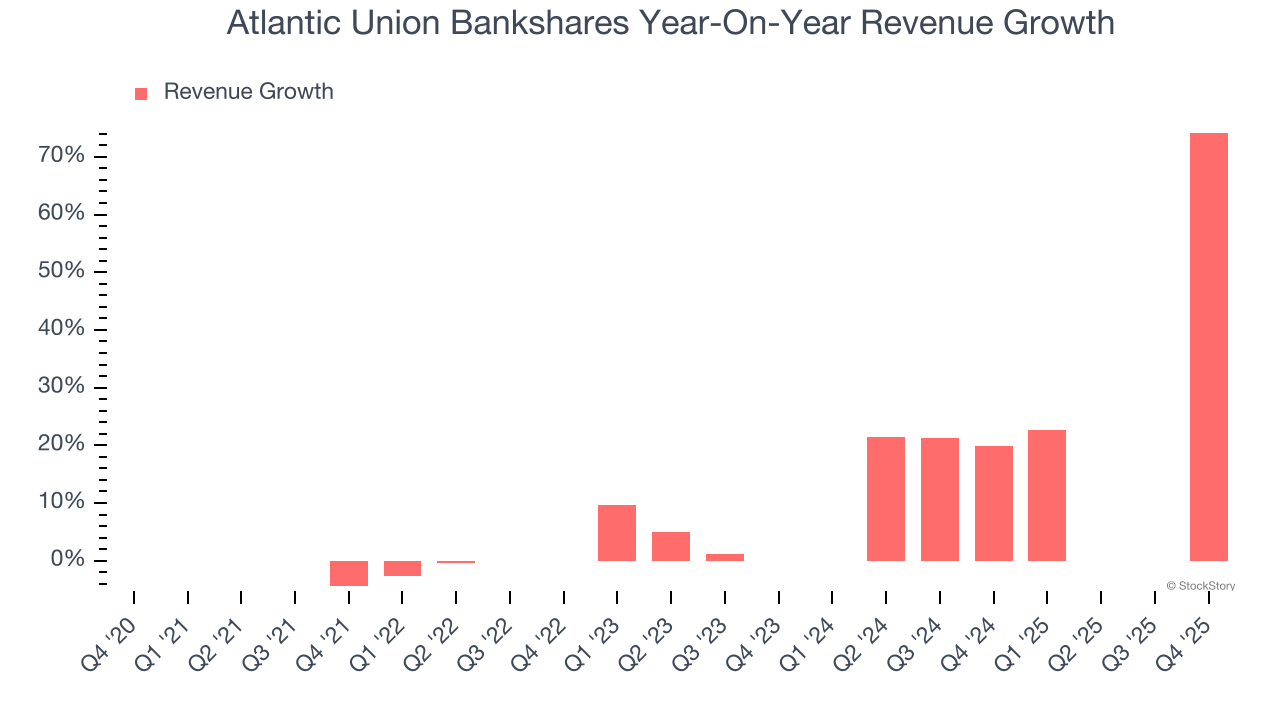

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Luckily, Atlantic Union Bankshares’s revenue grew at an impressive 14.7% compounded annual growth rate over the last five years. Its growth beat the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Atlantic Union Bankshares’s annualized revenue growth of 36.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Atlantic Union Bankshares reported magnificent year-on-year revenue growth of 74.2%, and its $387.2 million of revenue beat Wall Street’s estimates by 2%.

