Multifamily sector underwent swift, unprecedented reversal in conditions throughout 2022

Today, Apartments.com – a CoStar Group company – published an in-depth report of multifamily rent growth trends for Q4 2022 backed by analyst observations. Across the board, multifamily fundamentals continued to deteriorate throughout the fourth quarter with limited absorption, significant imbalances between supply and demand and ongoing economic uncertainty.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230110005347/en/

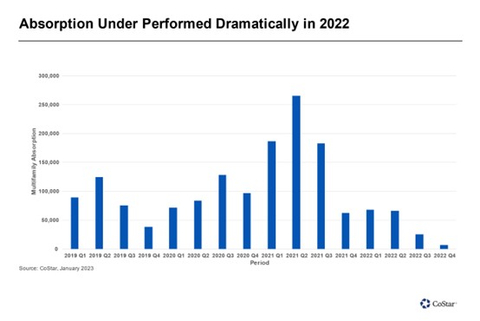

Absorption, Quarter Over Quarter (Graphic: Business Wire)

“We ended the year with absorption barely remaining positive and vacancy rates trending upwards,” said Jay Lybik, National Director of Multifamily Analytics at CoStar Group. “As 2022 progressed, economic uncertainty suppressed household formations which limited multifamily demand. Consumer confidence started off weak early on with high inflation and the war in Europe, only to be continued by the Fed’s interest rate hikes and impending recession fears. With 2023’s national forecast predicting the highest new supply totals since the 1980s, expect vacancy to rise above 7% and rent growth to push much lower.”

ABSORPTION COMPARED TO DELIVERIES HIGHLIGHTS SIGNIFICANT IMBALANCE

Multifamily conditions continued their stark reversal of fortune in Q4 2022. Limited absorption in the face of 96,000 newly delivered units drove up the vacancy rate from 5.7% at the end of the third quarter to 6.2% on the last day of December 2022. Additionally, the remarkable imbalance between supply and demand pushed the national year over year asking rent growth down to 3.7%, or 740 basis points lower than 12 months prior.

Full year absorption totaled 169,000 units compared to 431,000 deliveries, highlighting the significant imbalance felt industry-wide. While 2022 was expected to come in lower than 2021’s record breaking absorption at 700,000 units, the lackluster demand weakened in each proceeding quarter throughout the year, resulting in half of the initial projection.

40 LARGEST MARKETS SEE RENT GROWTH RETREAT, PALM BEACH LEADS THE PACK

The effects of new supply outstripping demand are best illustrated in the dramatic pullback of rents across the majority of the nation’s 40 largest markets. Over the past four quarters, all 40 markets have witnessed rents retreating, despite 38 of them remaining positive for the year. Palm Beach sits at the helm, with year over year rent growth declining by 29 percentage points from 30.4% a year ago to just 1.7% at the end of 2022. Phoenix and Las Vegas saw rent growth peak above 20% in 2021, yet closed out the year in the red.

MIDWEST, GATEWAY MARKETS POST HIGHEST RENT GROWTH

Indianapolis finished the year with the highest year over year rent growth in the nation, coming in at 7.4%. Other Midwest markets rounded out 2022 near the top of the rent growth chart, including Cincinnati, St. Louis and Columbus, representing a remarkable change from a year ago when the top 10 was littered with Sun Belt locations that are now posting the weakest rent growth.

RENTS EXPECTED TO CONTINUE DOWNWARD TREND INTO 2023

As we head into 2023, the rent growth situation is not positioned for drastic improvement. Looking at rents quarter over quarter, we expect to see rents declining across the majority of markets. And unfortunately, this is not the typical seasonal effect of rents softening in the fourth quarter. Instead, rent deceleration began in June, during what should have been the peak leasing season. The accelerating rent decreases are a direct result of weak demand across the nation.

The reversal in multifamily performance over the past four quarters has been swift and unprecedented, especially considering the economy is not yet in a recession. The fast-growing Sun Belt markets of 2021 entered a perfect storm in 2022, as demand throttled back while deliveries accelerated. With recession fears looming, 2023 has the potential to create even more distress for Sun Belt property operations with deliveries in many markets projected to reach record levels. Northeast and Midwest markets with minimal supply additions this year are best positioned to remain closest to equilibrium.

About CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information and analytics. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. Realla is the UK’s most comprehensive commercial property digital marketplace. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada and Asia. From time to time, we plan to utilize our corporate website, http://www.costargroup.com, as a channel of distribution for material company information. For more information, visit www.costargroup.com.

About Apartments.com

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry's largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a "Travel Time" feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps, and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that rent growth changes are not as expected, or do not occur at the pace expected; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2021, and Quarterly Reports on Form 10-Q for the quarters ending March 31, 2022, June 30, 2022, and September 30, 2022, each of which is filed with the SEC, including in the “Risk Factors” section of that filing, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230110005347/en/

Contacts

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com