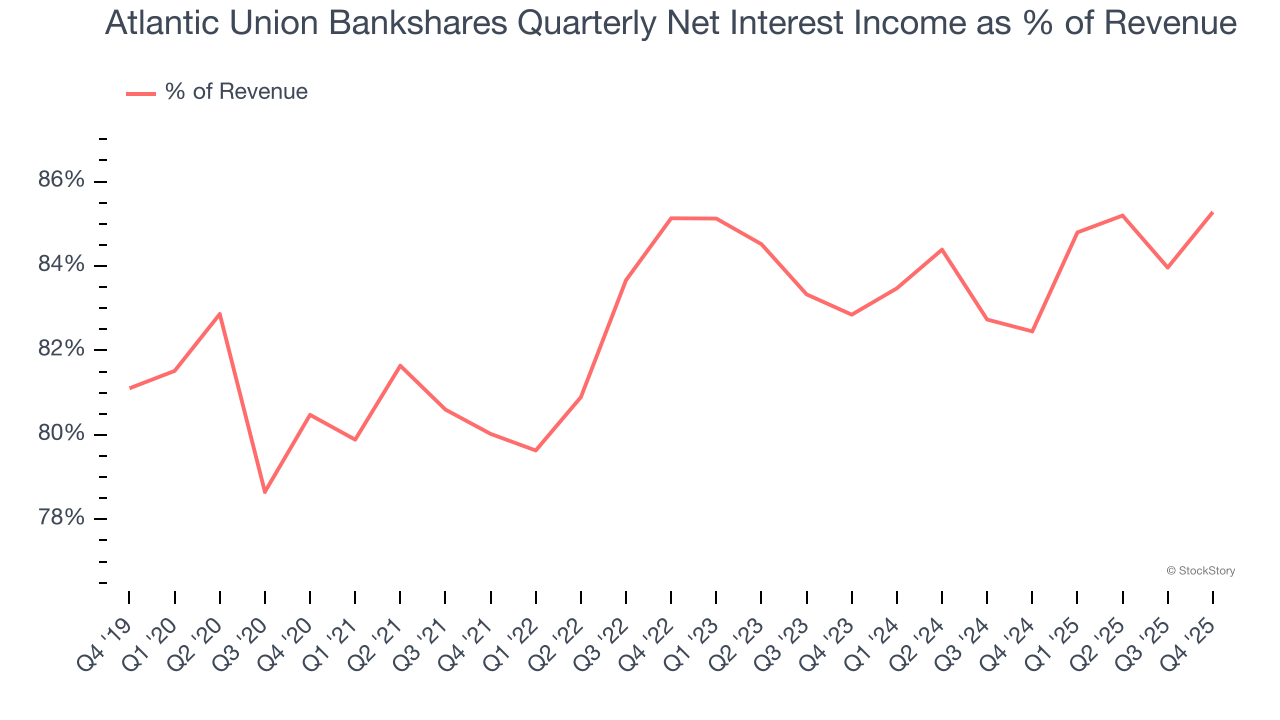

Net interest income made up 83% of the company’s total revenue during the last five years, meaning Atlantic Union Bankshares barely relies on non-interest income to drive its overall growth.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Tangible Book Value Per Share (TBVPS)

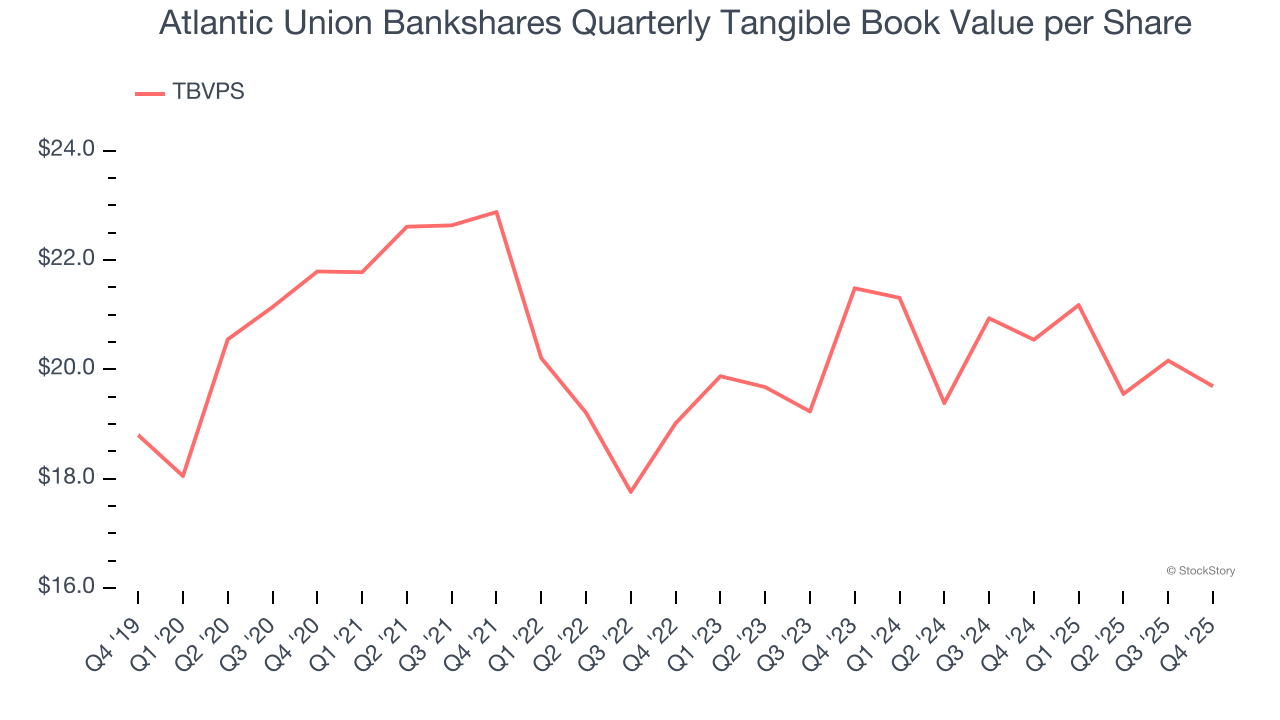

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

When analyzing banks, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value by removing intangible assets of debatable liquidation worth. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

Atlantic Union Bankshares’s TBVPS declined at a 2% annual clip over the last five years. A turnaround doesn’t seem to be in sight as its TBVPS also dropped by 4.3% annually over the last two years ($21.48 to $19.69 per share).

Over the next 12 months, Consensus estimates call for Atlantic Union Bankshares’s TBVPS to grow by 13.1% to $22.26, decent growth rate.

Key Takeaways from Atlantic Union Bankshares’s Q4 Results

It was good to see Atlantic Union Bankshares beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.1% to $41.23 immediately after reporting.

Atlantic Union Bankshares may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).